Small Business Lending

Introduction

Overview

My contributions

Timeline

1-week

Role

UX Lead

Problem

Goals

Trigger

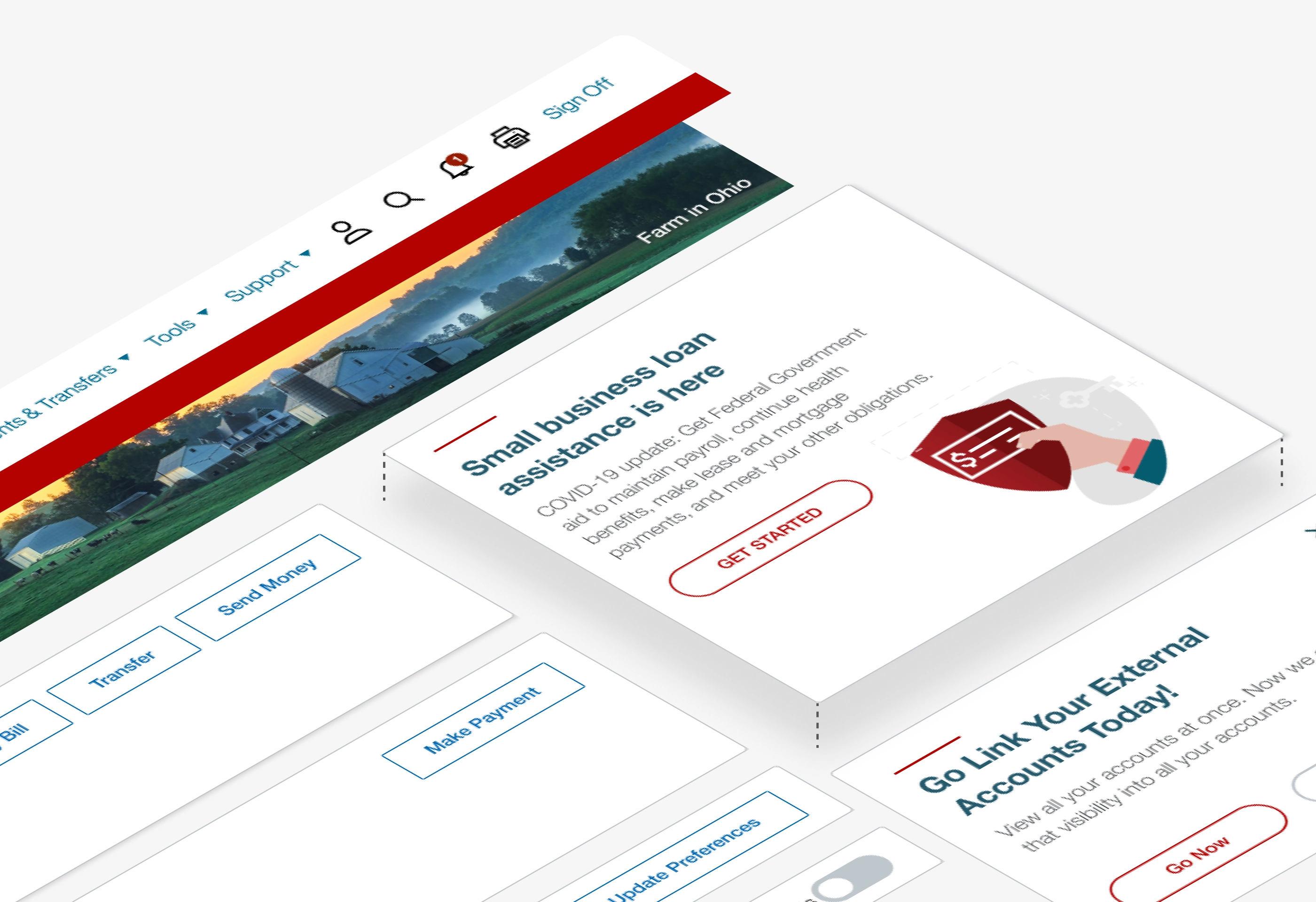

Client Experience: Bankers can send email links for prospects and clients to enter at home digital experience.

