Showcase

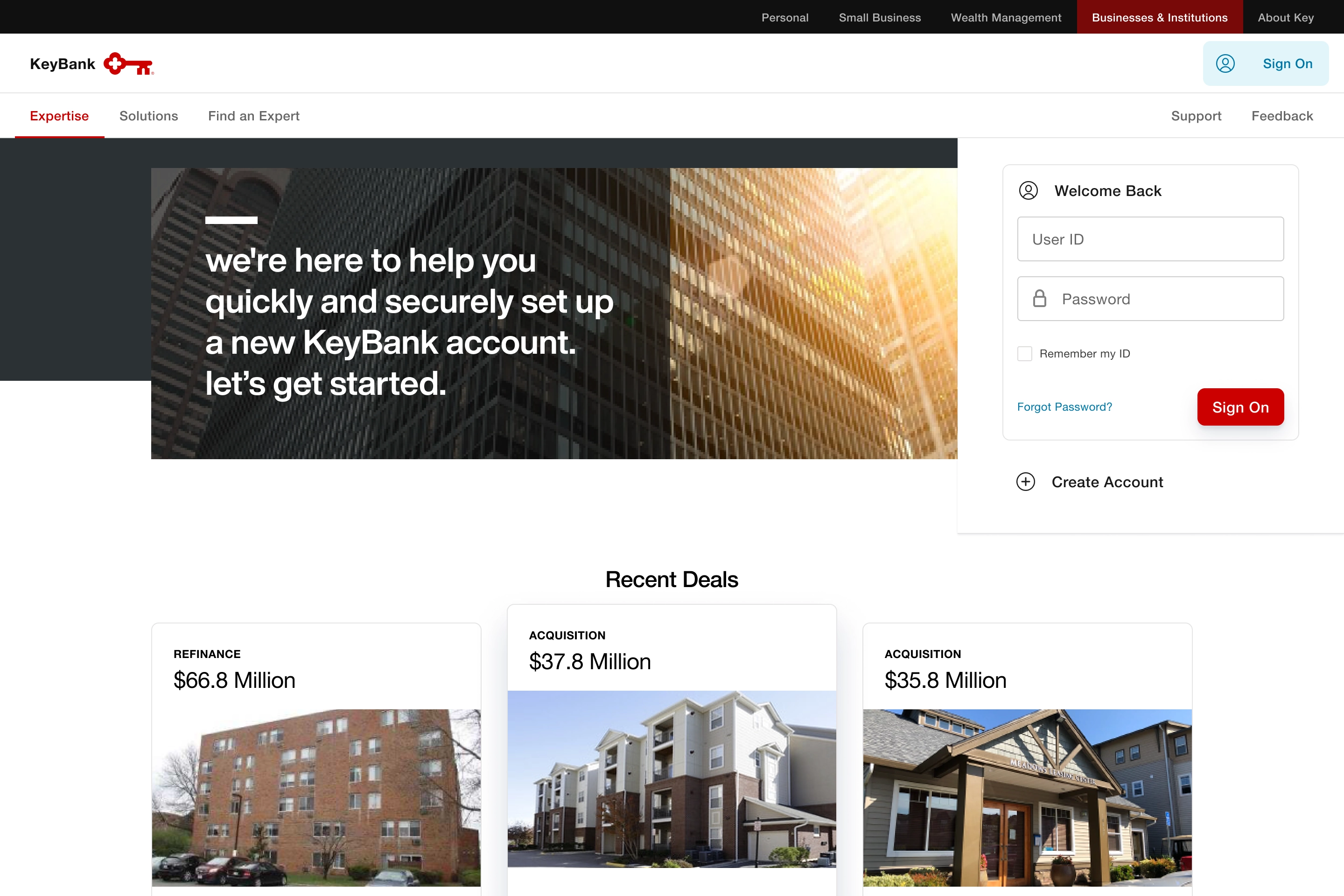

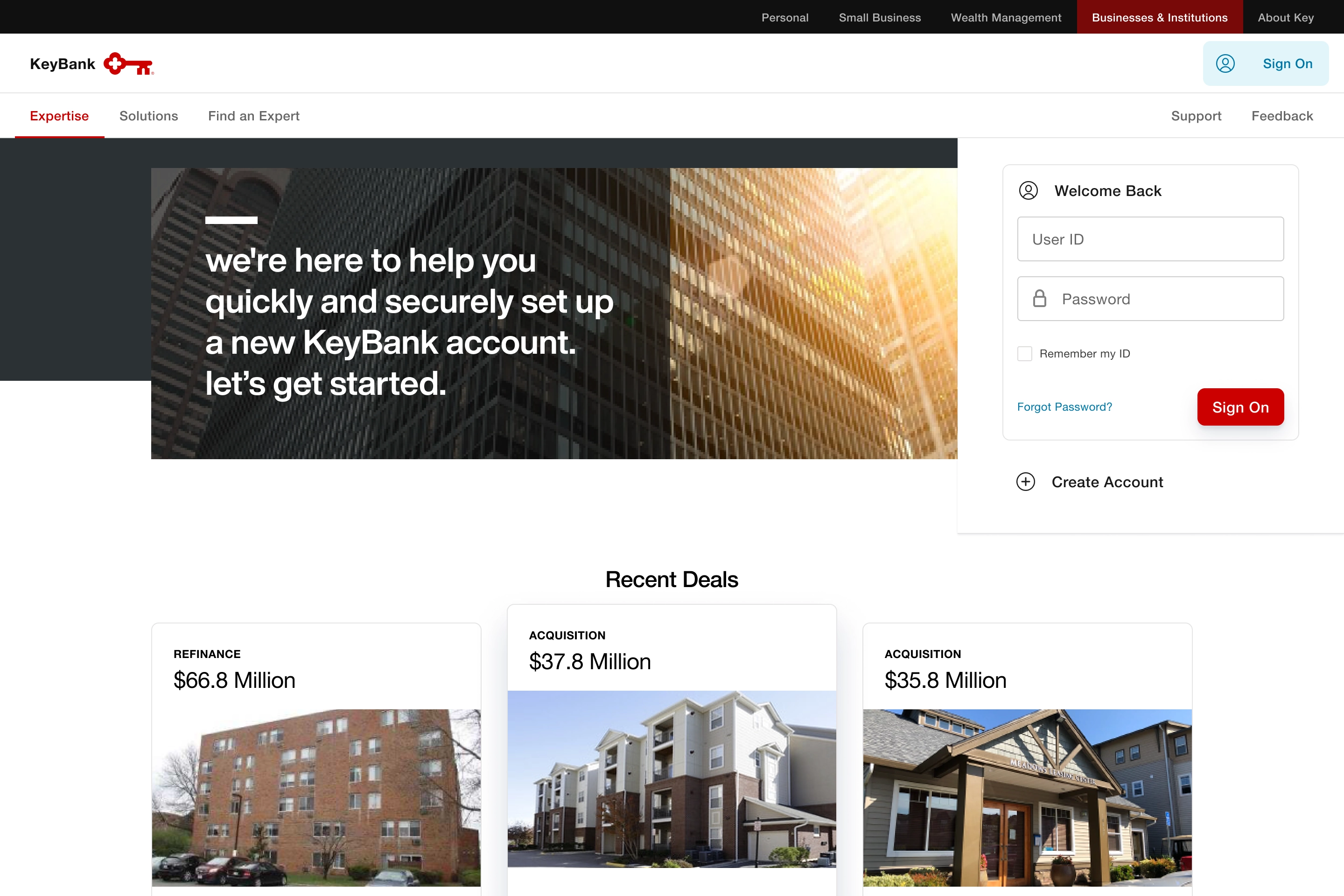

Keybank

About

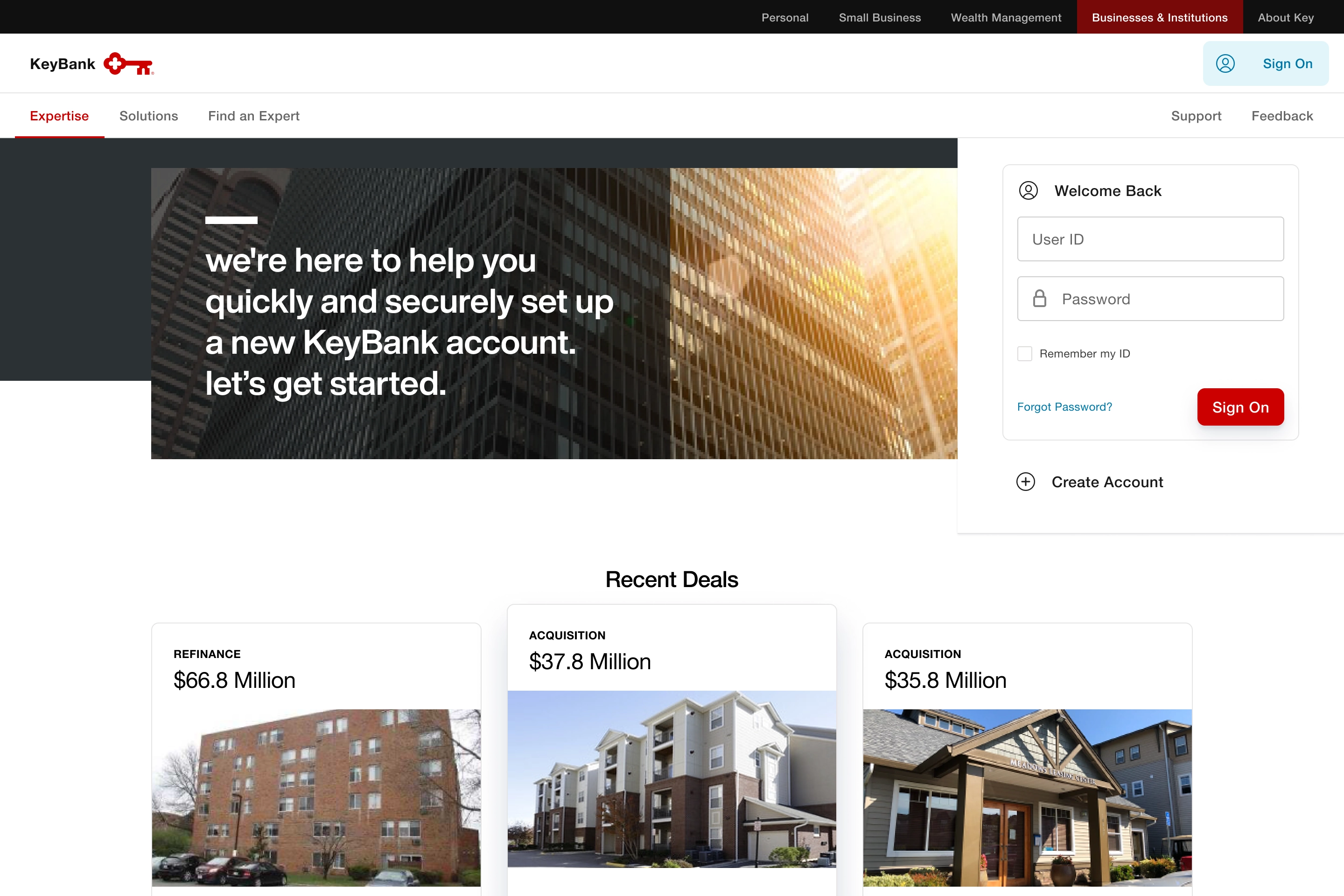

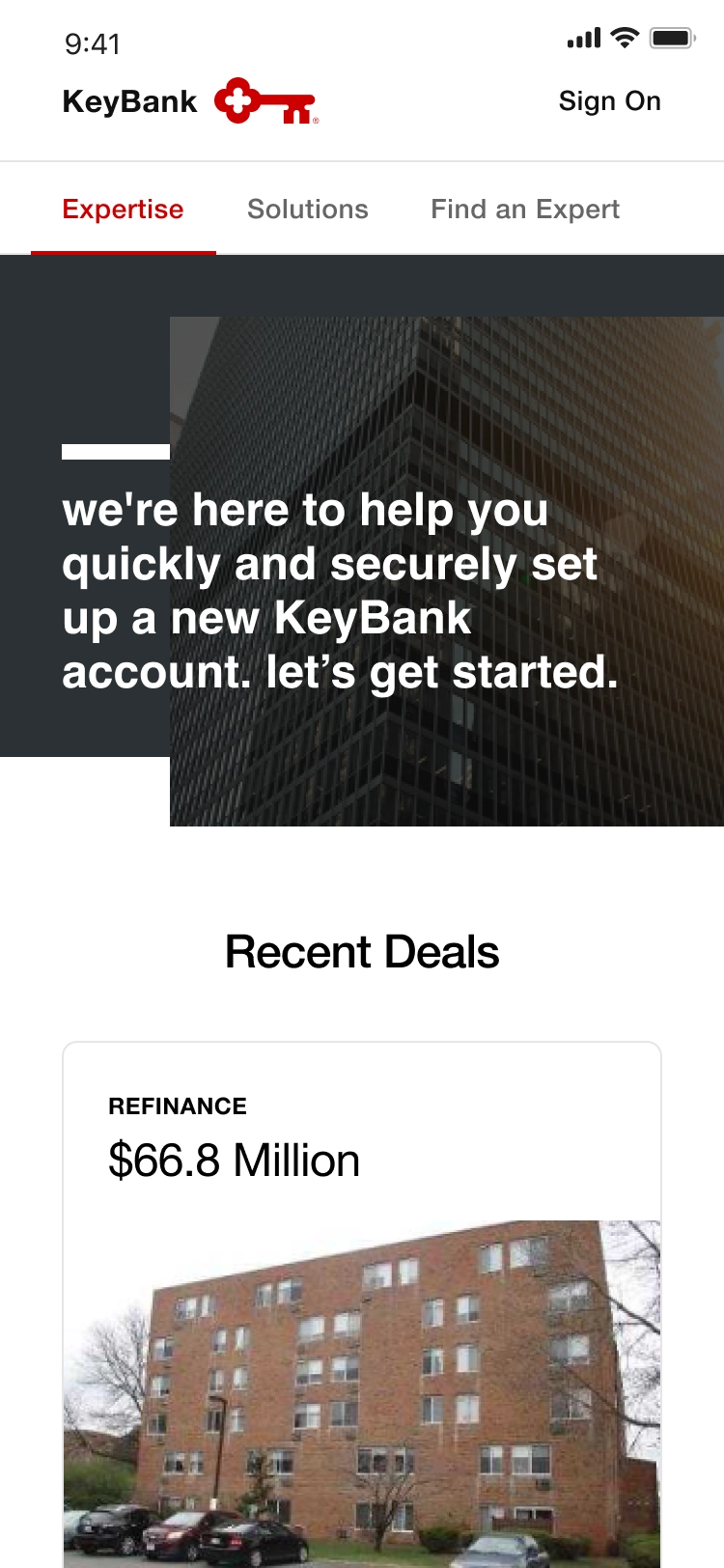

KeyBank is a regional financial institution with a presence in the Northeast and Pacific Northwest, providing banking, lending, and investment services with a focus on digital innovation and community growth.

Contribution

Executed design strategies that directly contributed to a 20% increase in conversion rates for consumer deposits, credit cards, small business originations, and real estate capital. Led design for Paycheck Protection Program, achieving a record 91% click-through rate for 28K+ small business, commercial, and institutional client applications during COVID-19.