Action

Loans are not guaranteed and are on a first-come, first-serve basis.

Investment

Any amount not forgiven after Dec 31, 2020, is converted to a term loan not to exceed ten years or 4% interest.

Variable Reward

Monthly payments differ between 6 and 12-months.

Constraints

Speed to market

Small Business Association (SBA) Guidelines

Research

User insights

Mapping the experience

Key features

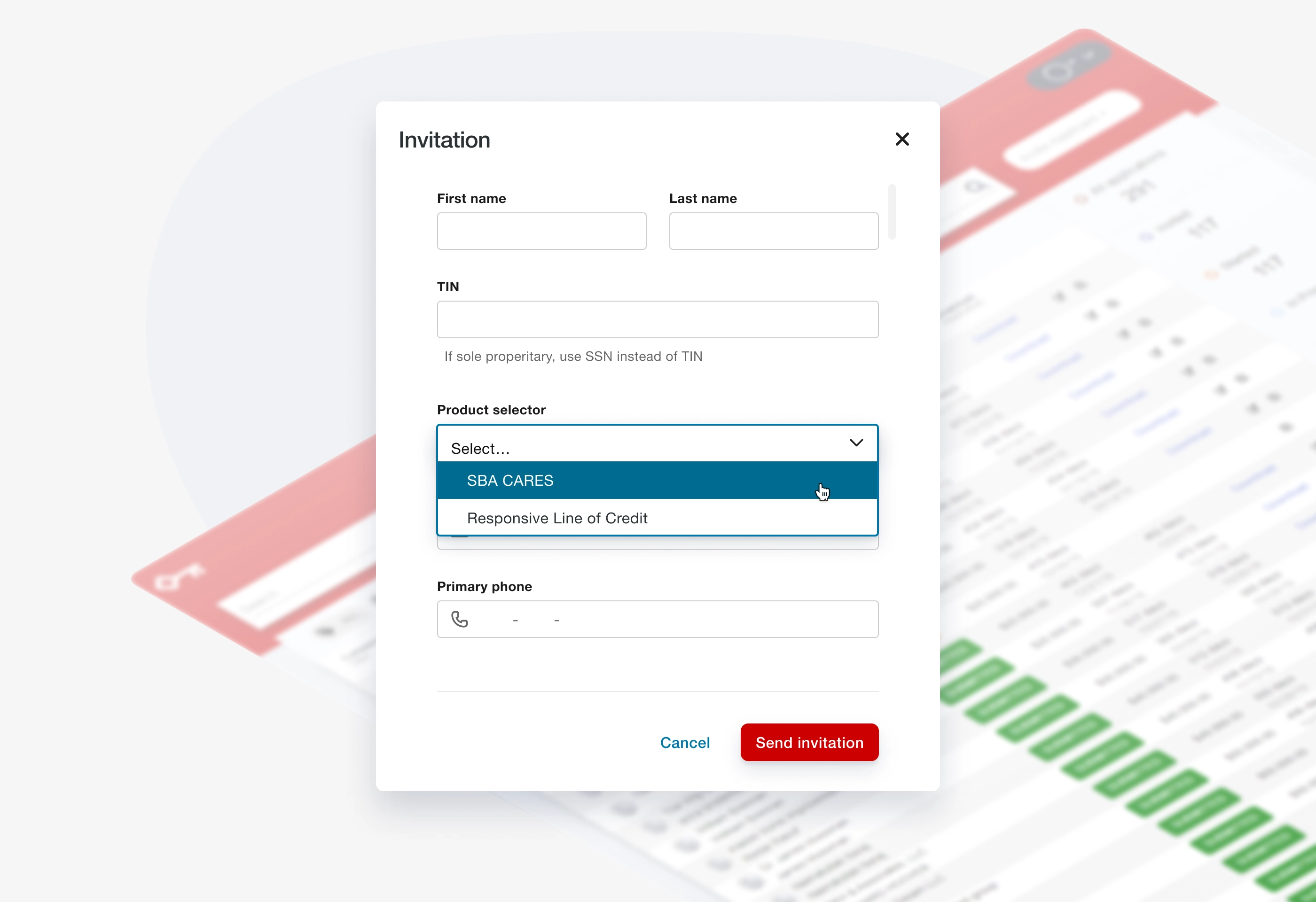

Employee admin portal

We implemented a Client Relationship Manager (CRM) for inviting clients to apply for the loan.

Account summary

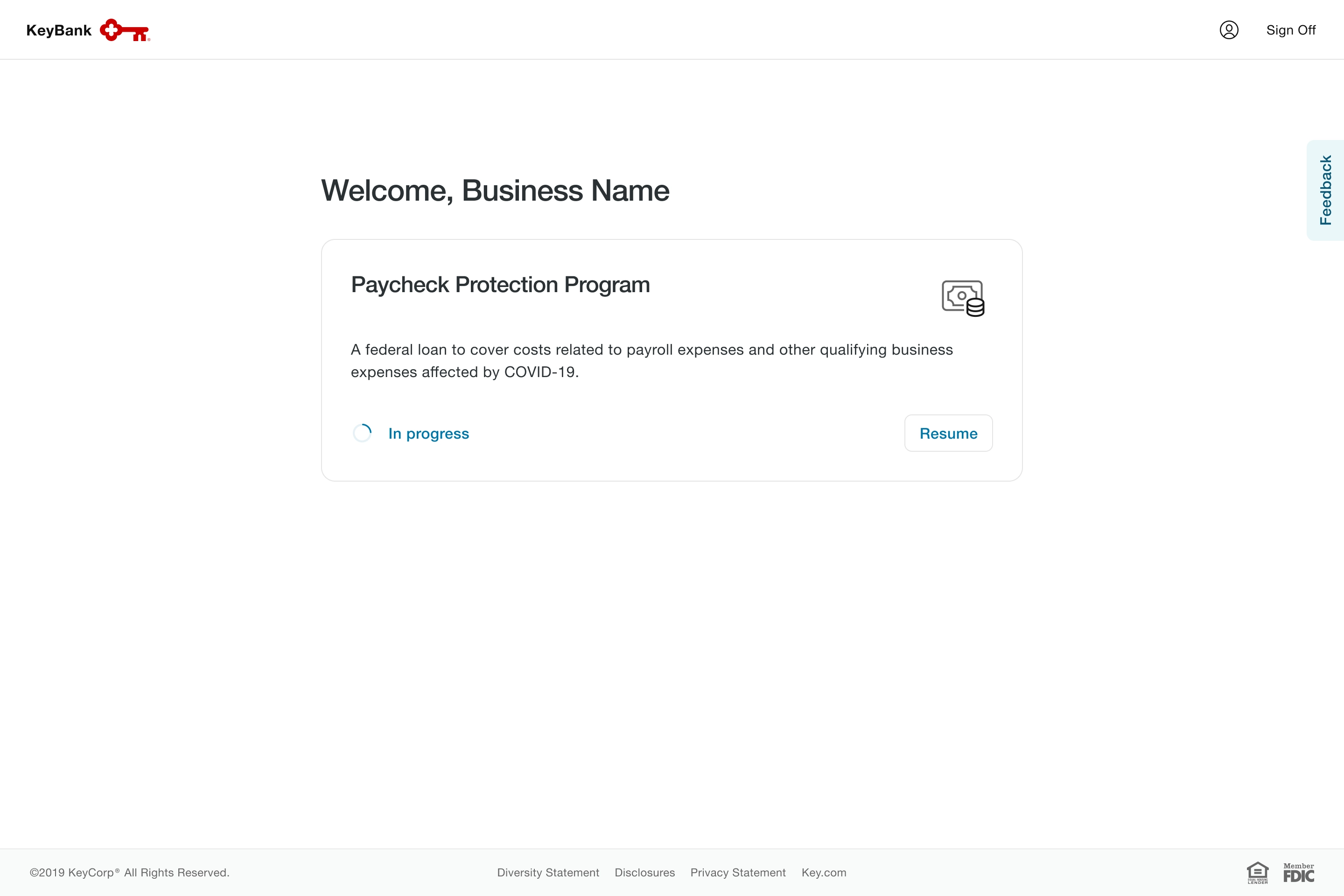

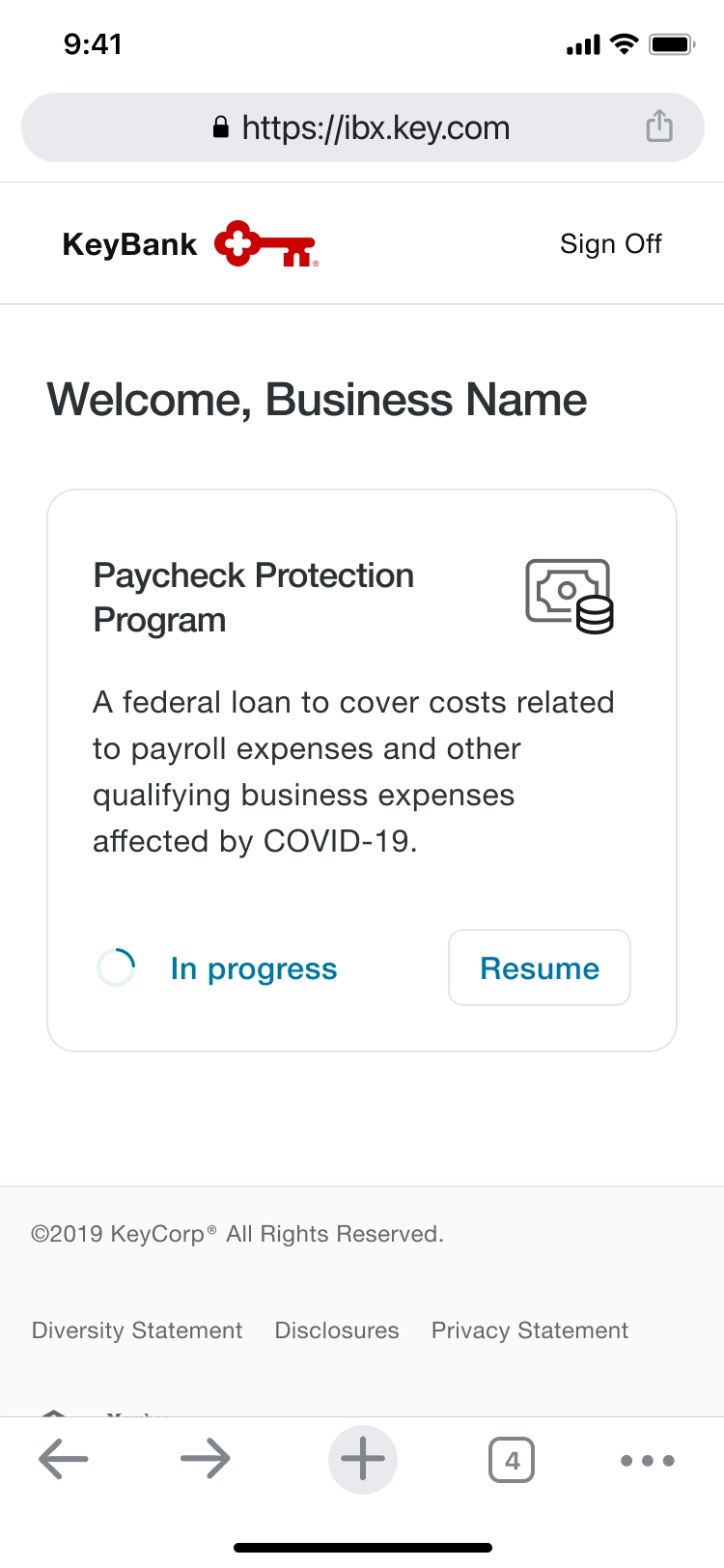

We integrated authenticated client-facing access to the loan application.