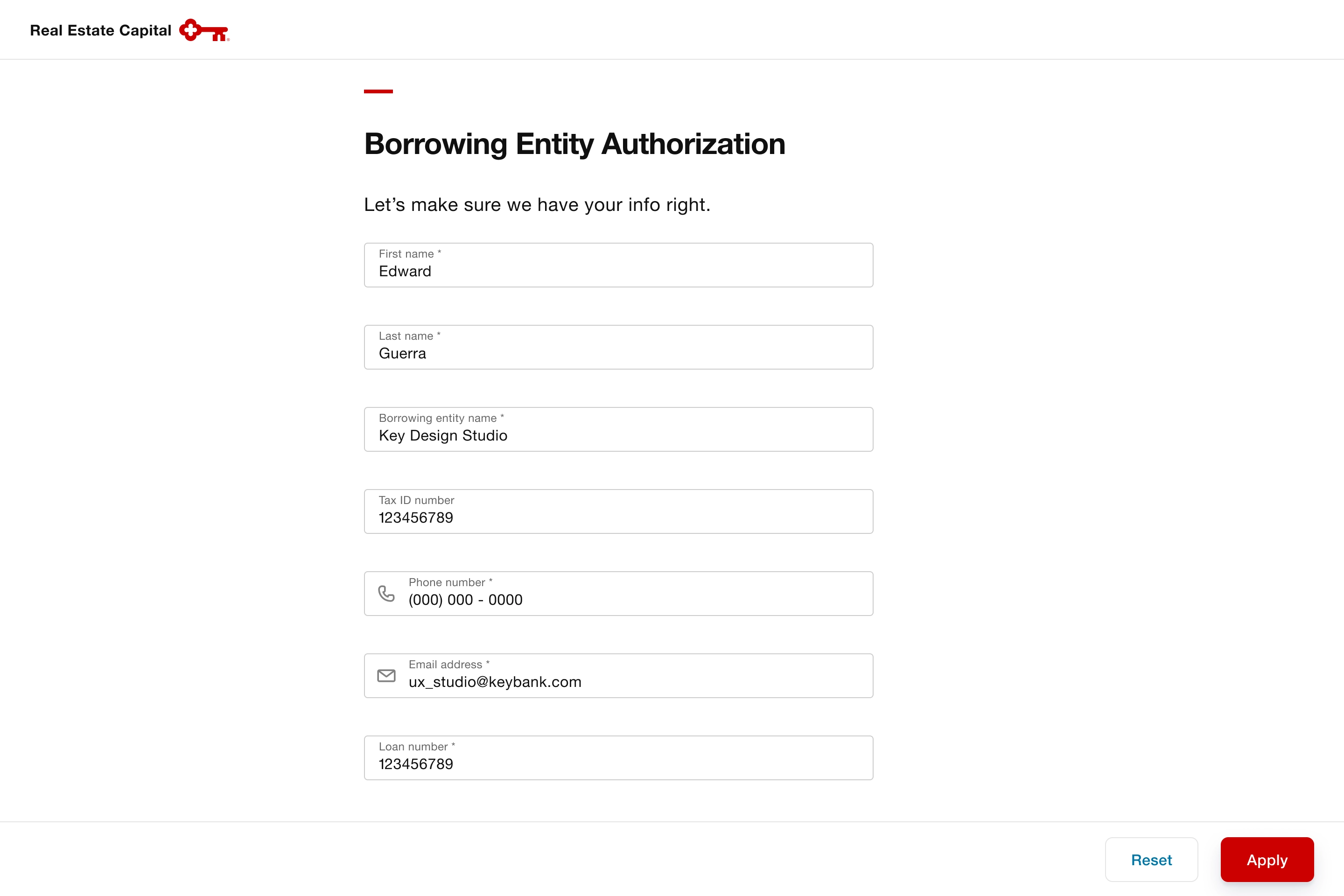

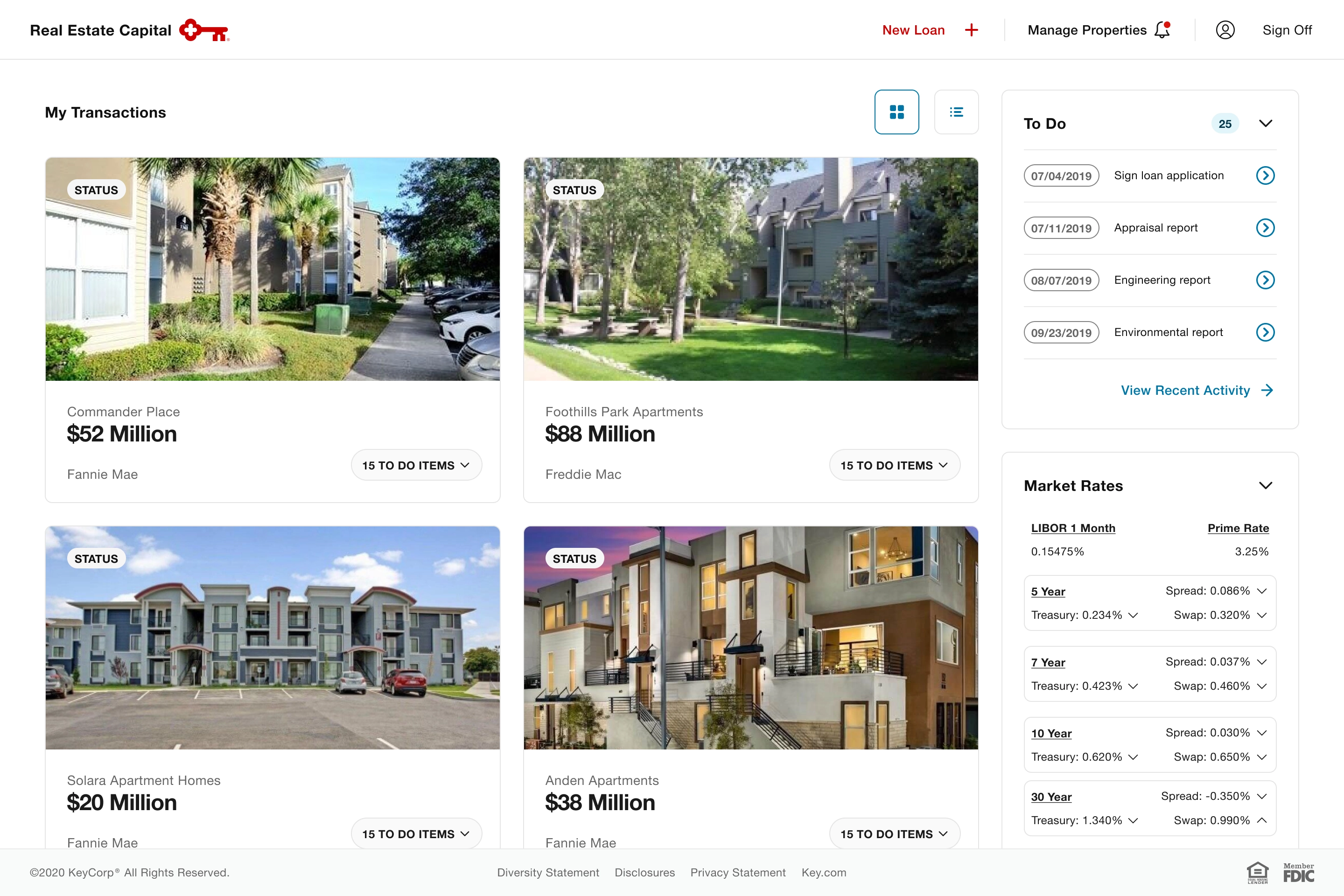

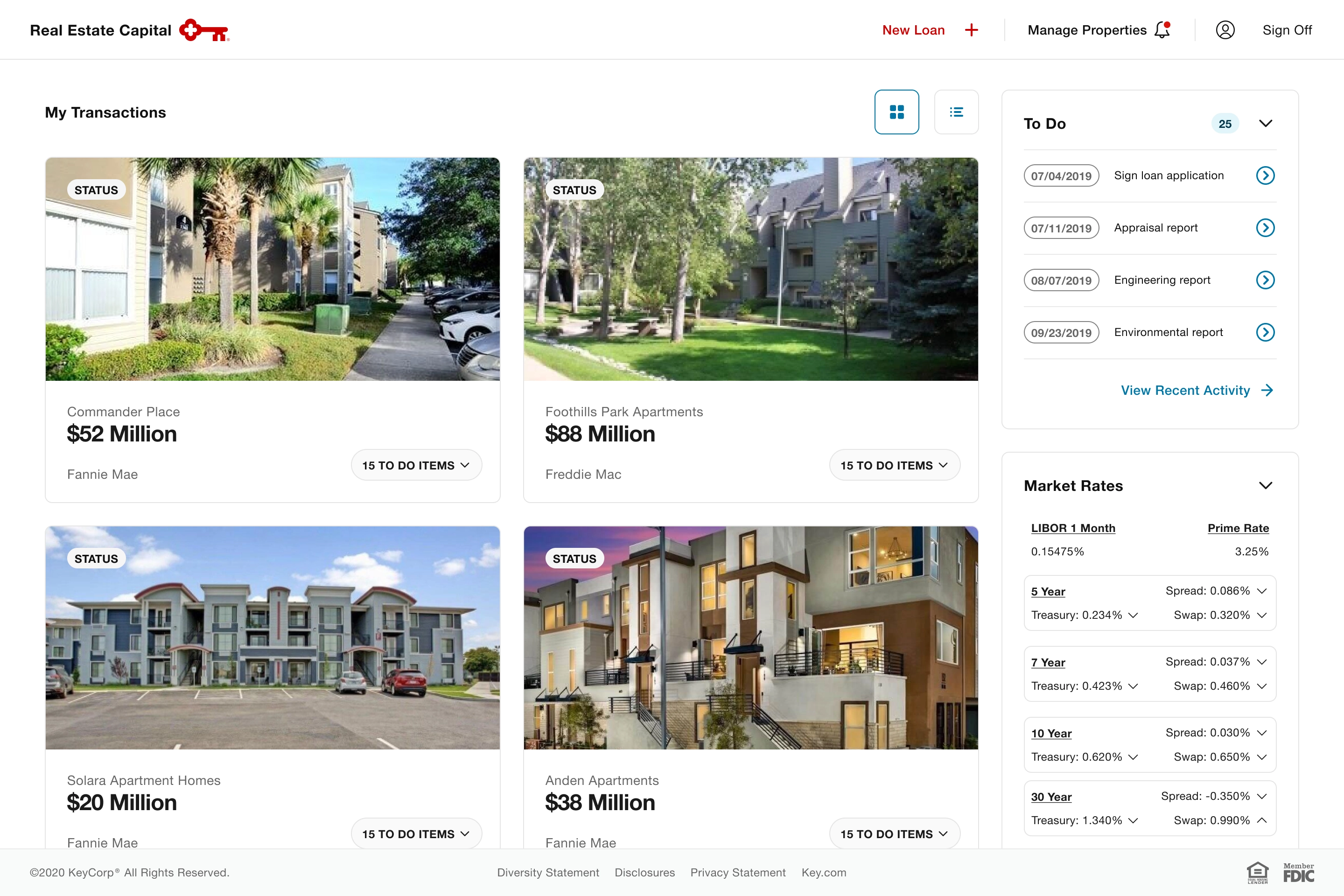

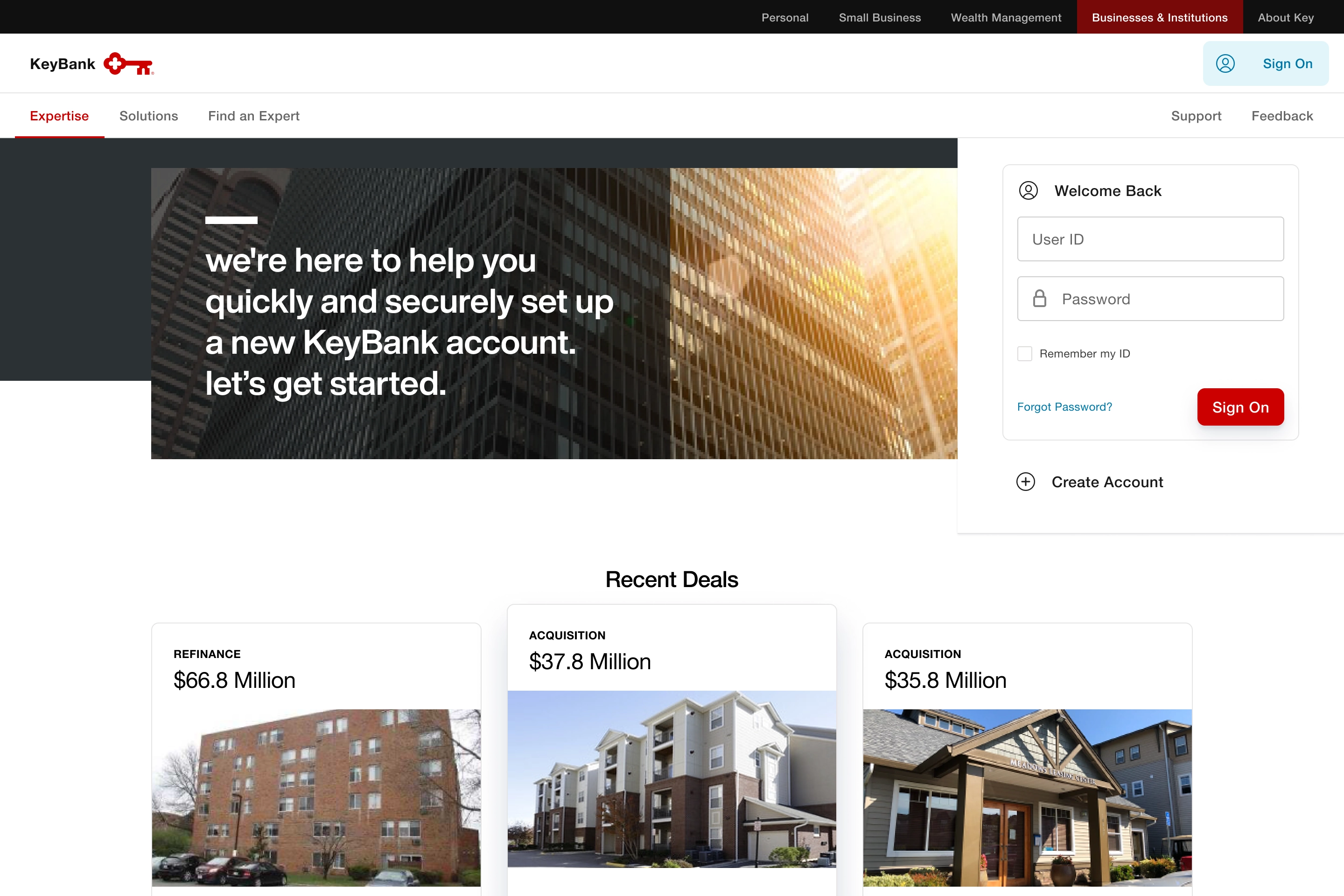

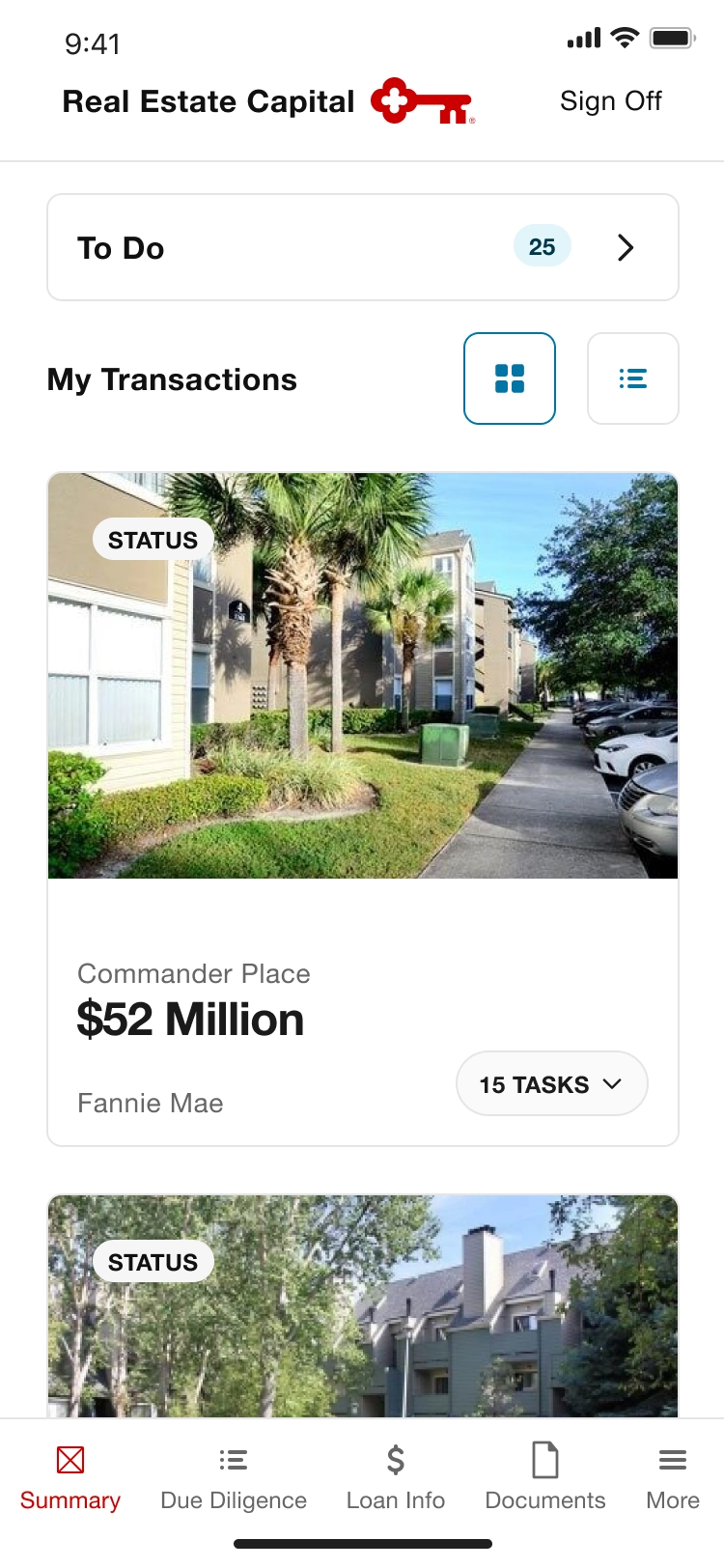

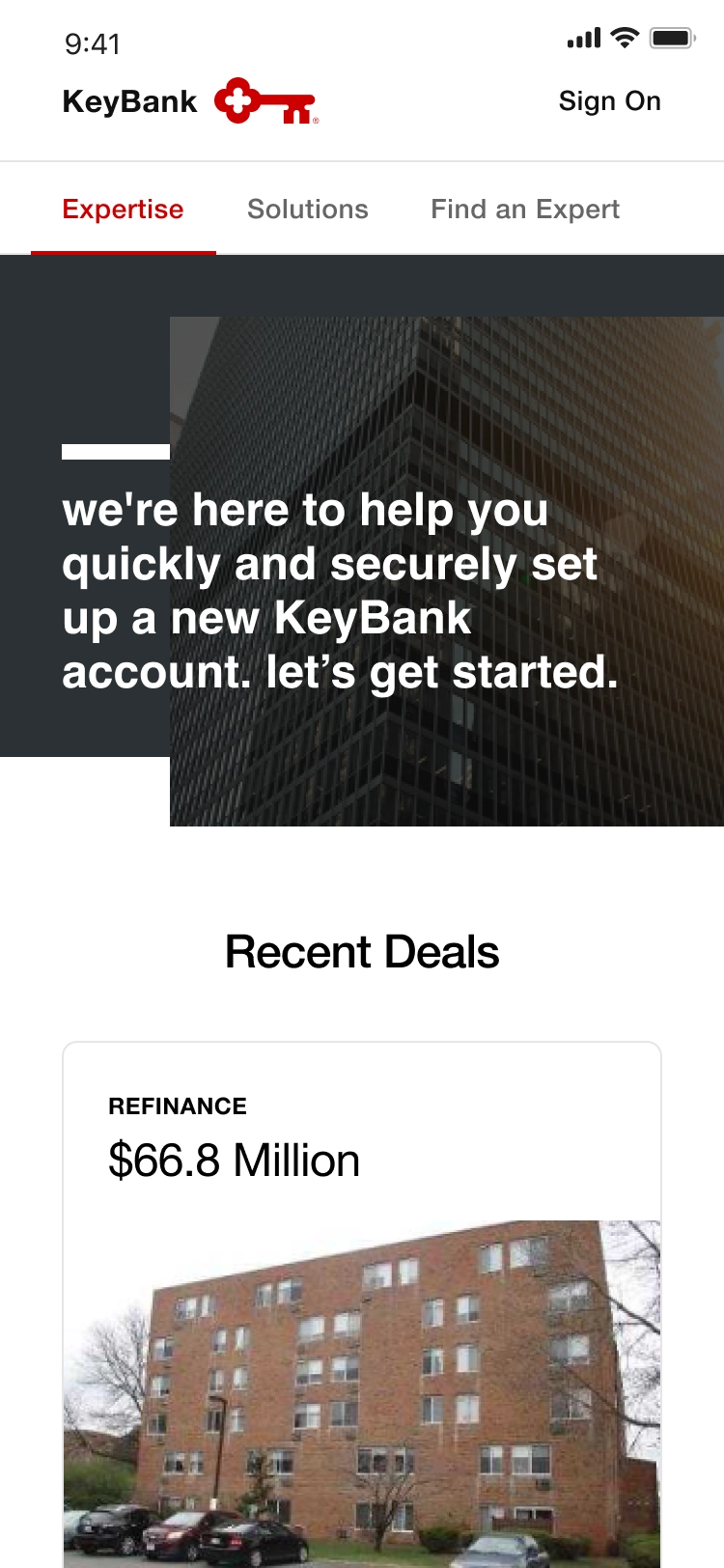

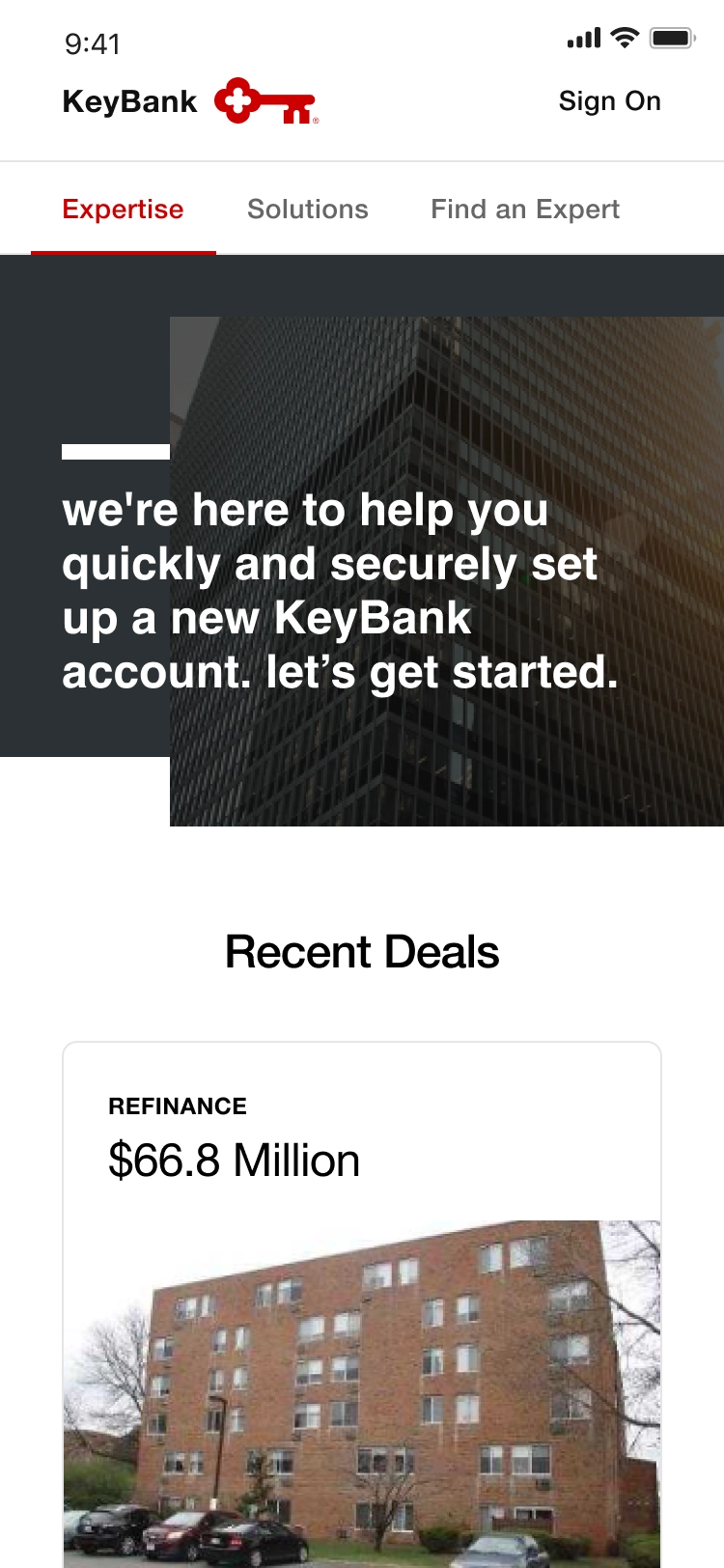

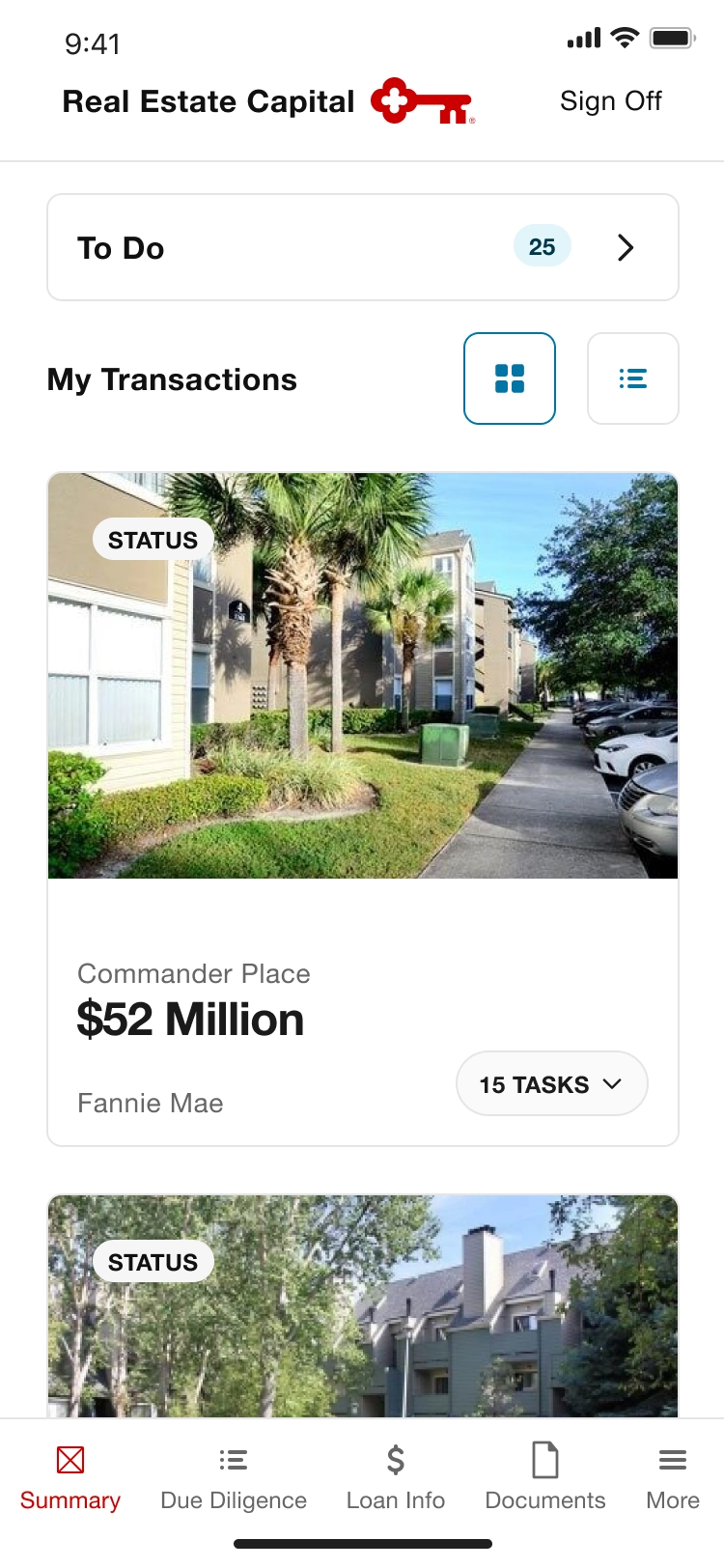

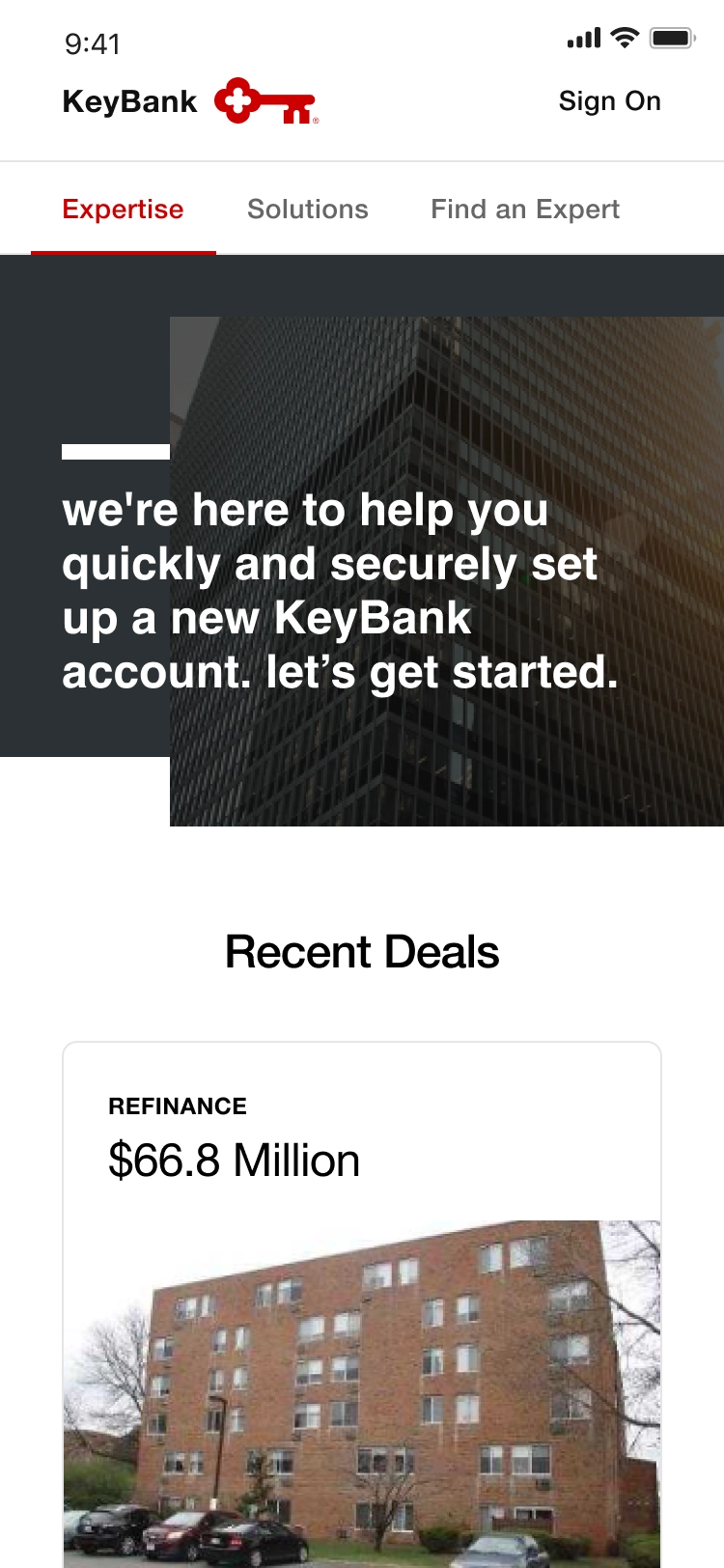

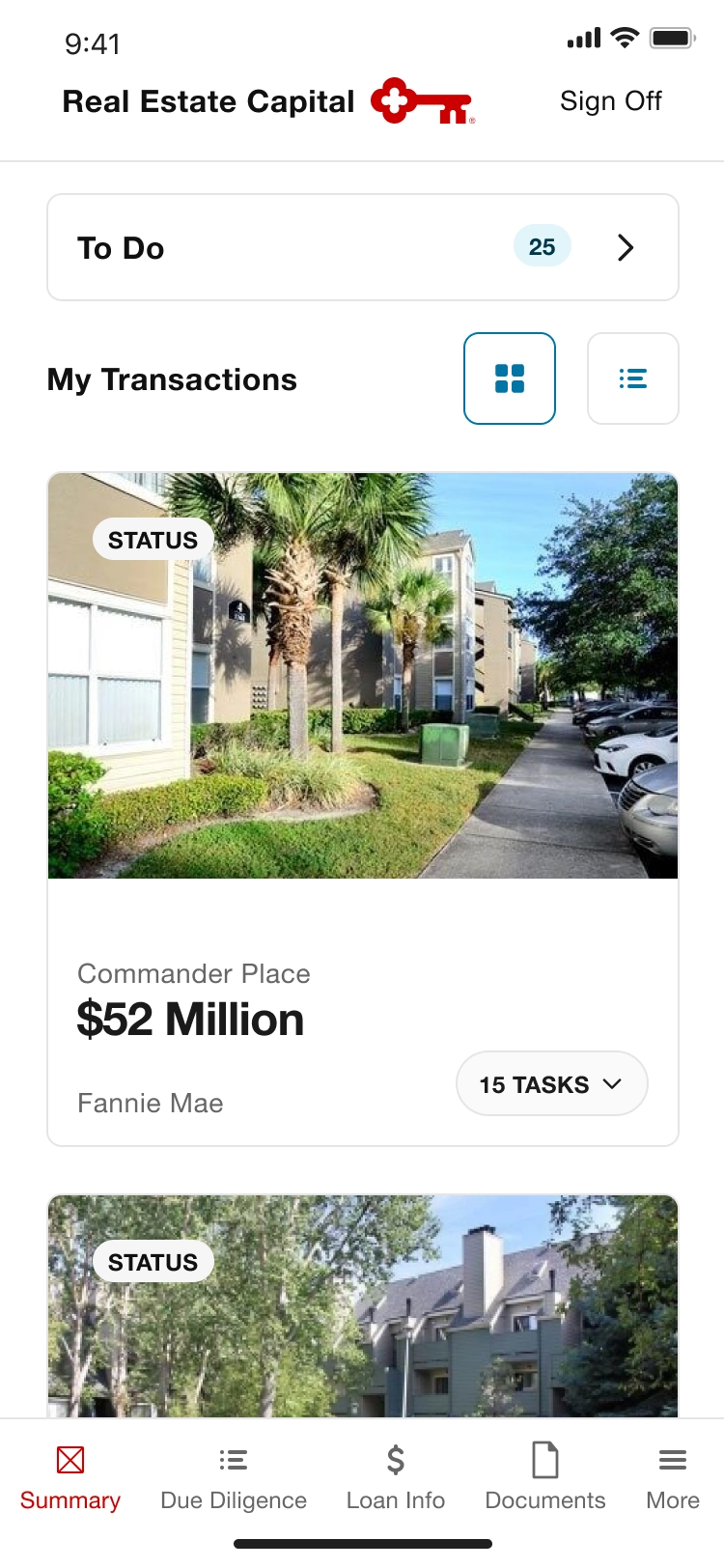

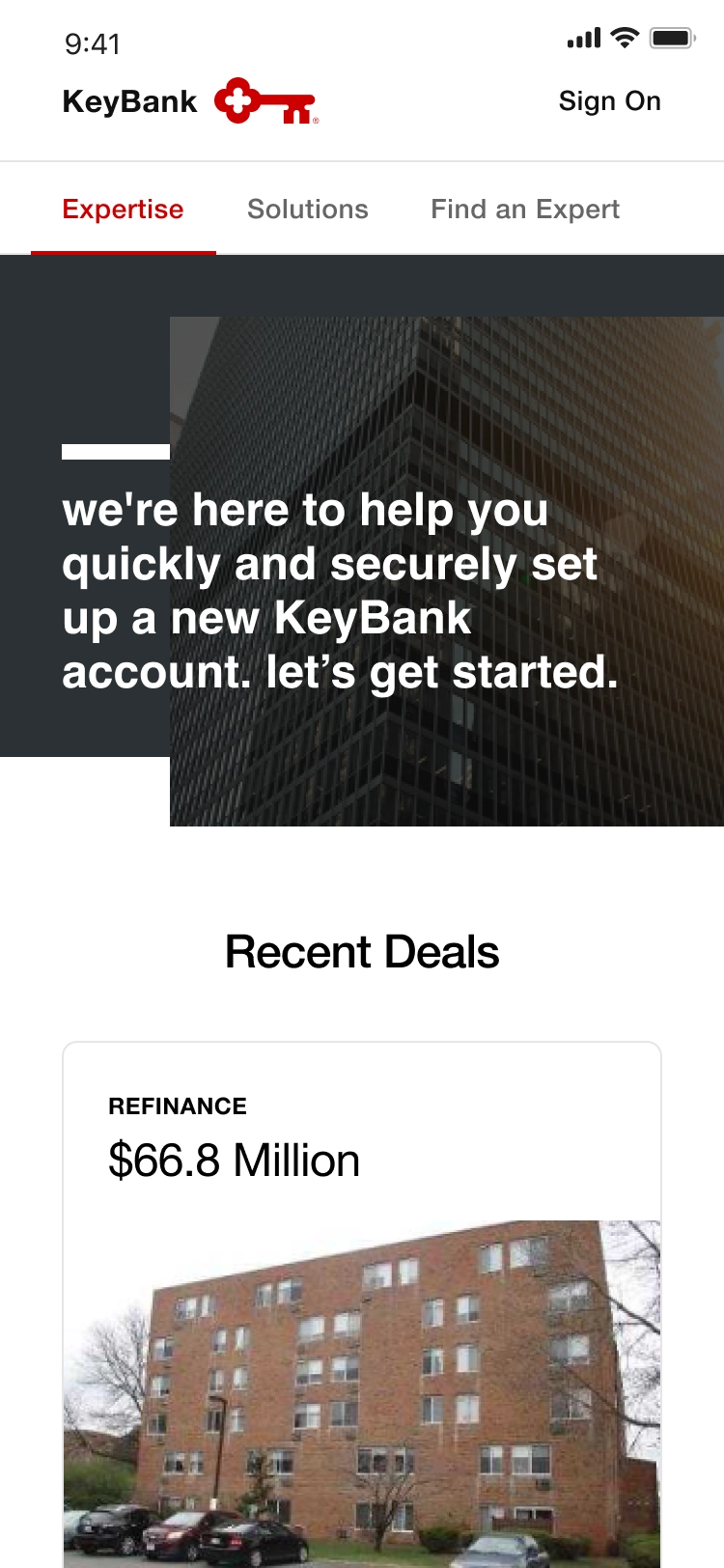

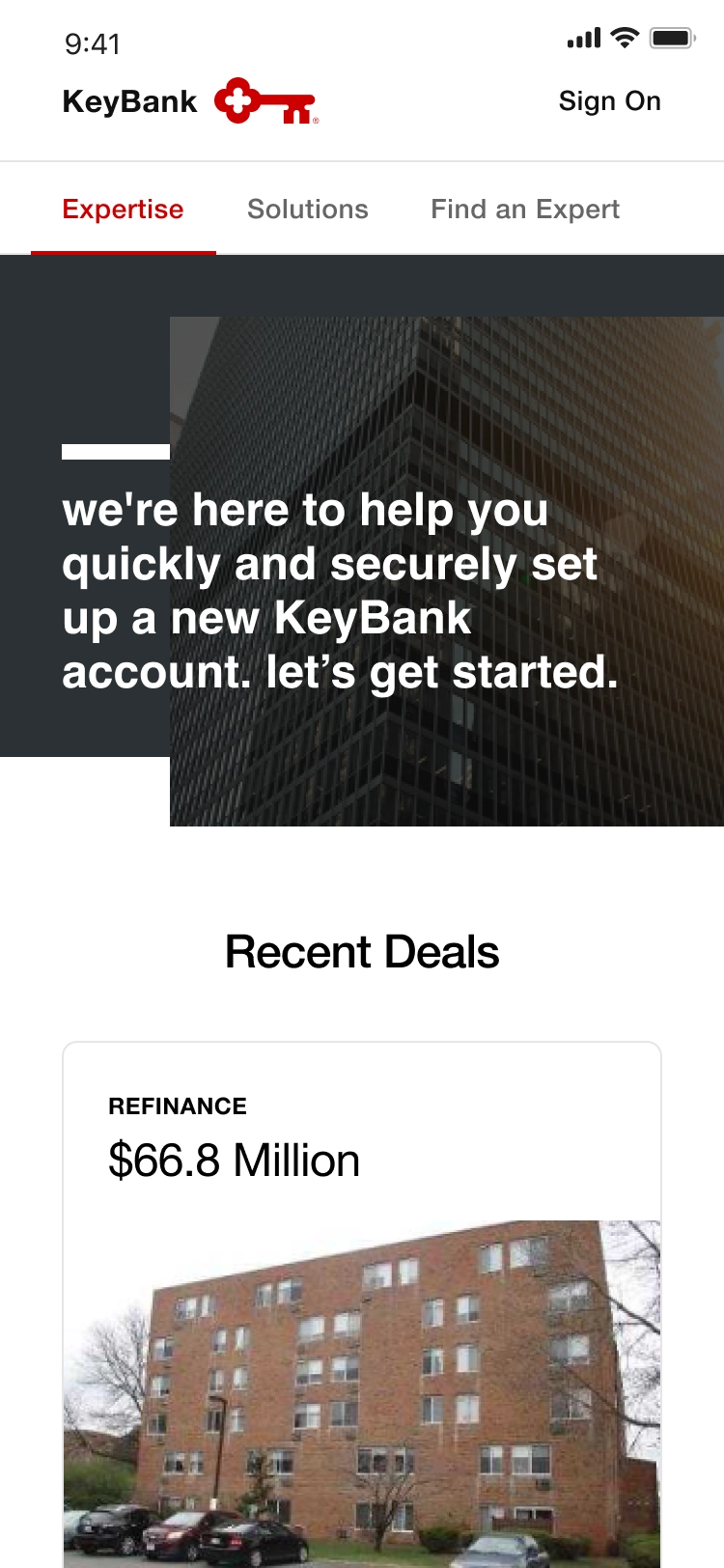

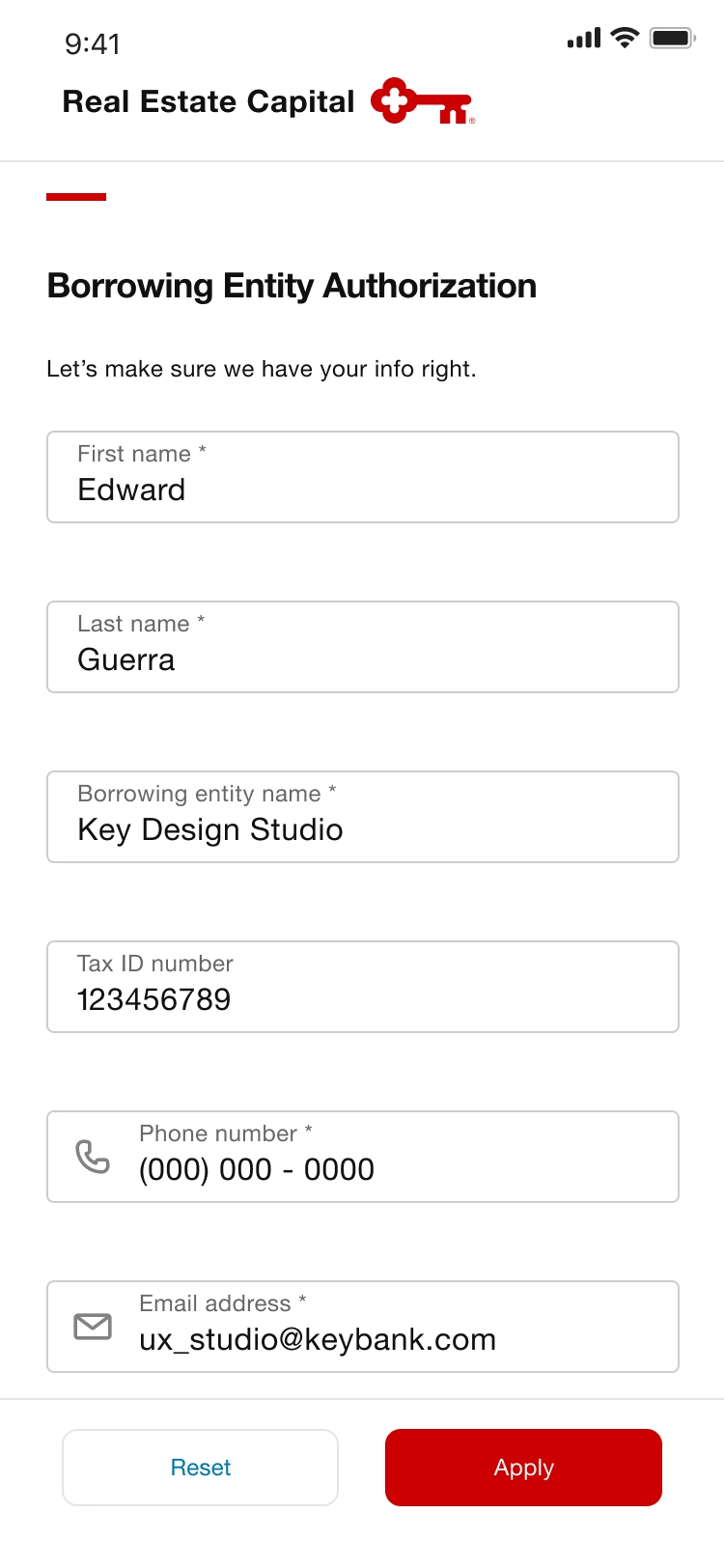

Real Estate Capital

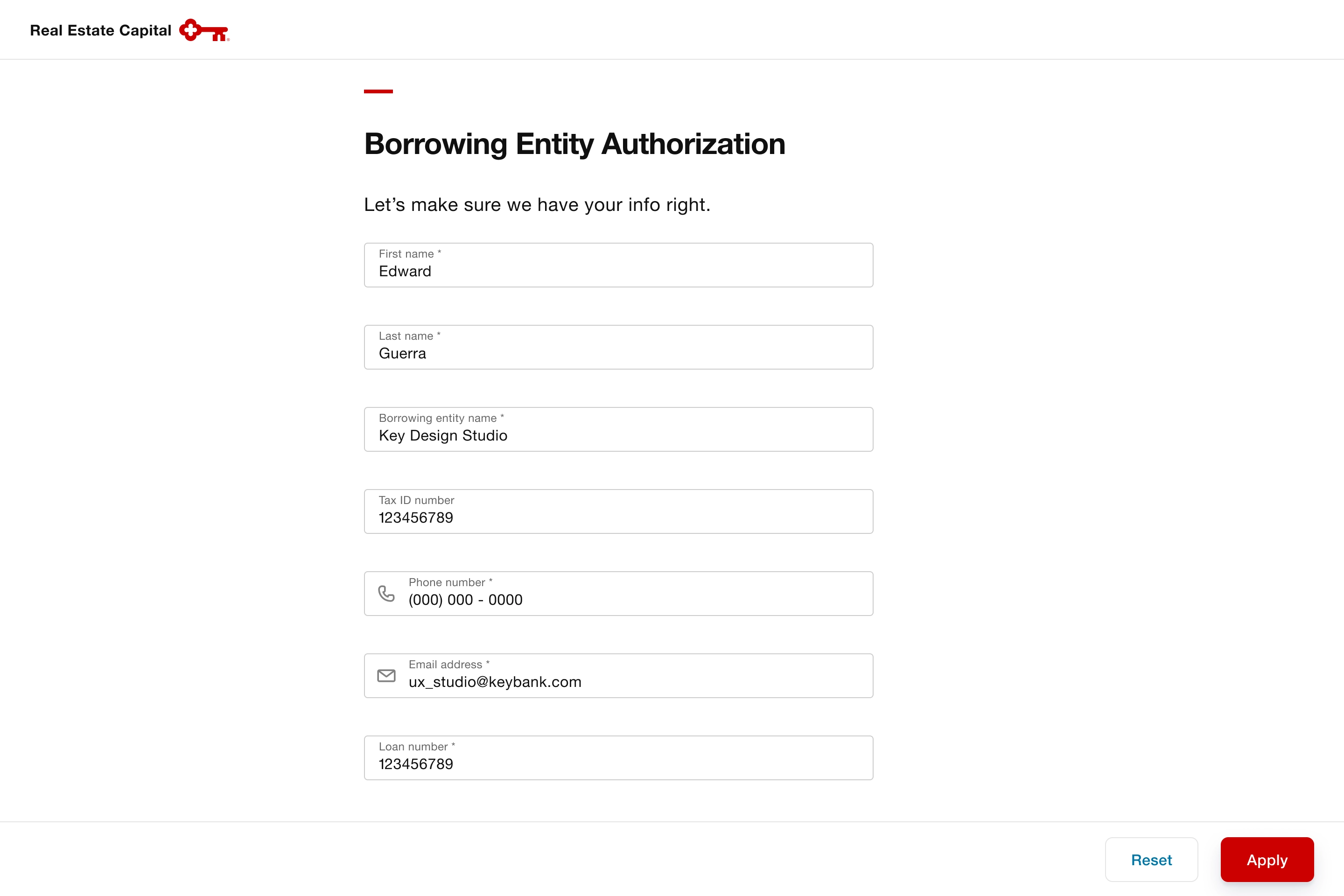