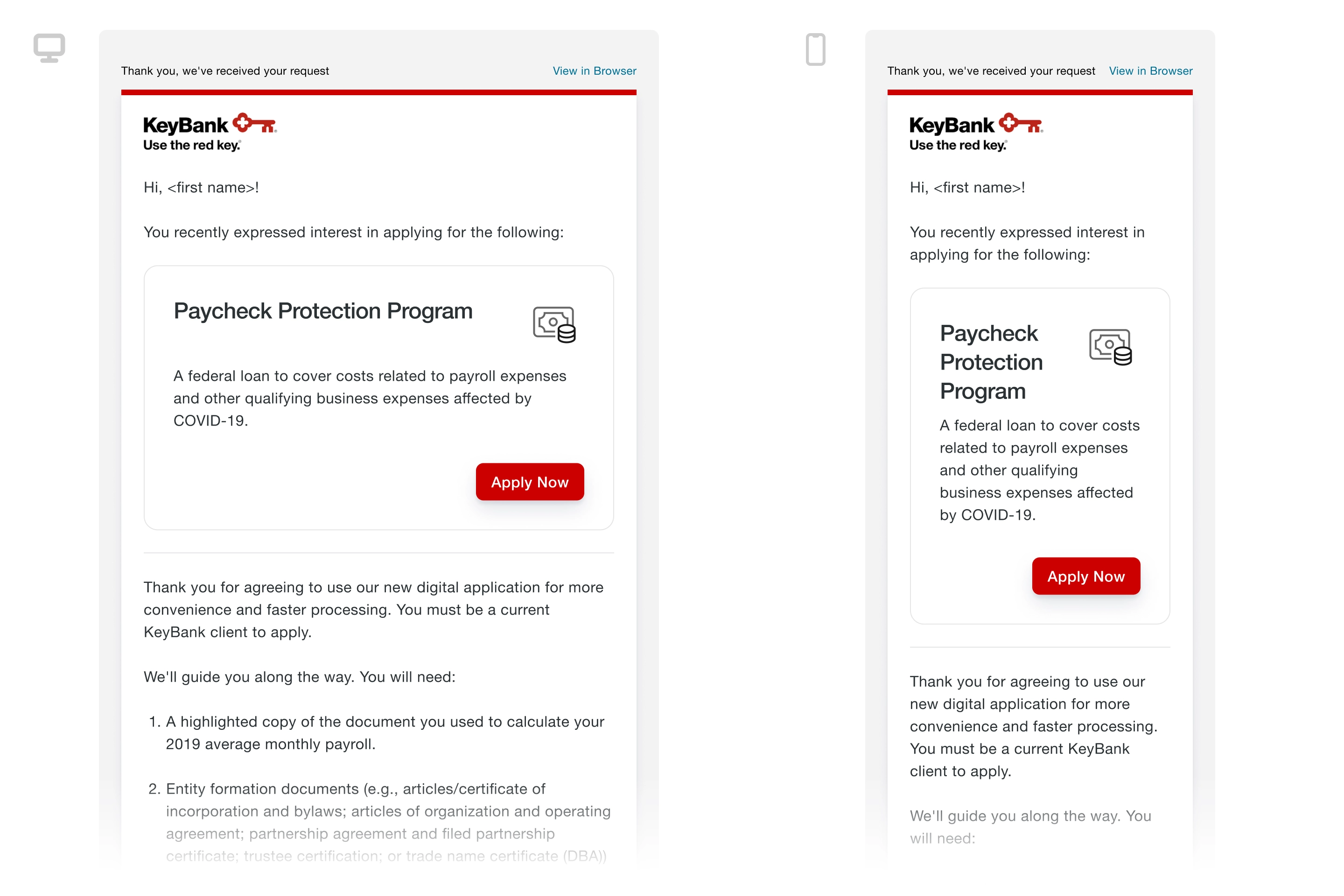

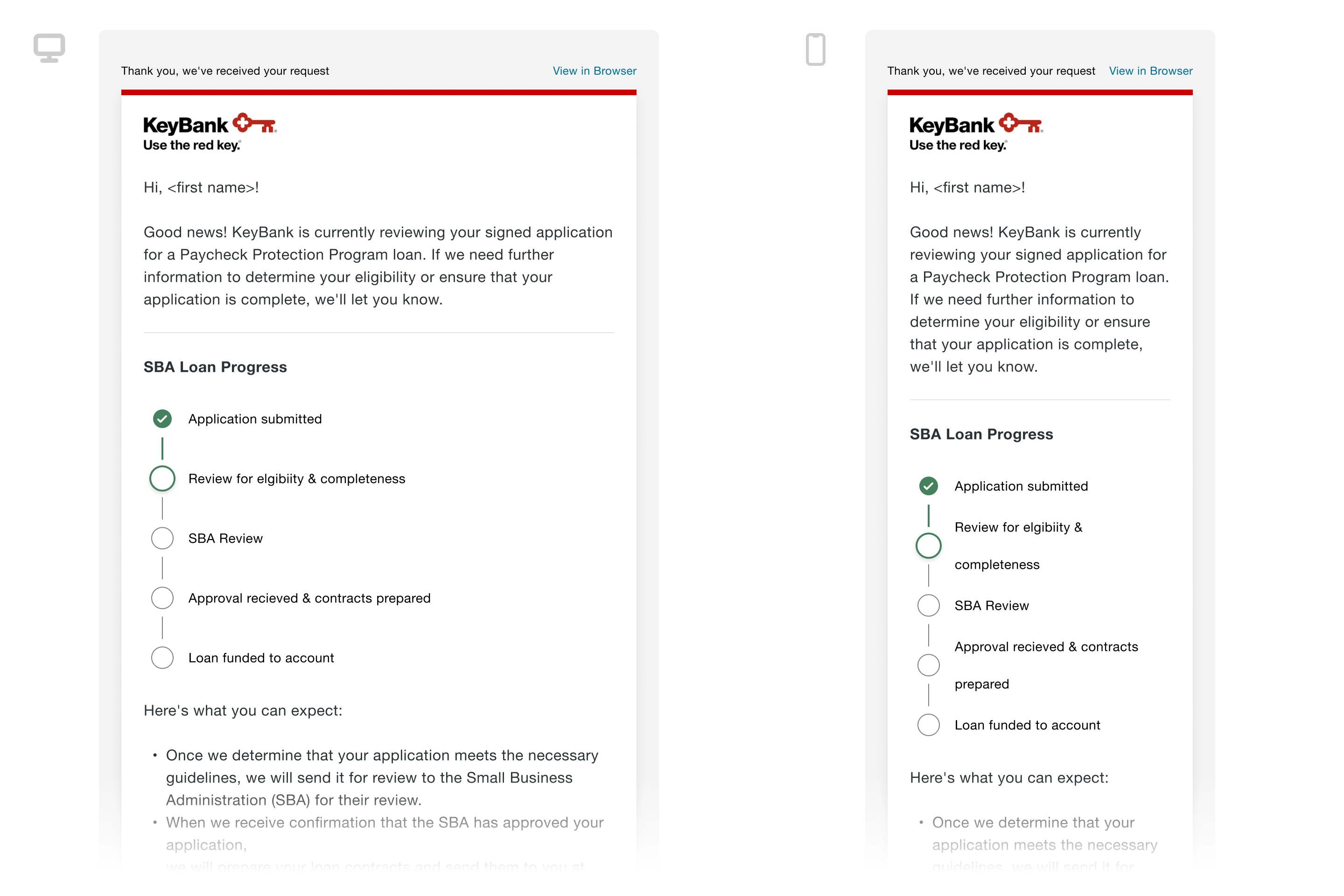