Overview

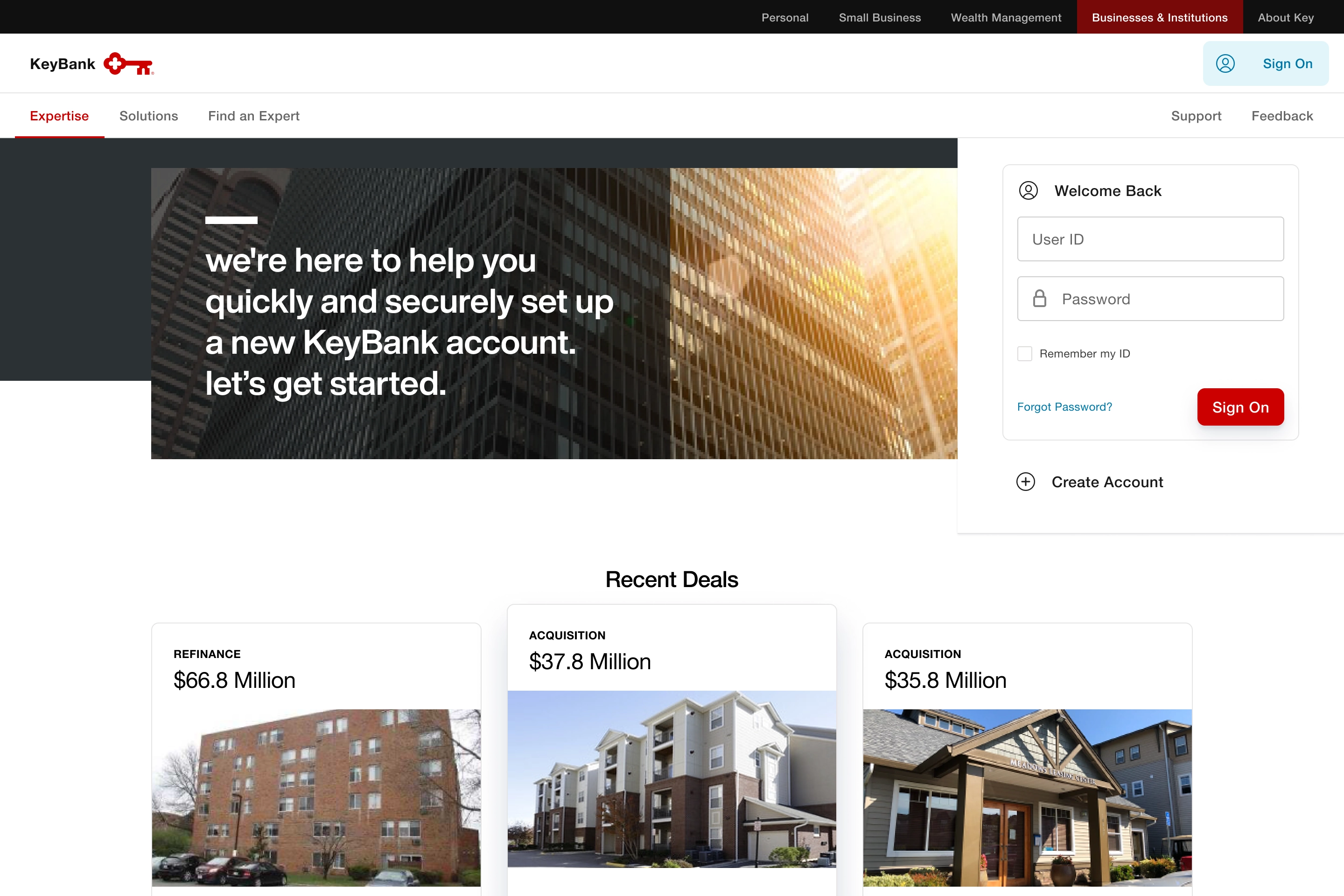

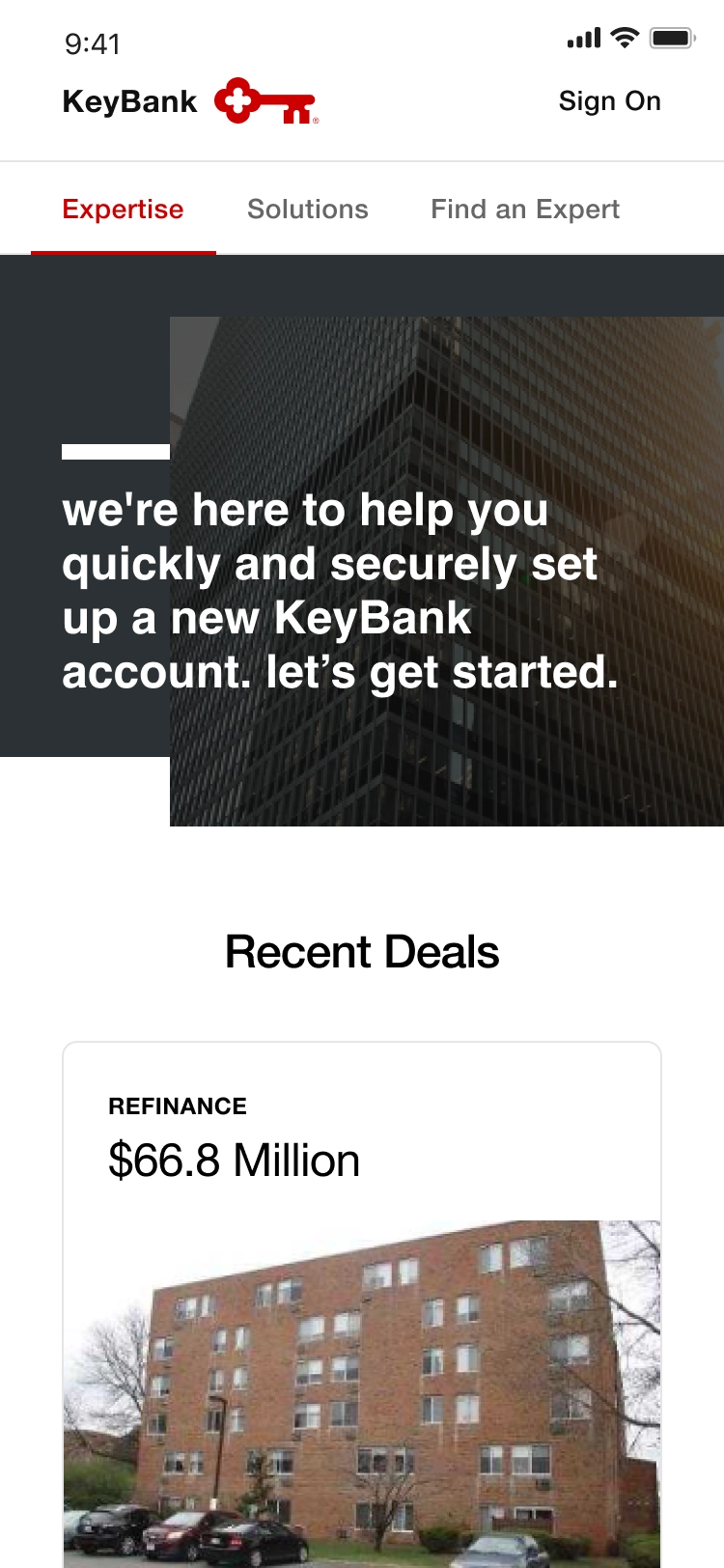

KeyBank Real Estate Capital is a leading lender in commercial and multifamily sectors, providing financing, investment banking, and loan servicing solutions to support businesses in achieving strategic growth.

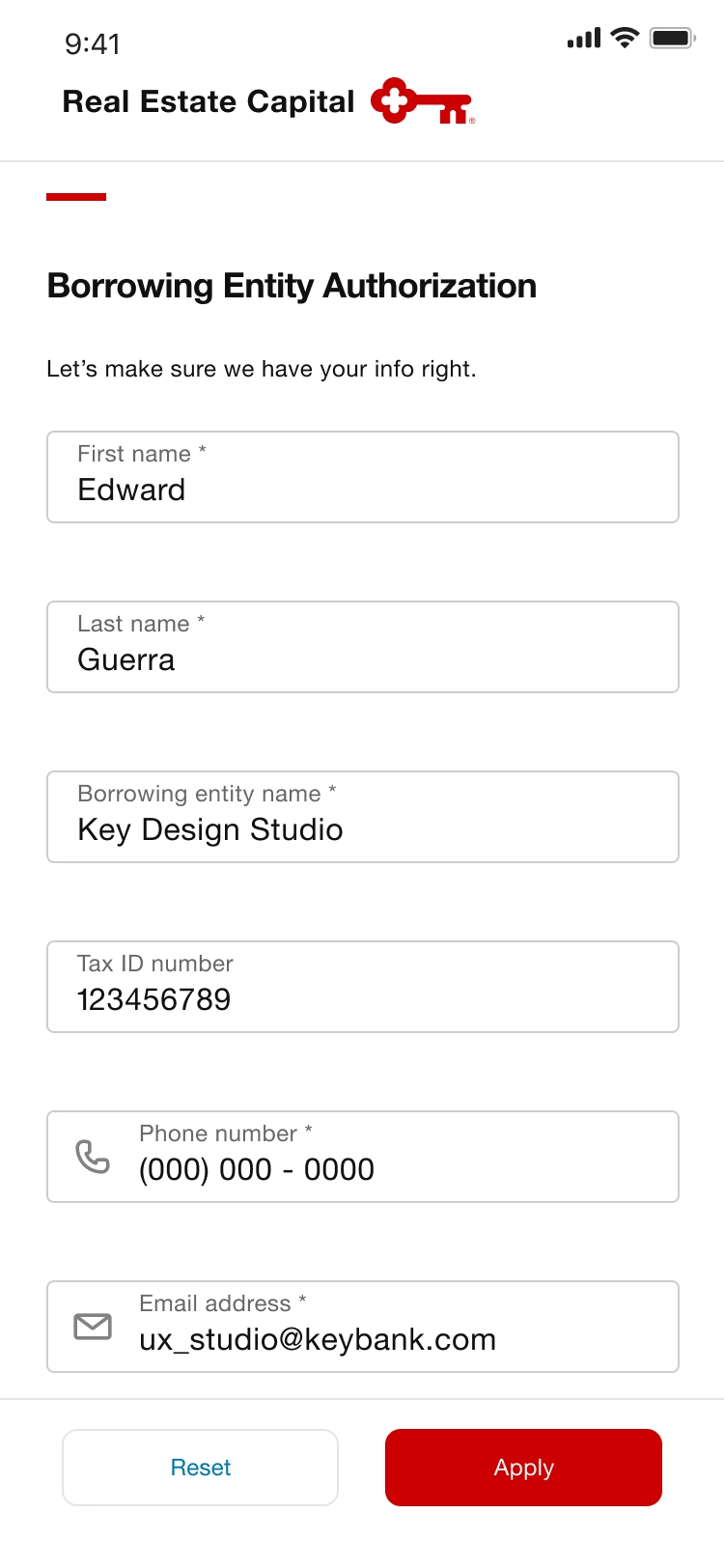

Problem

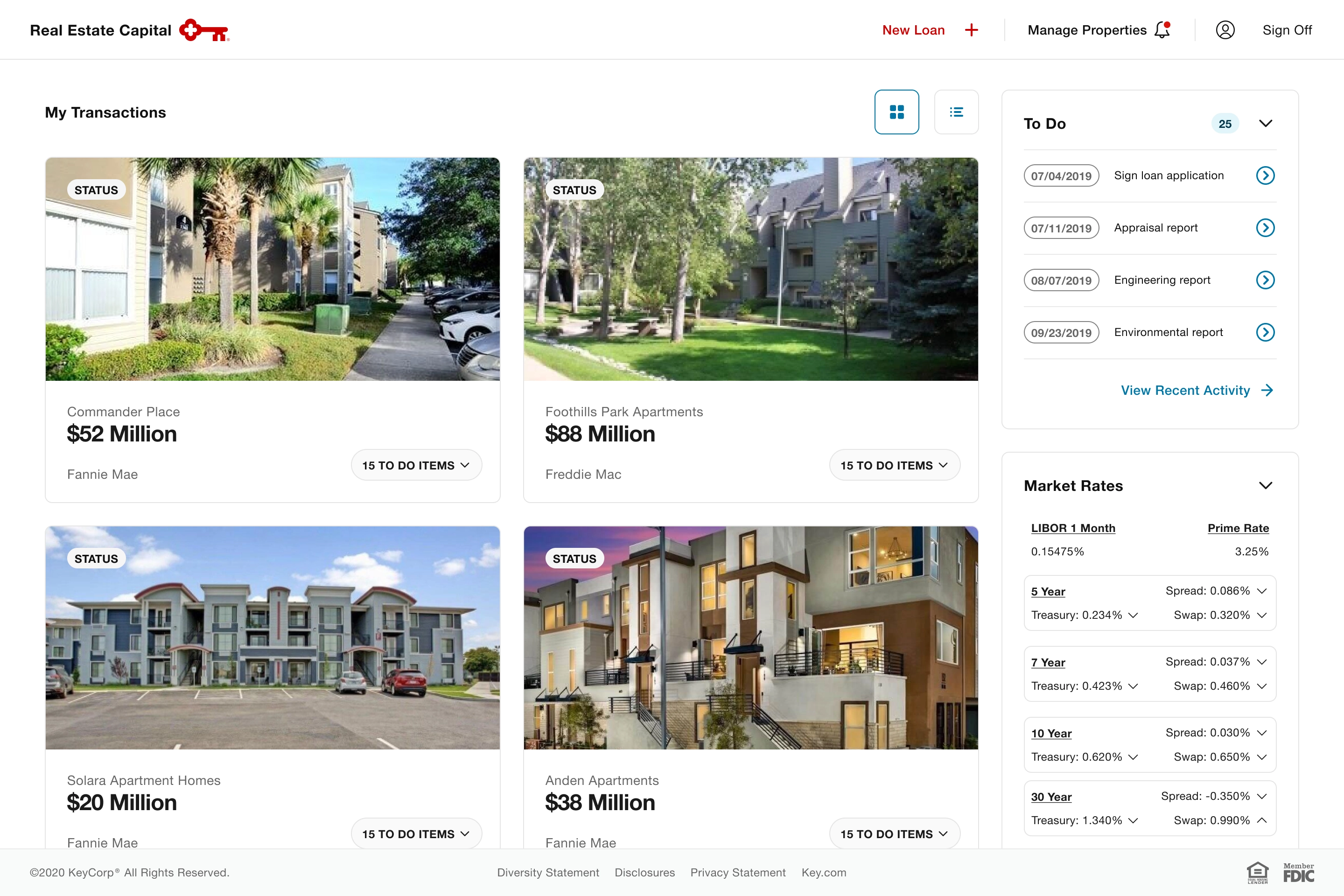

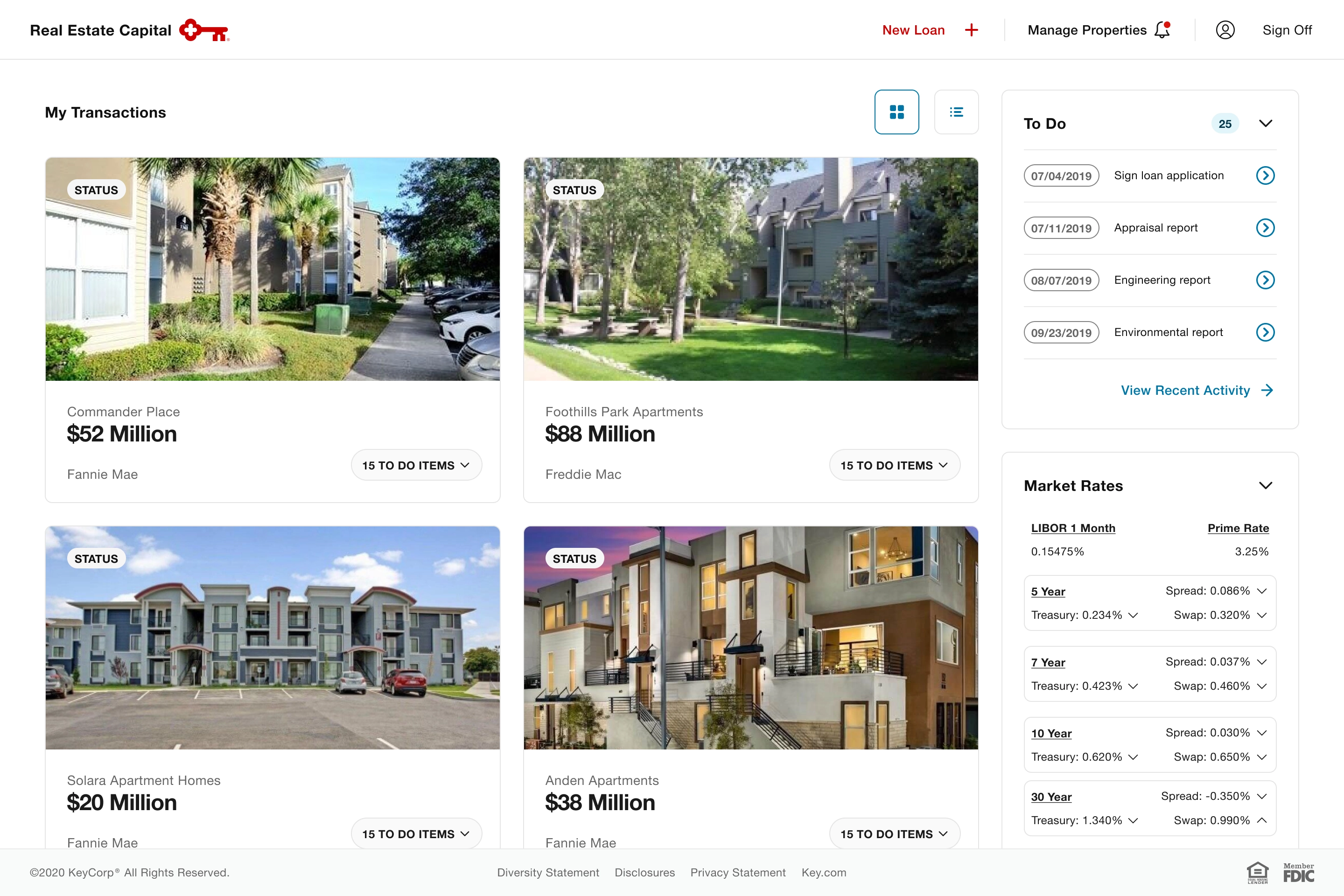

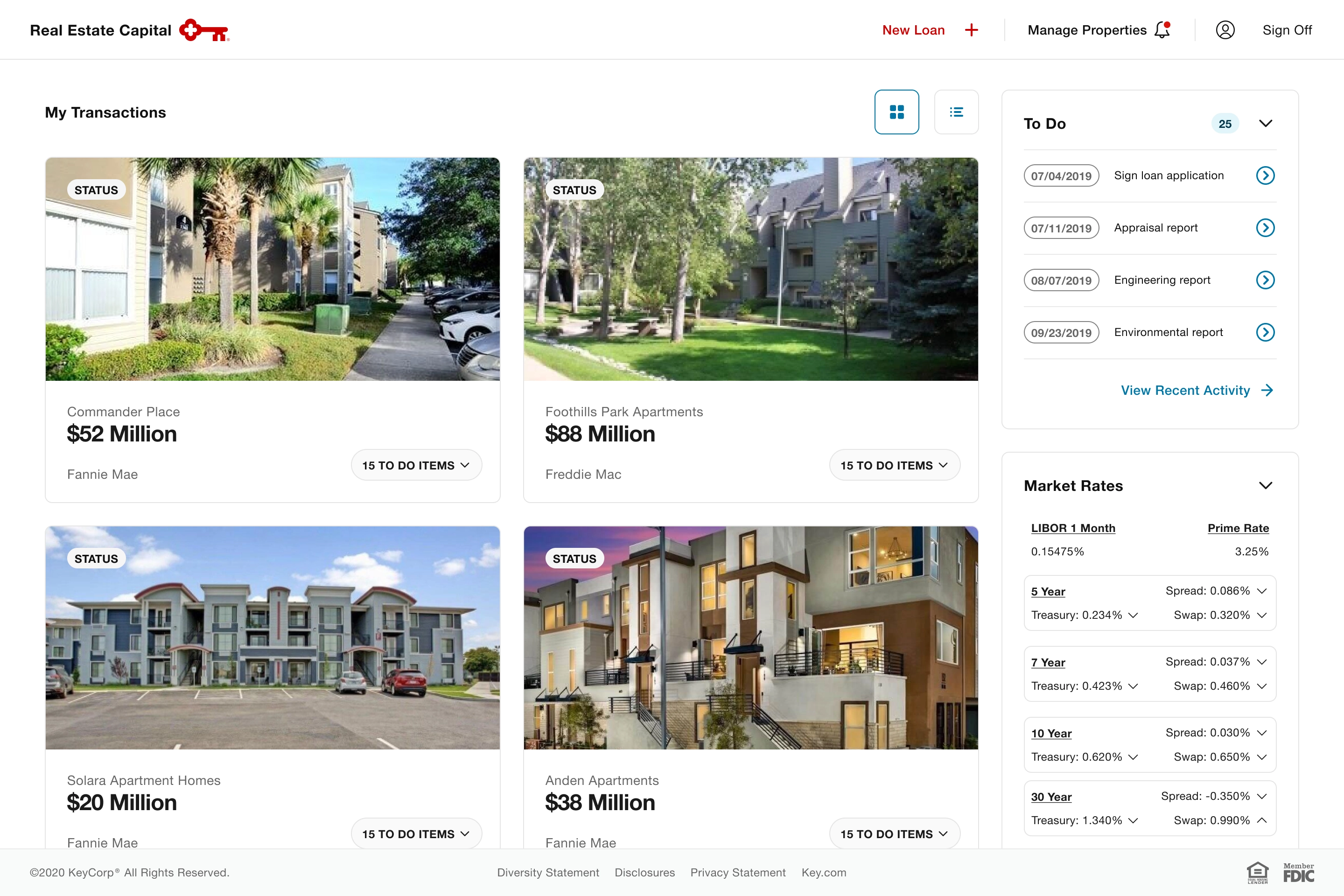

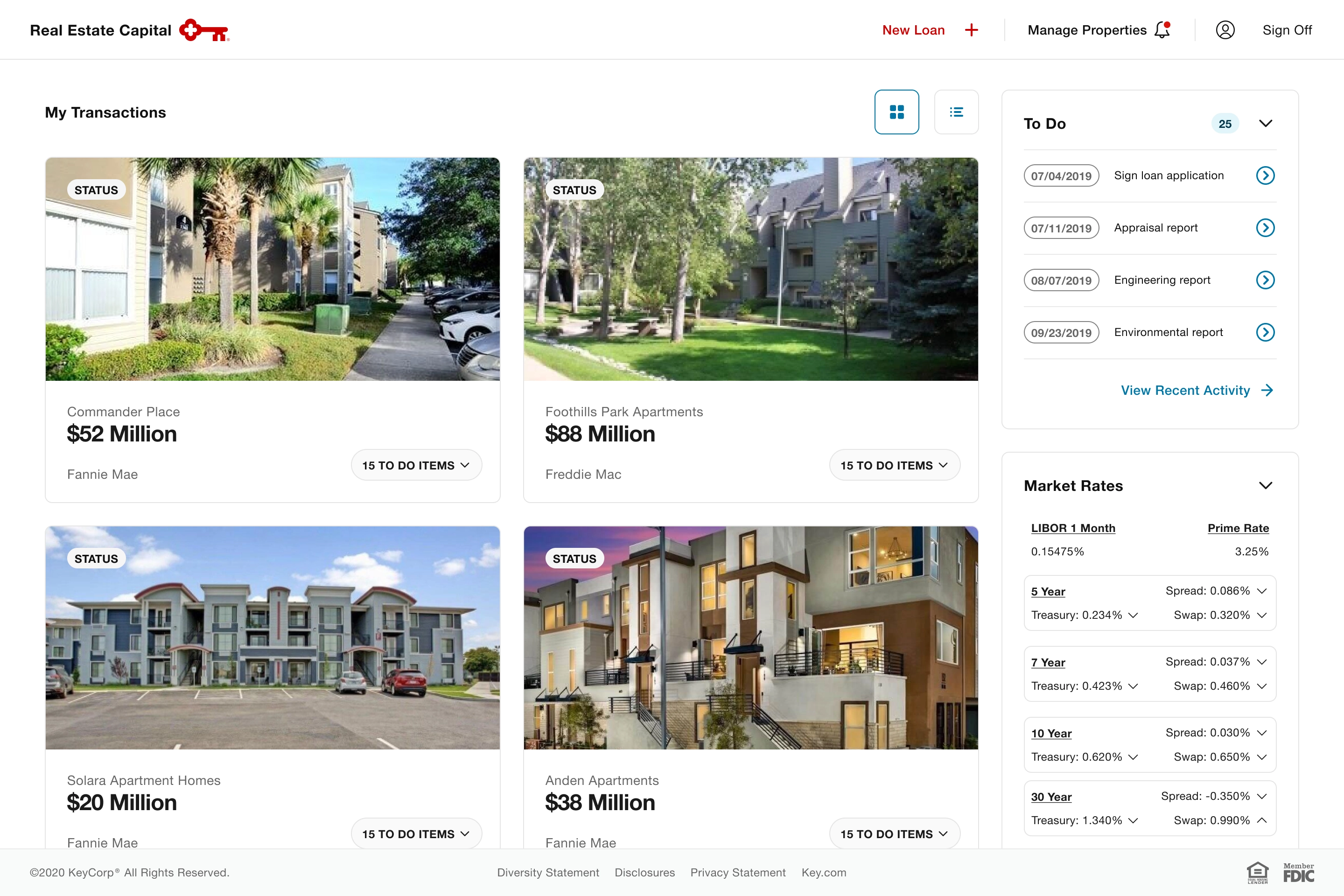

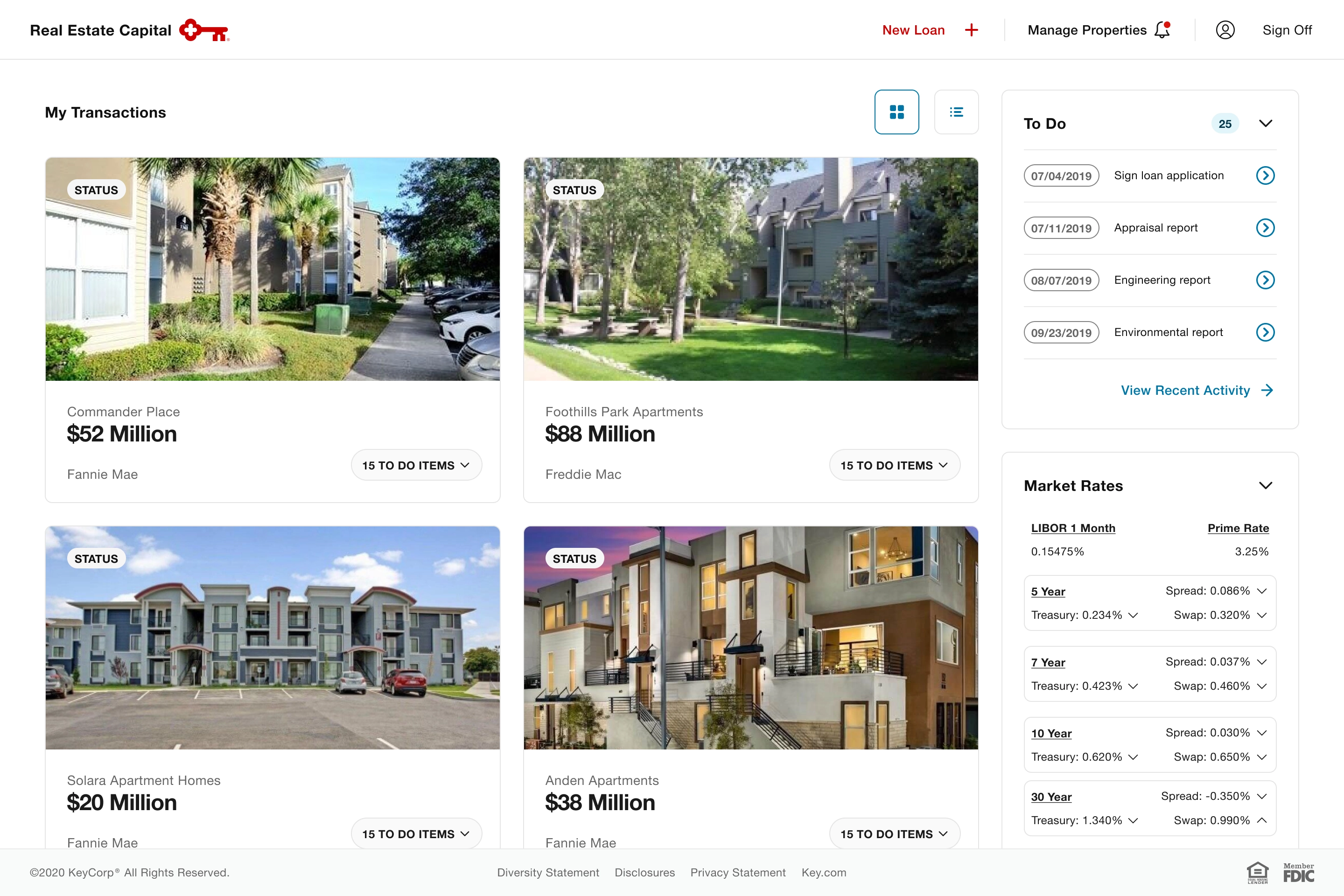

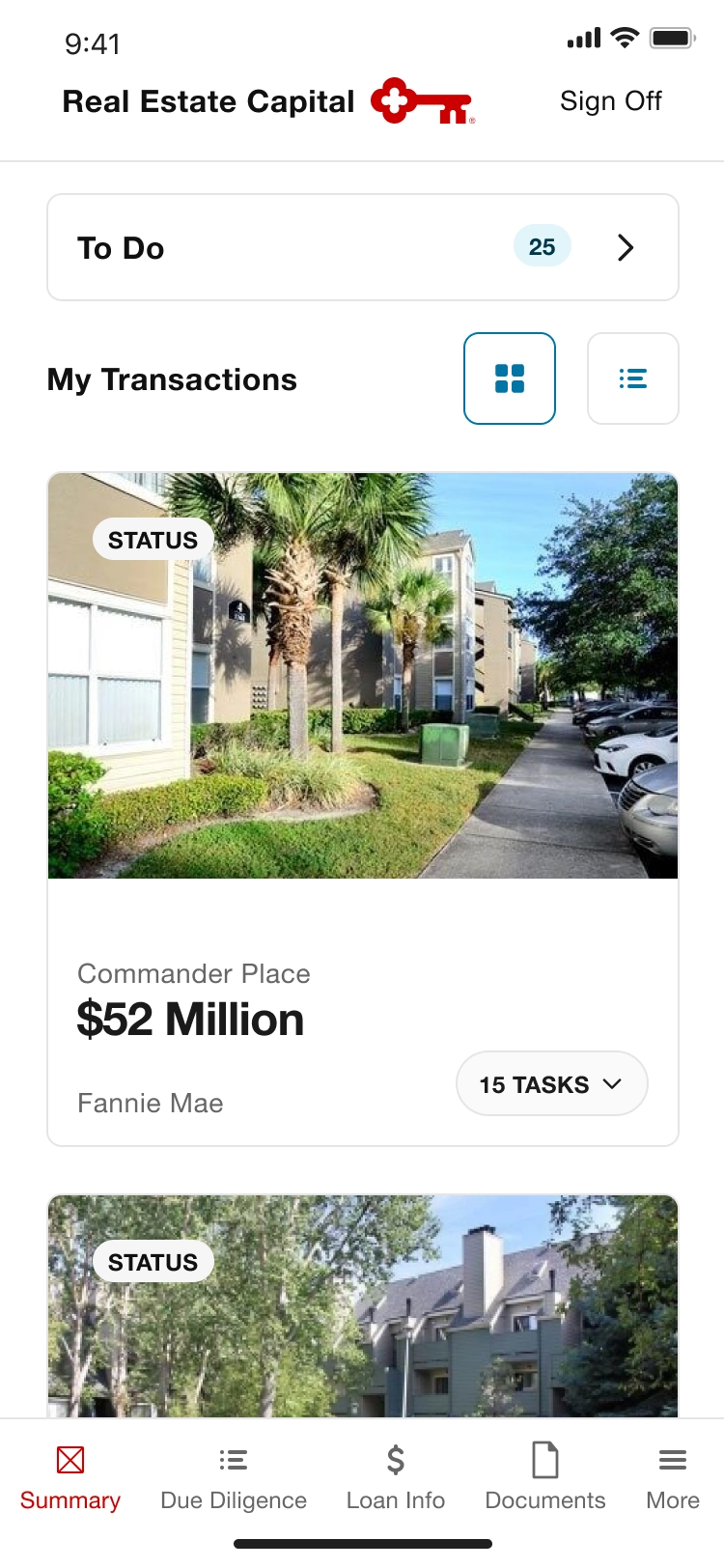

Fragmented systems force underwriters, vendors, and clients to navigate up to 50 platforms, making complex transactions inefficient and hindering centralized data access in real estate capital lending.

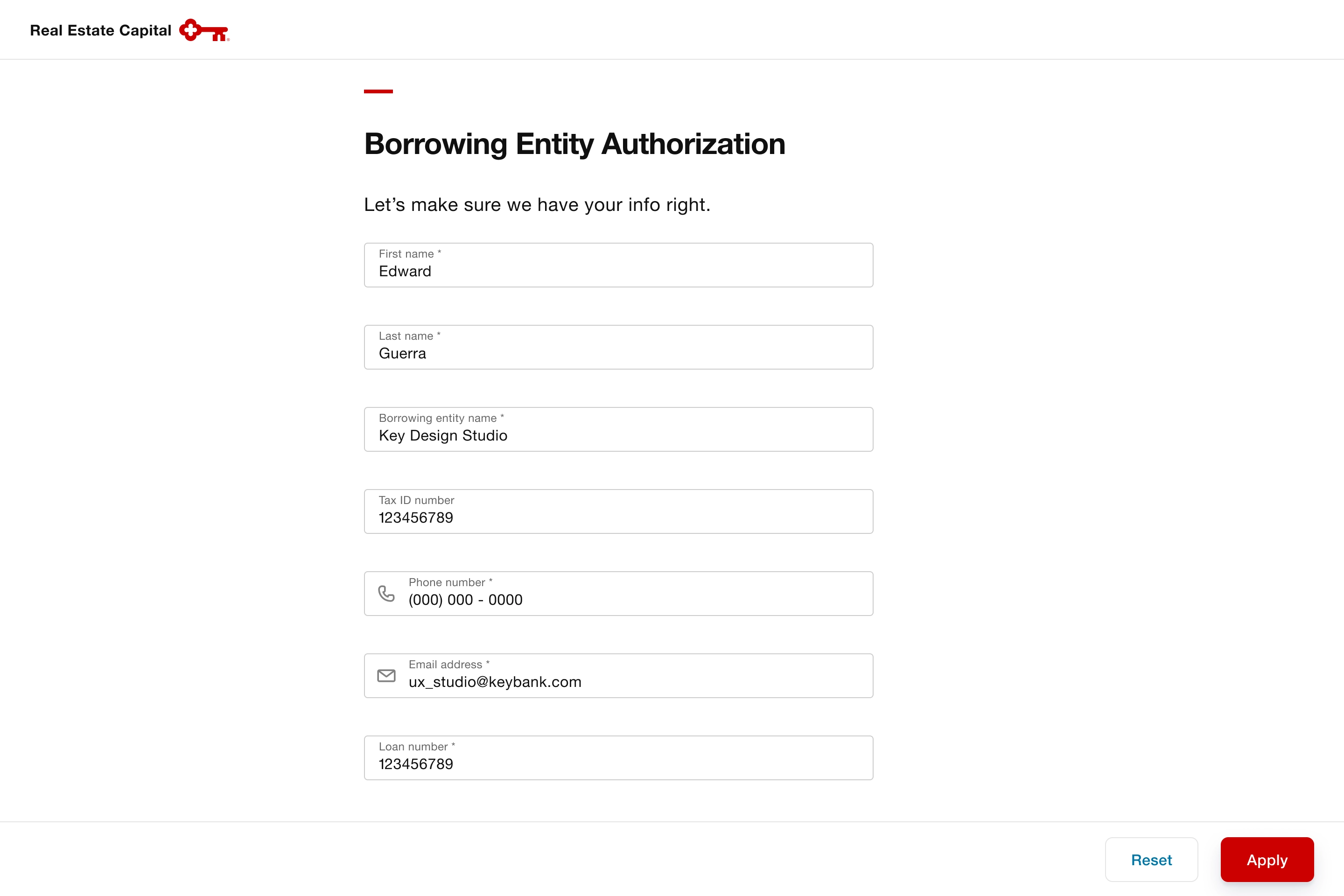

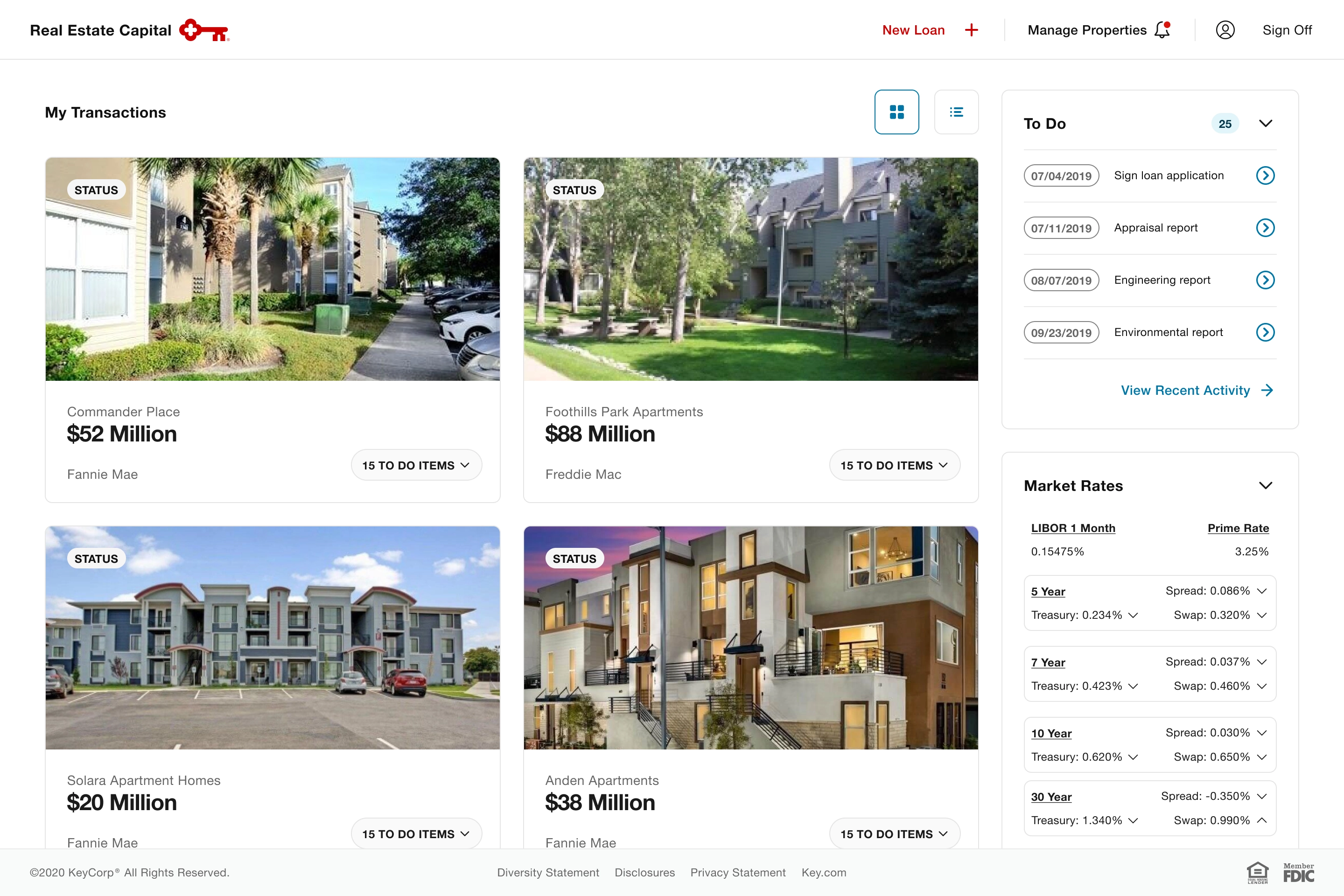

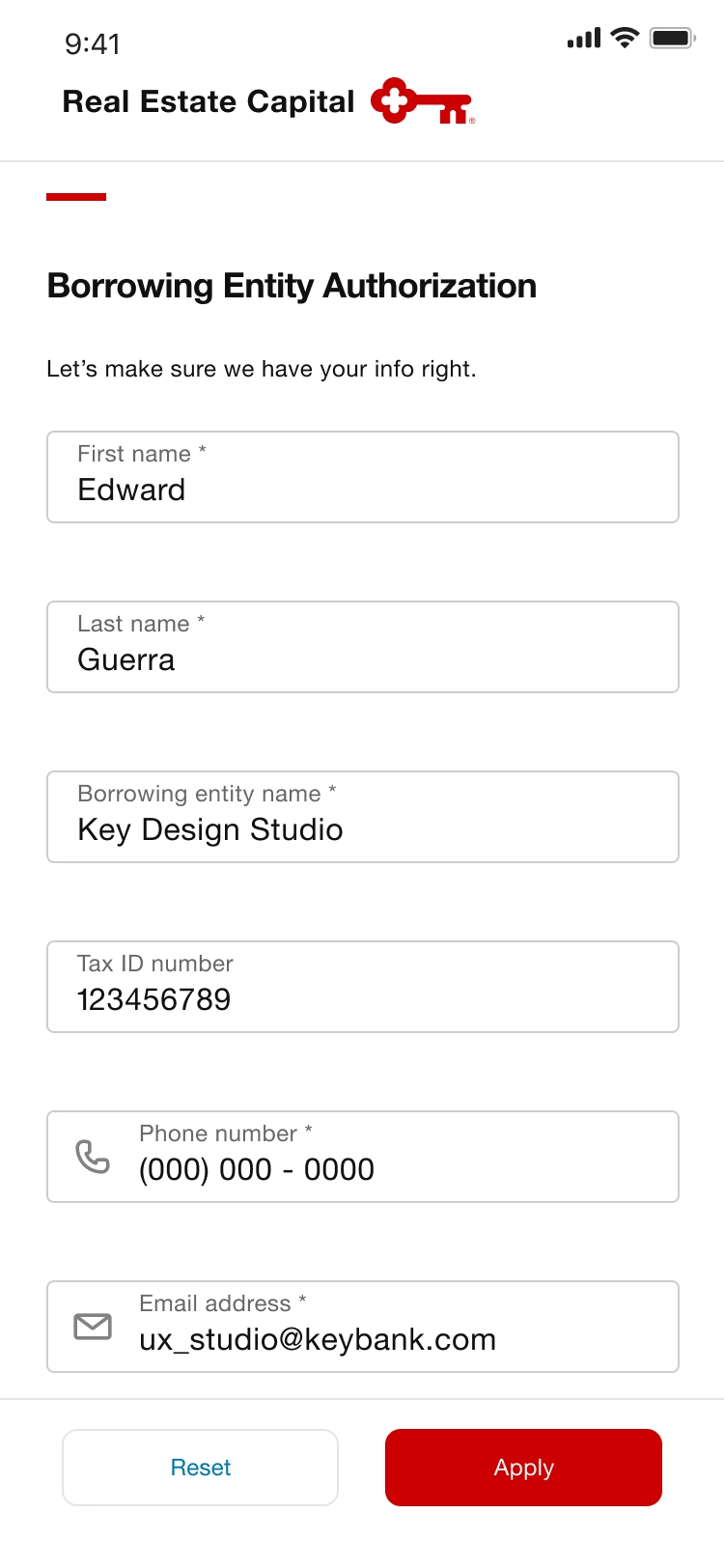

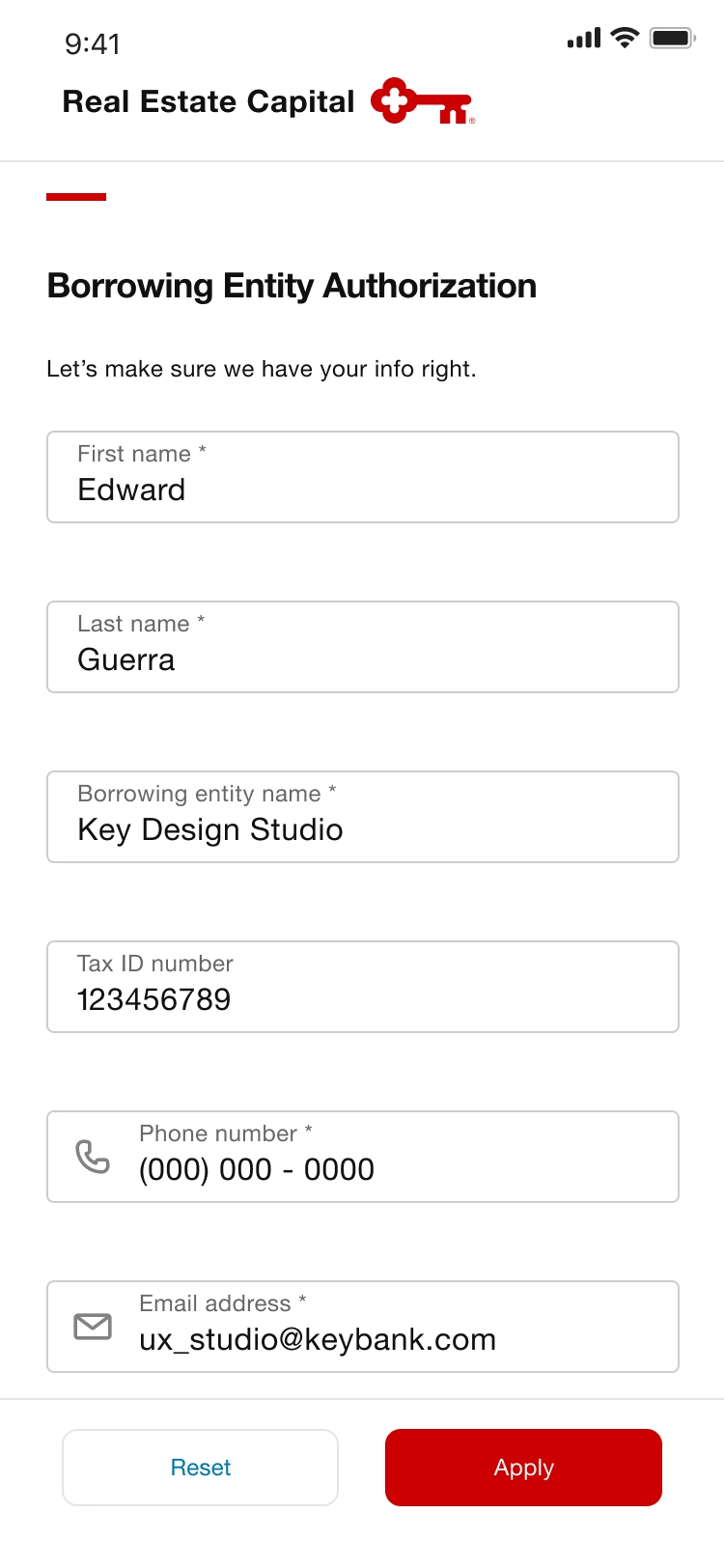

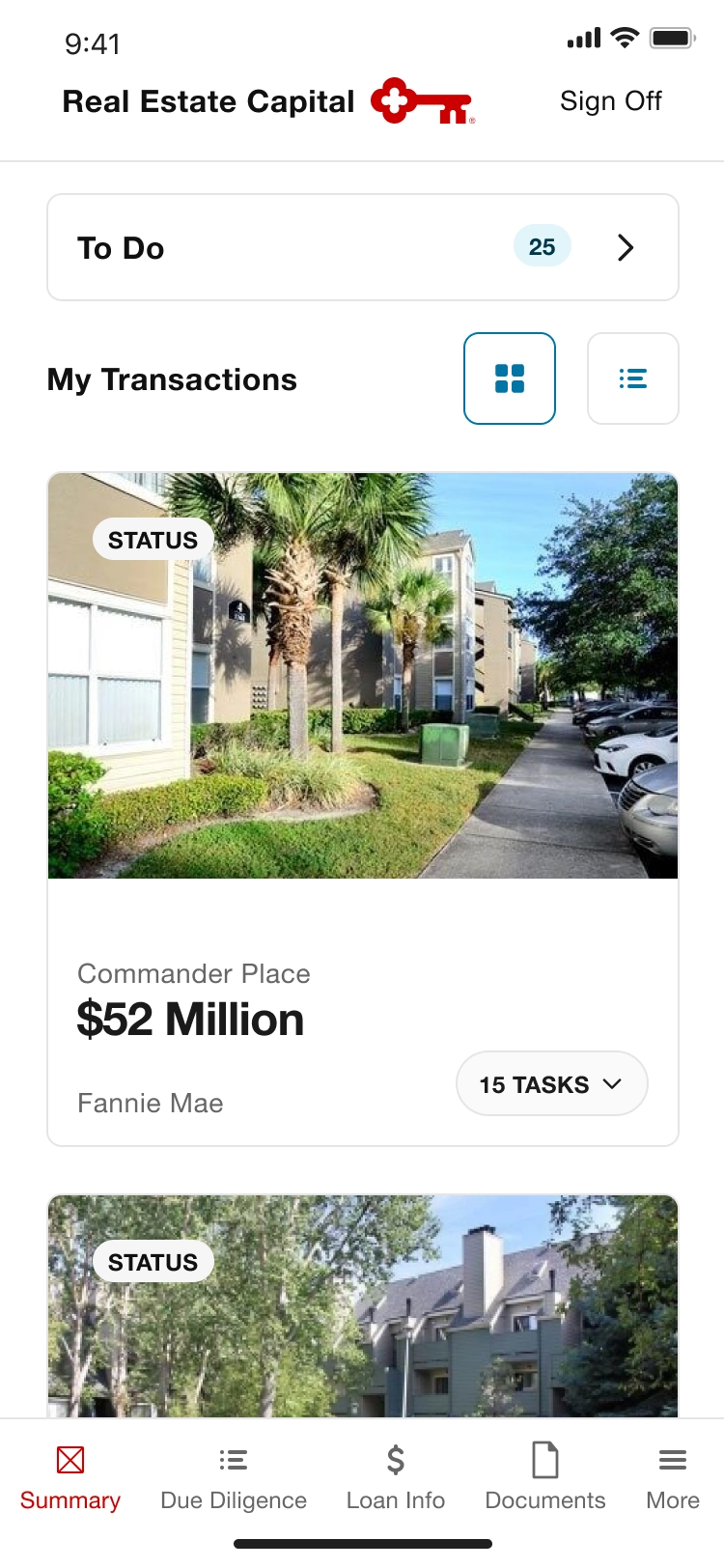

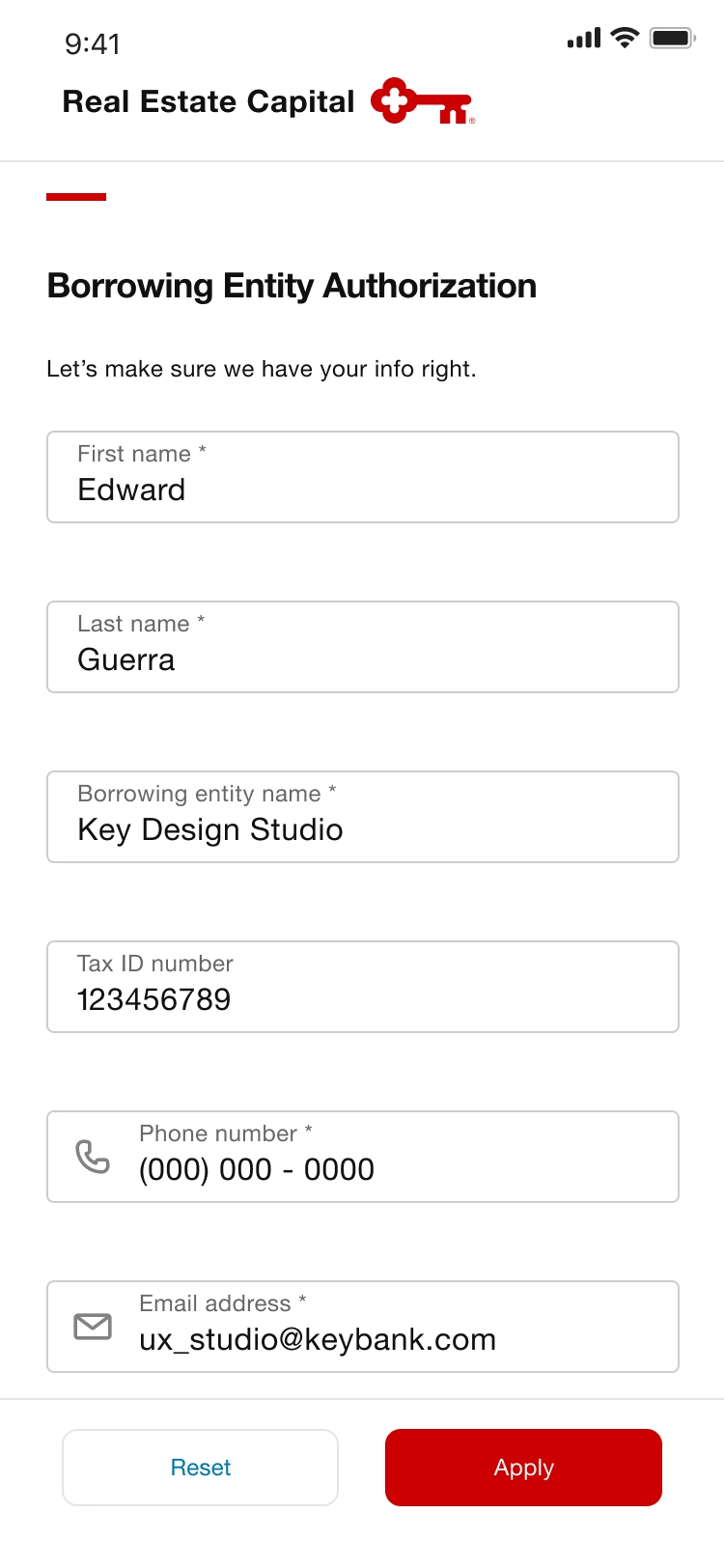

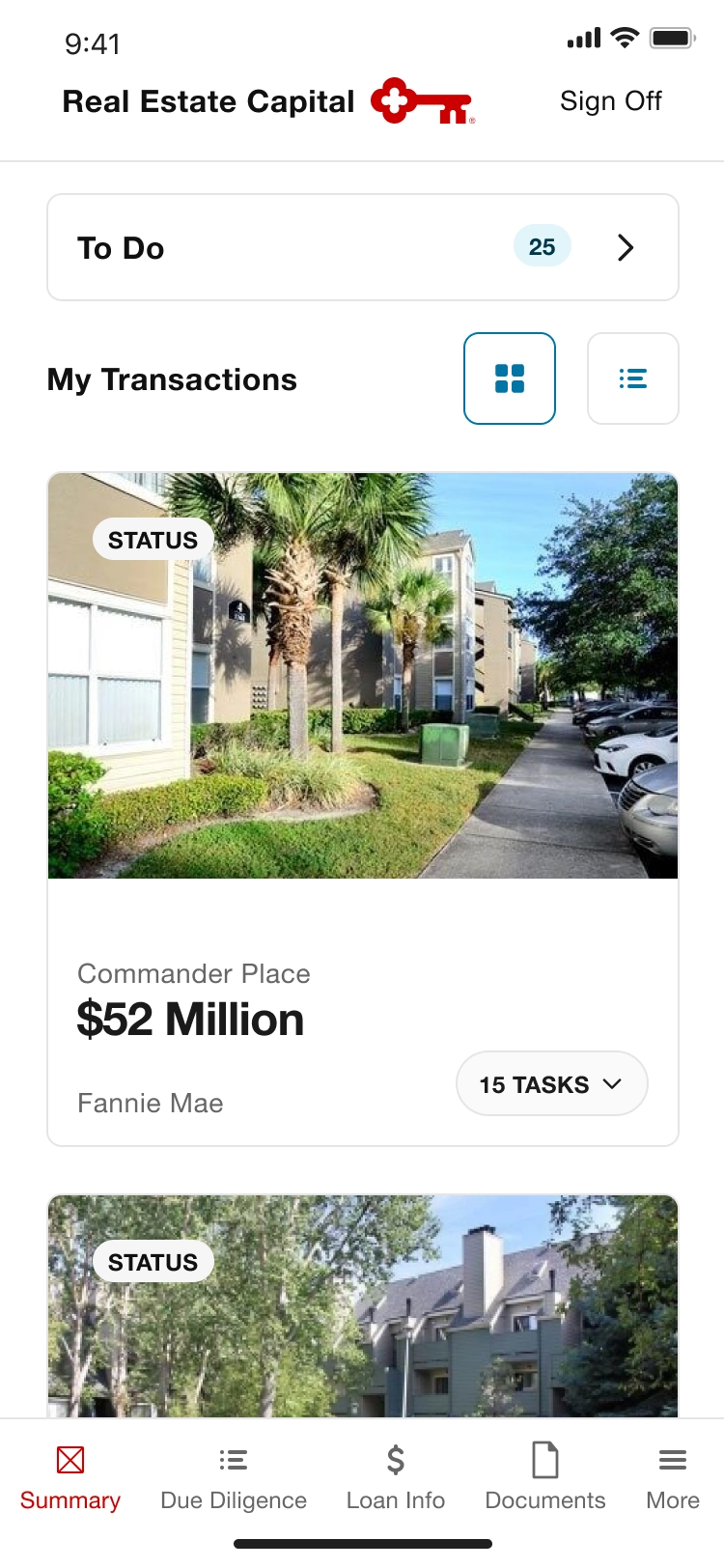

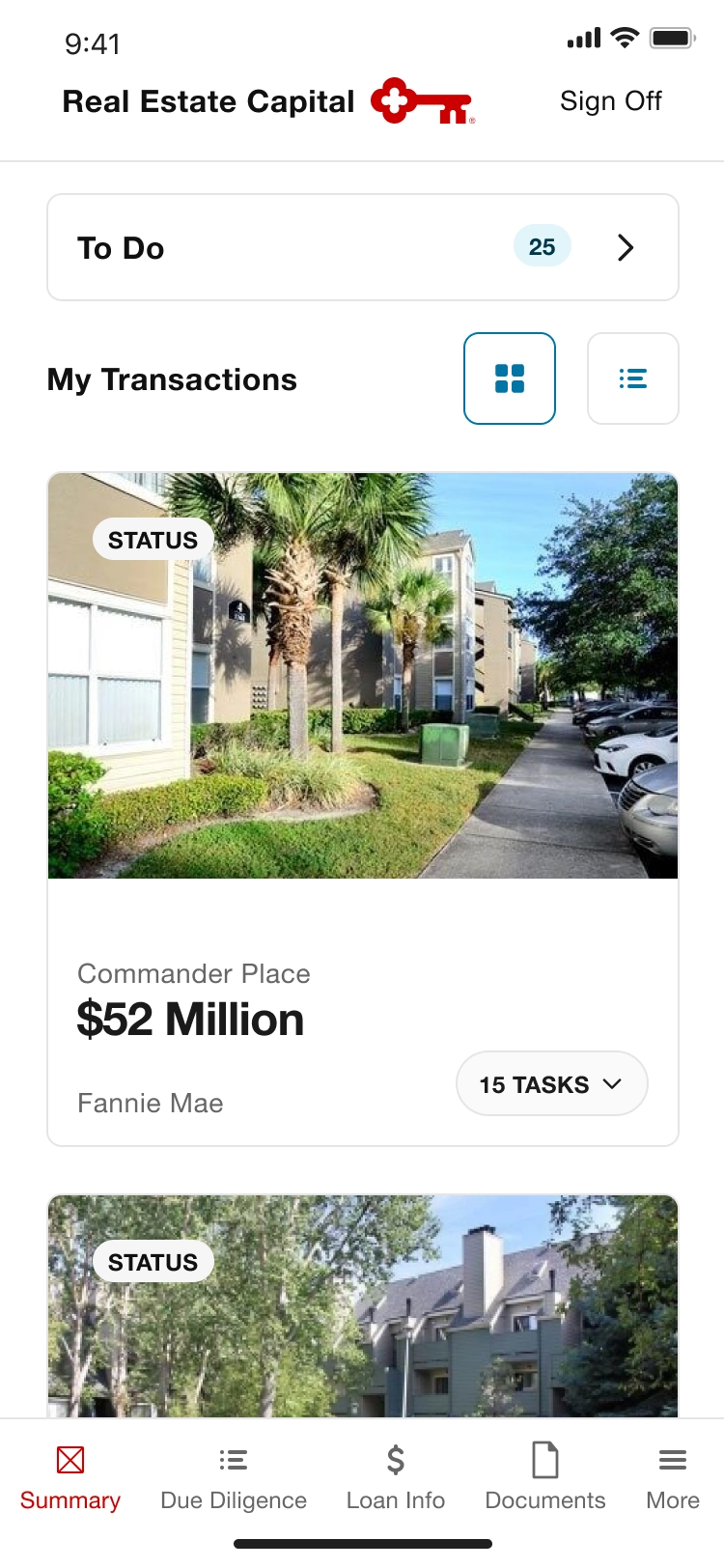

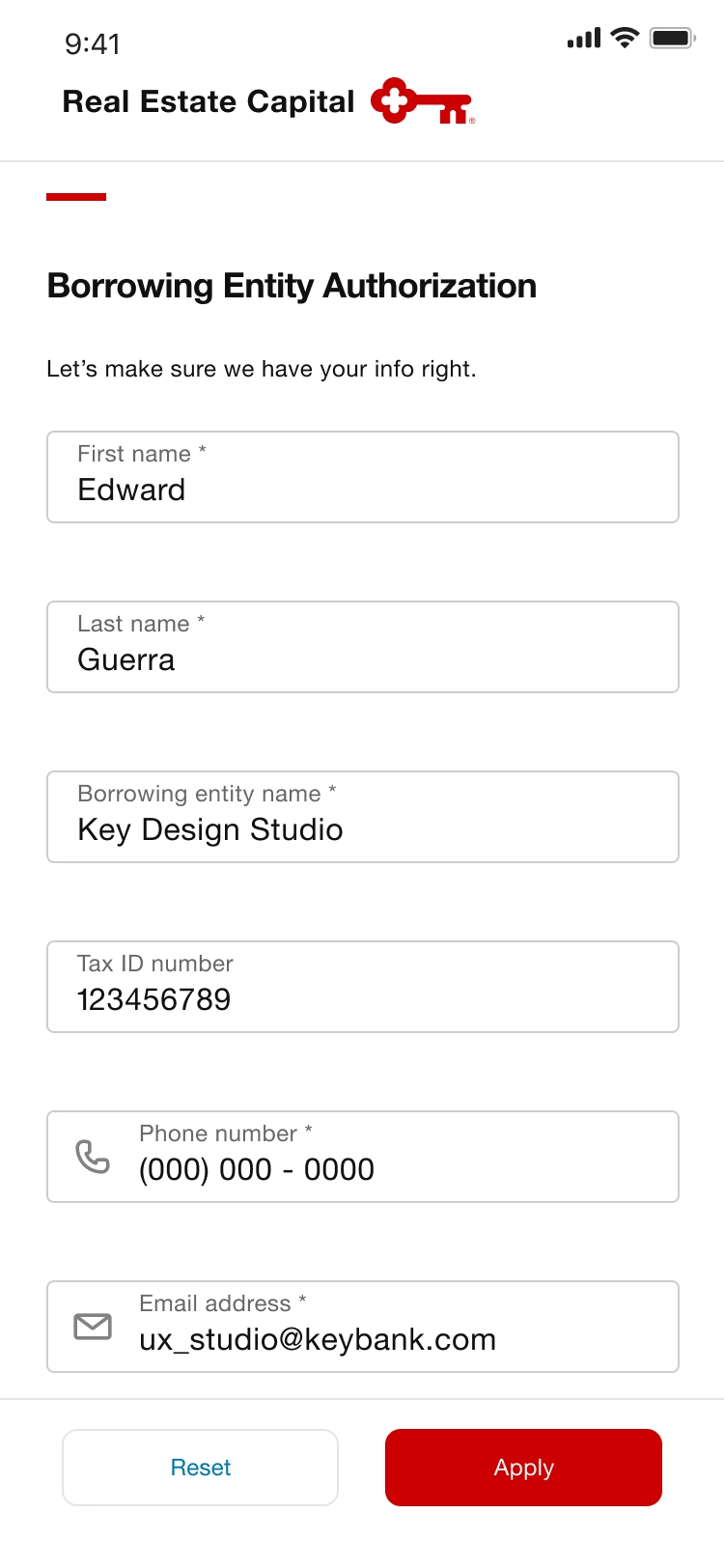

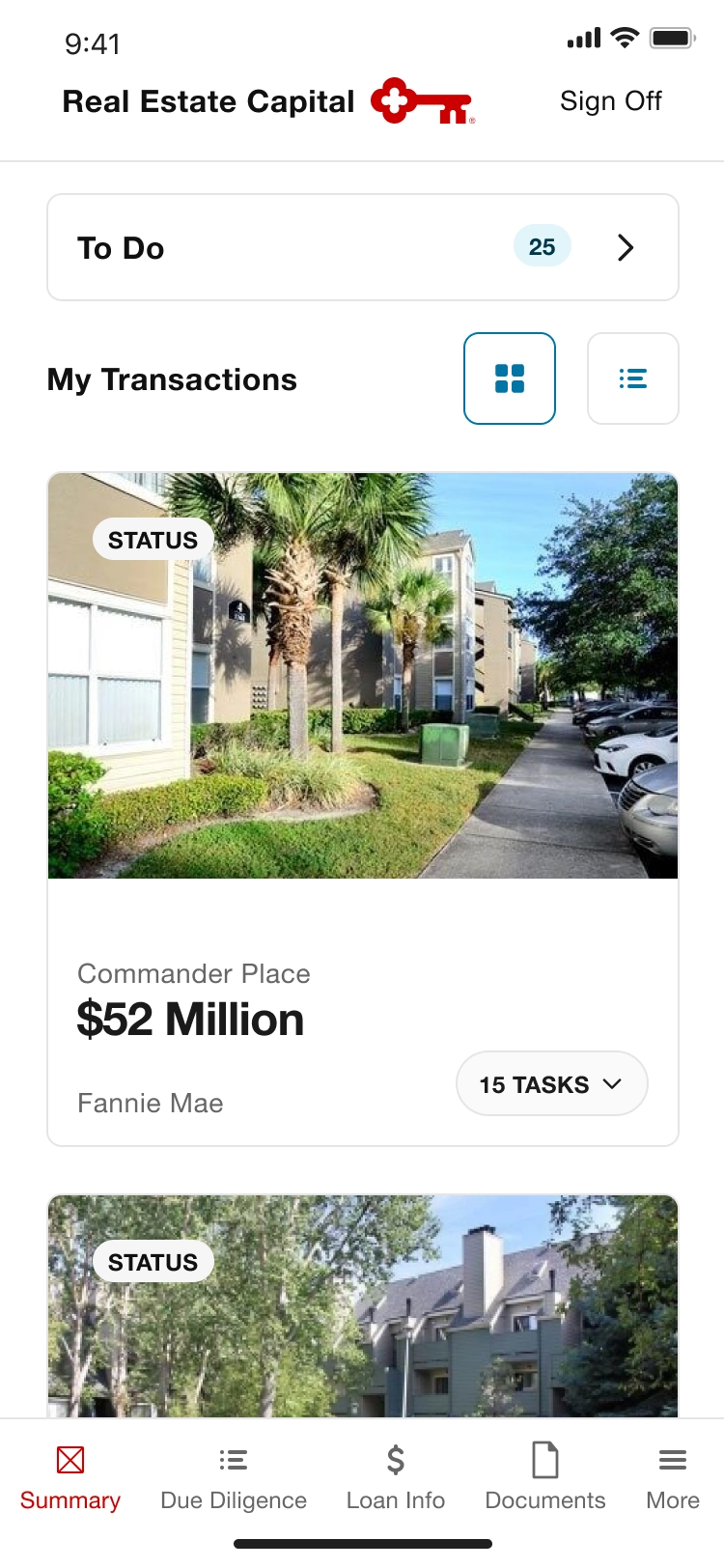

Solution

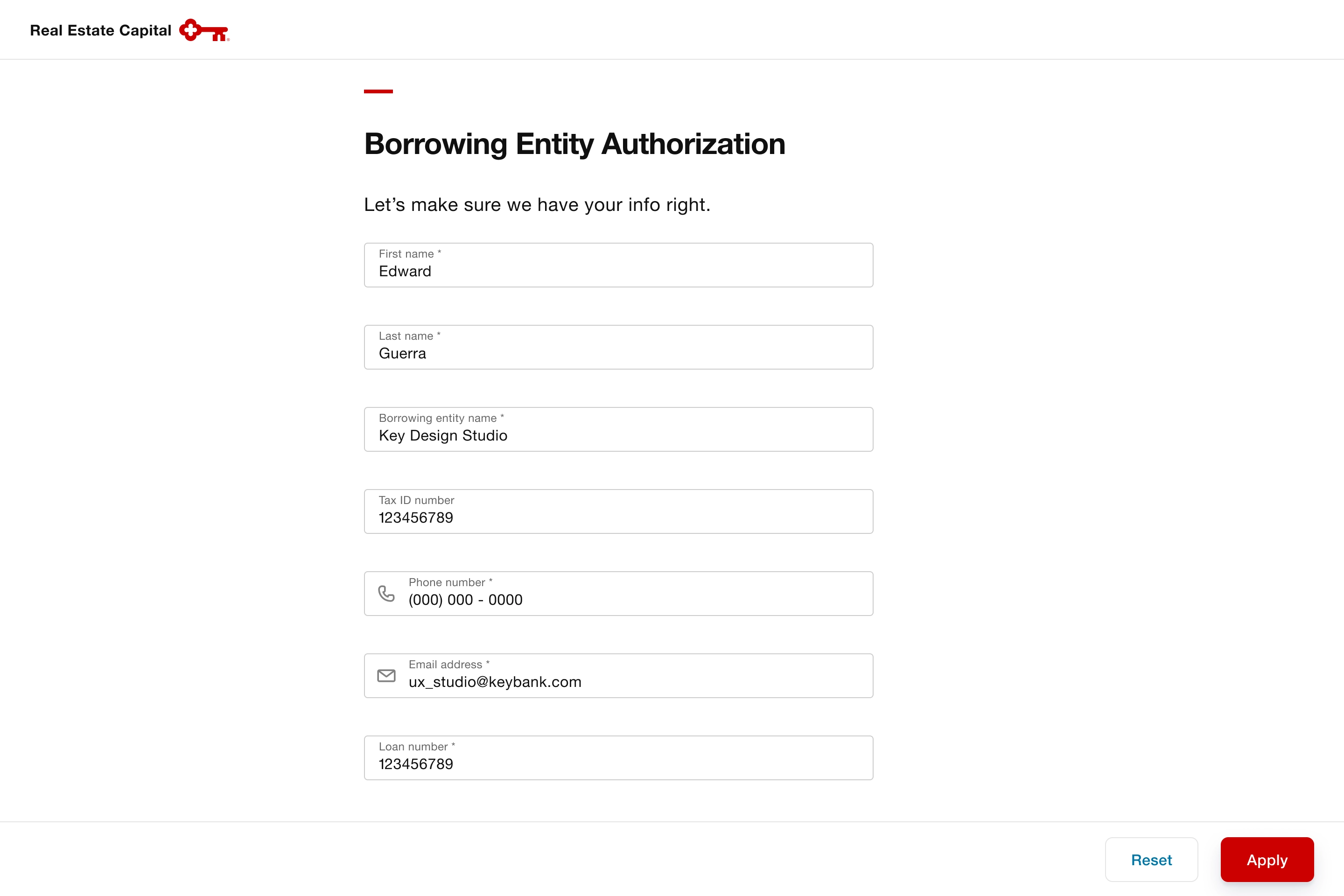

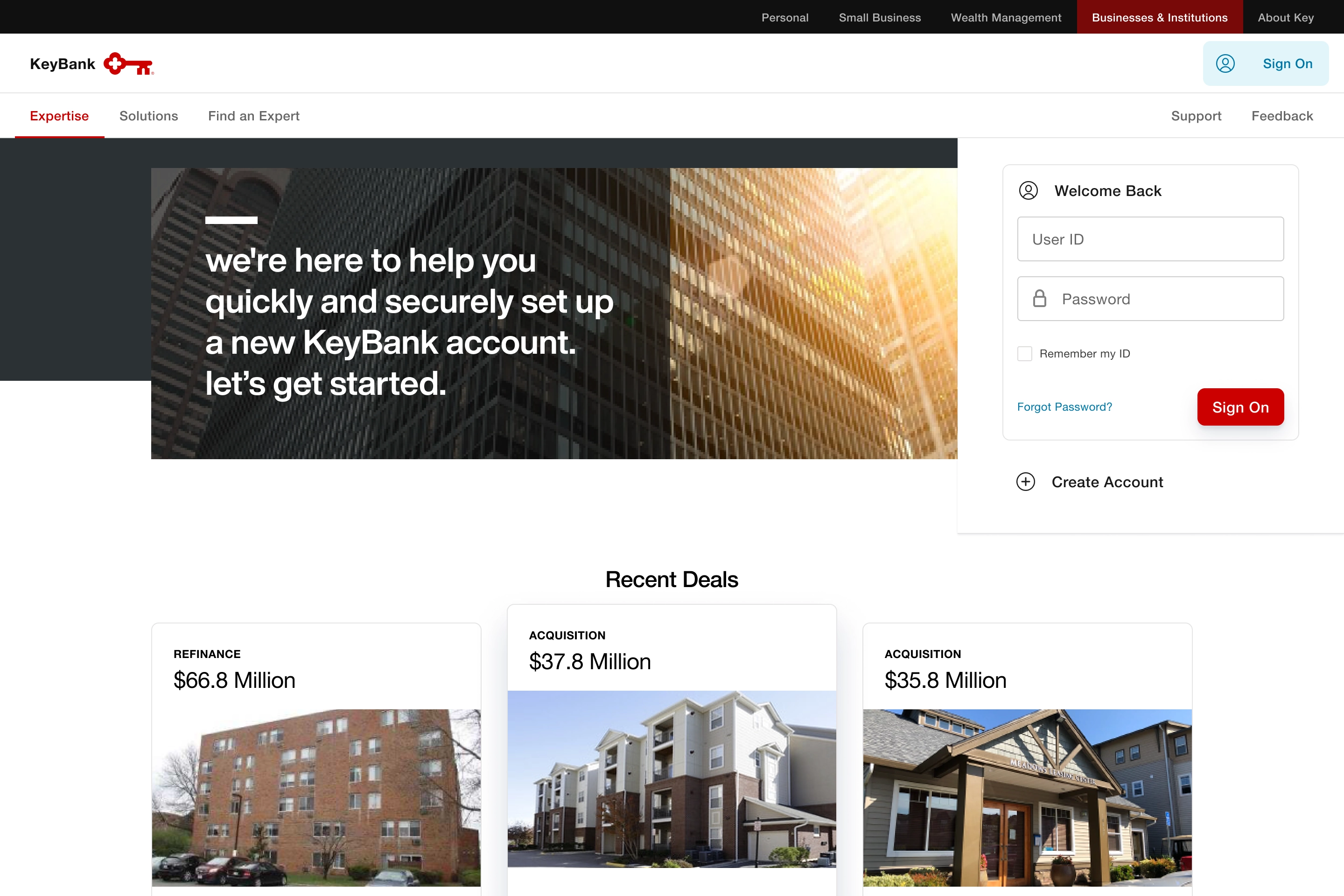

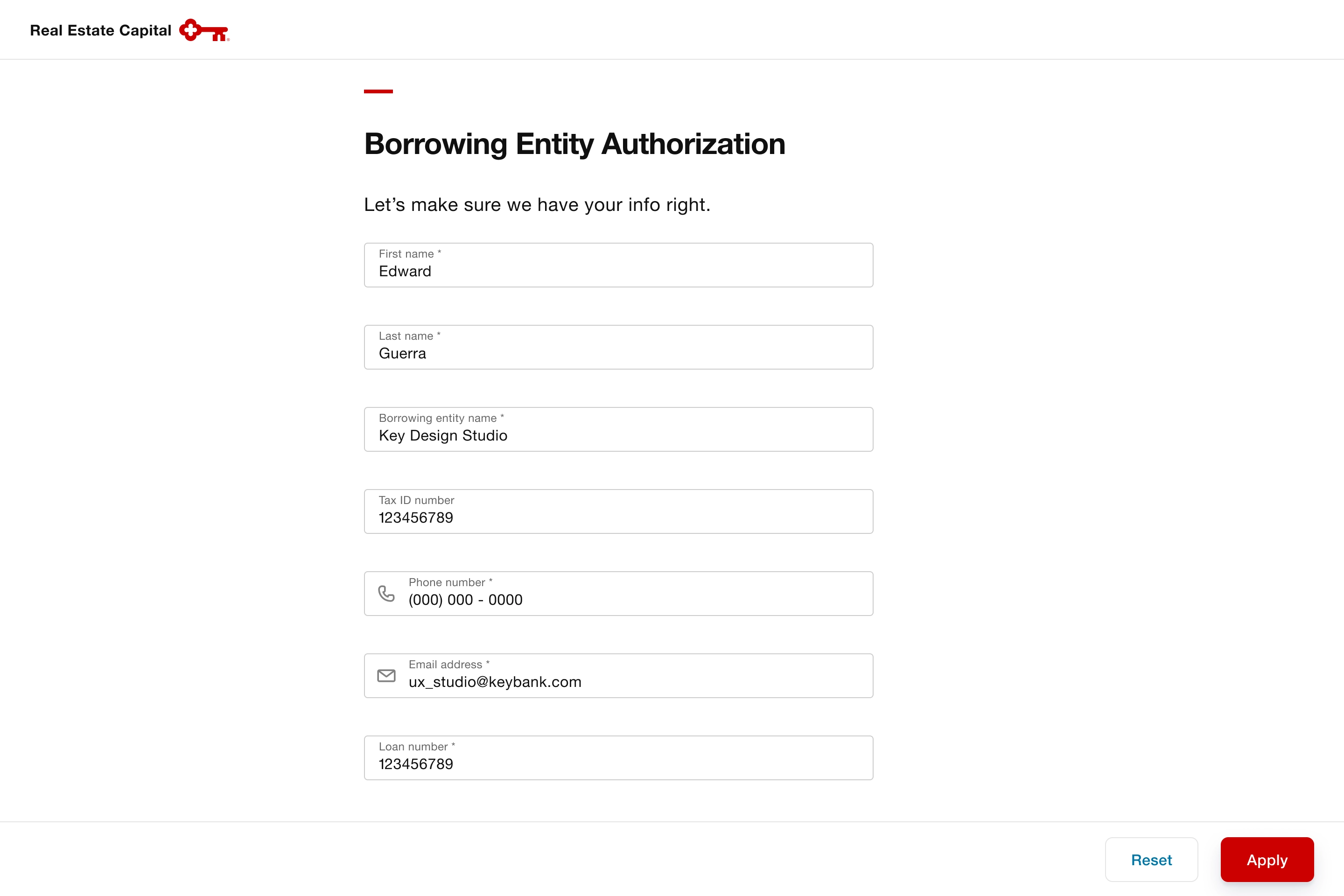

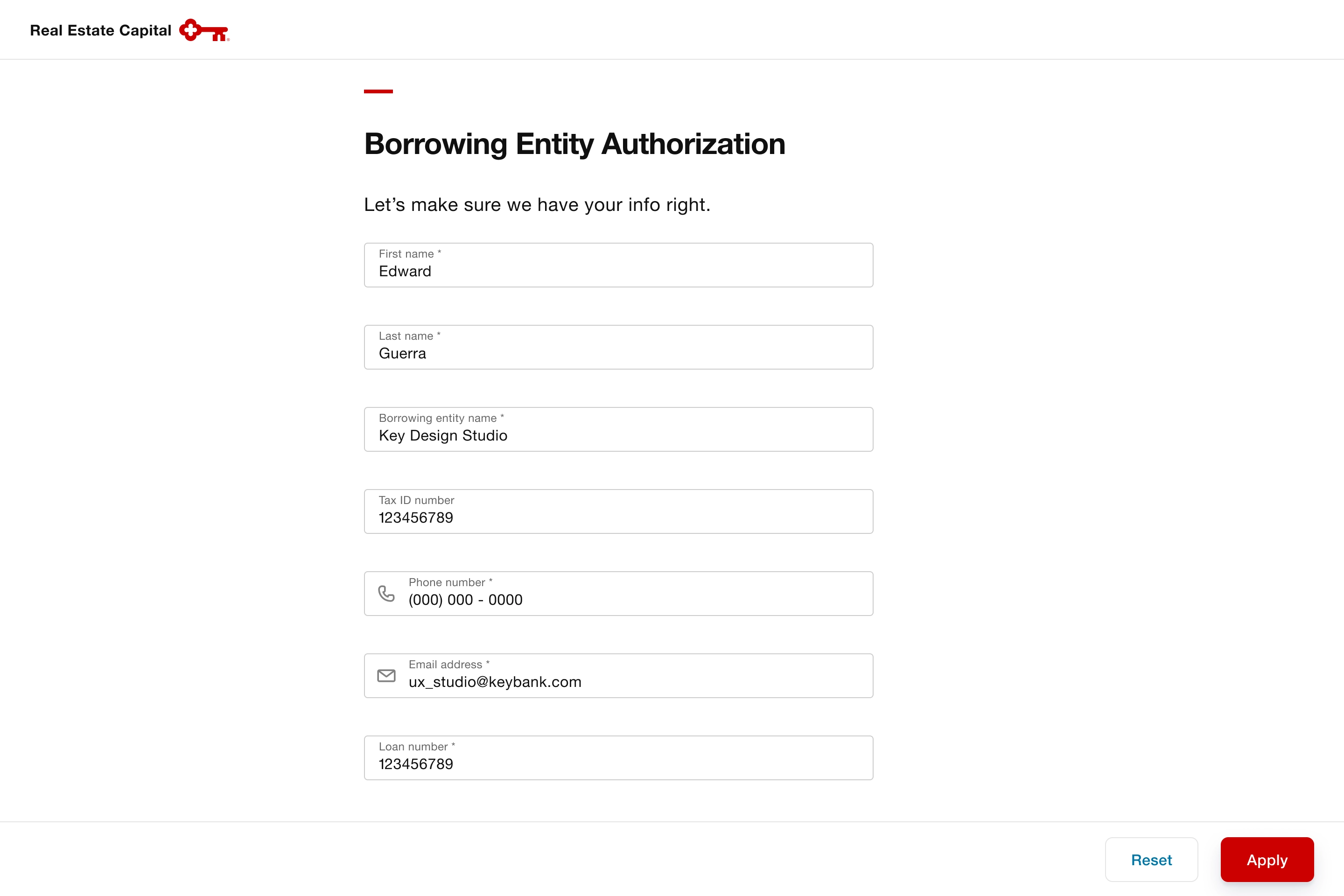

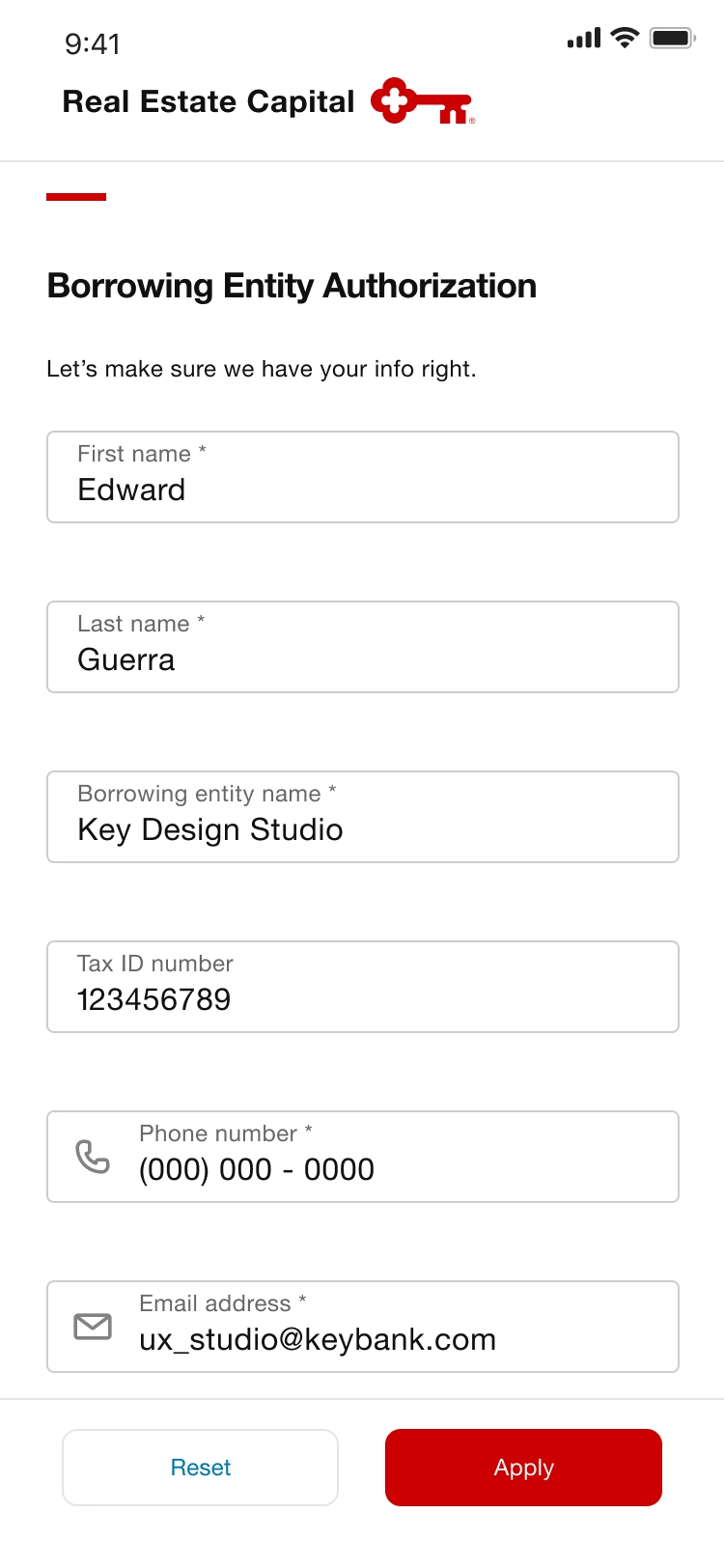

Collaborated with Commercial Real Estate Capital to define a journey and wireframe for a Client Portal to improve our underwriting process with customers. Co-led a Commercial Real Estate Capital Design Thinking workshop, producing 10 ideation concepts, 3 user personas, and 4 journey mapping outputs, fostering a customer-centric approach and driving innovative solutions.

Result

Developed a proof of concept that consolidated 32 tools into a unified experience, streamlining workflows. Secured $7.2M in funding to advance platform modernization and integration efforts.

Want more details?

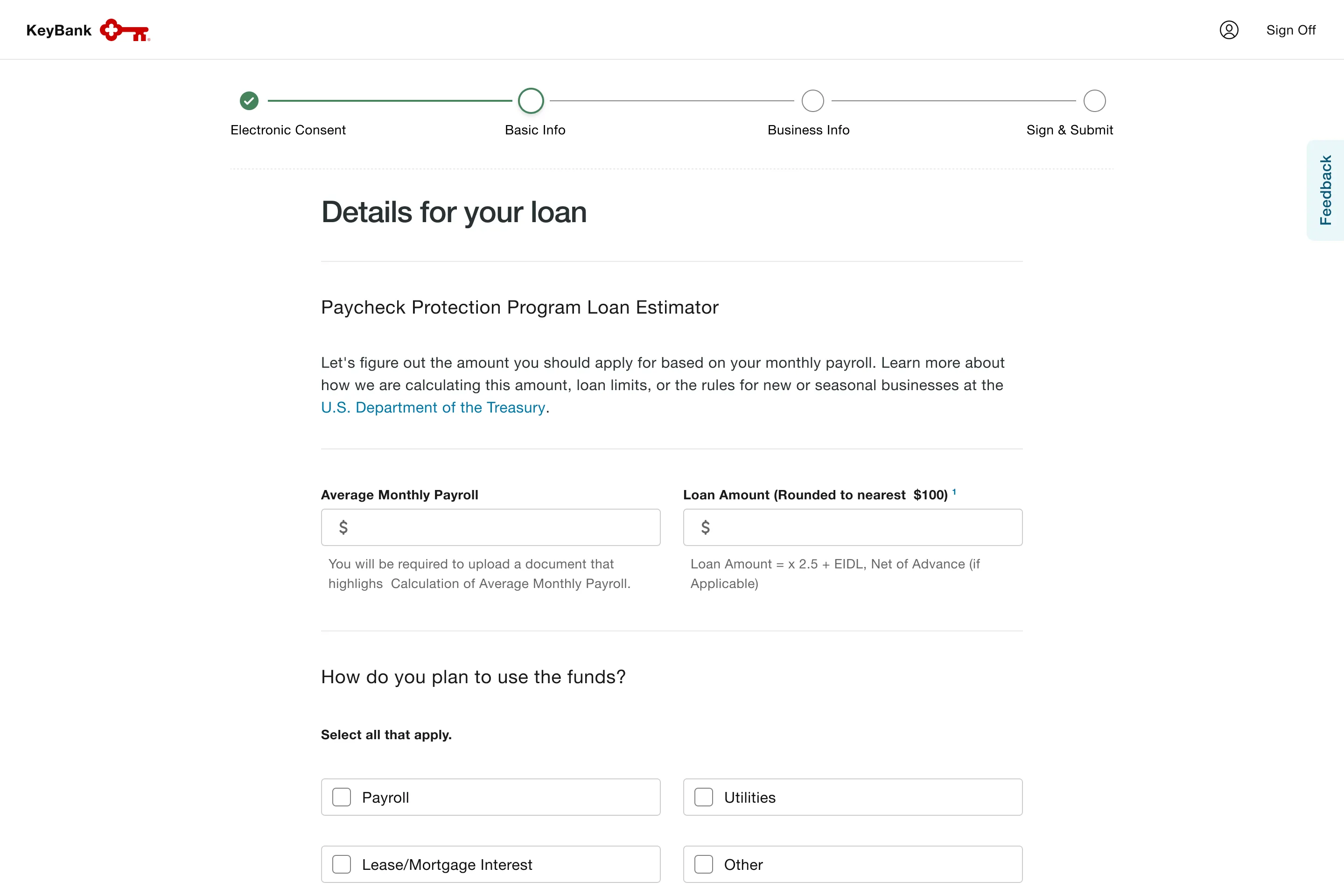

Small Business Lending

Overview

KeyBank, a top-10 SBA lender, facilitated PPP loans during COVID-19, helping businesses secure funds for payroll, healthcare, leases, utilities, and debt, supporting economic recovery amid a $2.2T stimulus effort.

Problem

Limited Small Business Administration (SBA) loan funds created a rush to market, requiring quick queuing and tracking of applications to secure funding on a first-come, first-served basis.

Solution

Expanded system capabilities to support new application needs. Introduced a loan progress tracker with emails and a dynamic page to enhance transparency and reduce call volume, creating more transparency for our customers during a critical time of need.

Result

Delivered design for Paycheck Protection Program end-to-end digital application that processed more than 28K+ small business, commercial, and institutional clients to apply with a historically high 91% click-through rate through COVID-19.

Want more details?

Previous

Fidelity Investments

Next