Email communications

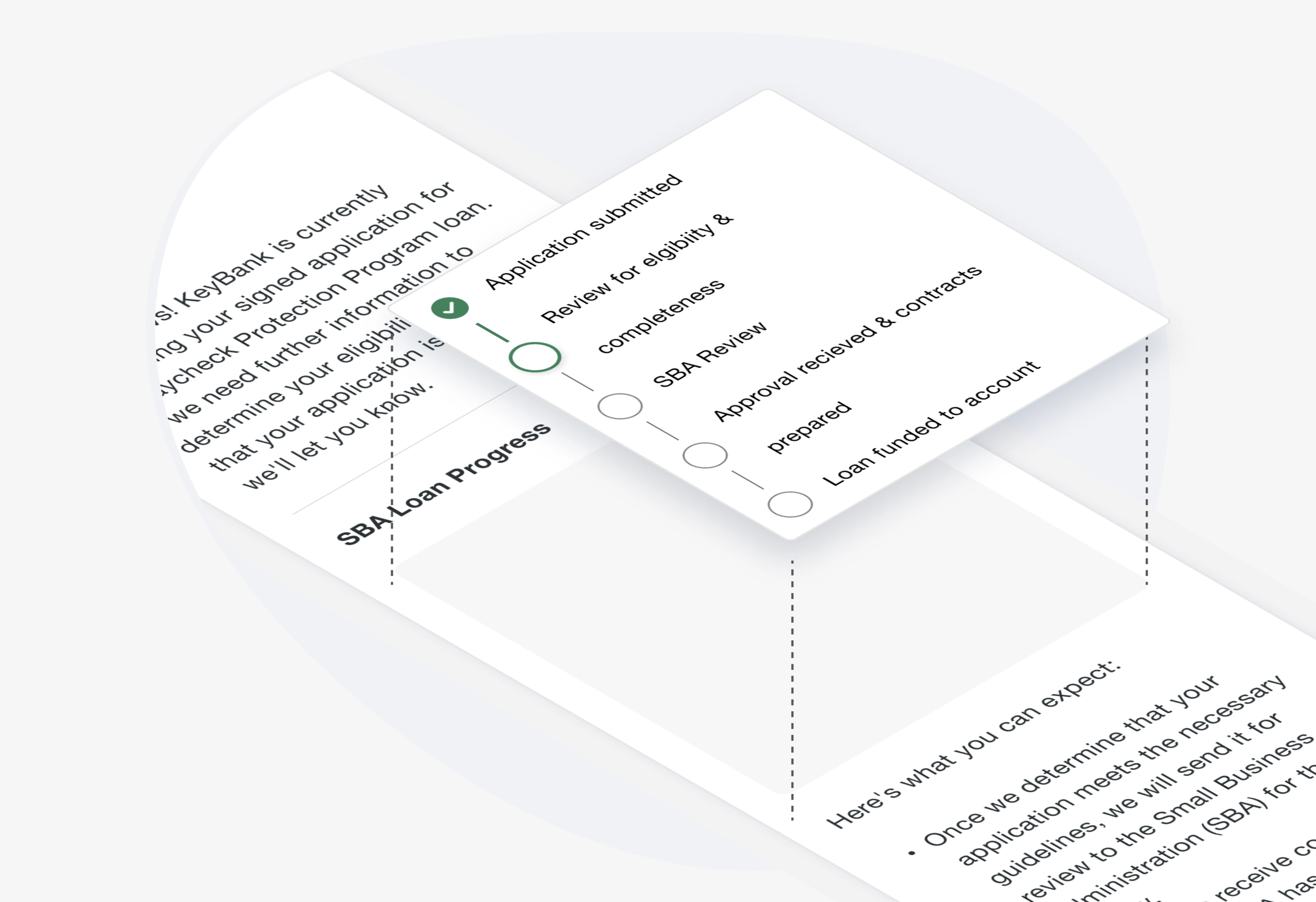

We supported client communications with updates on the status of their loan application.

Key screens

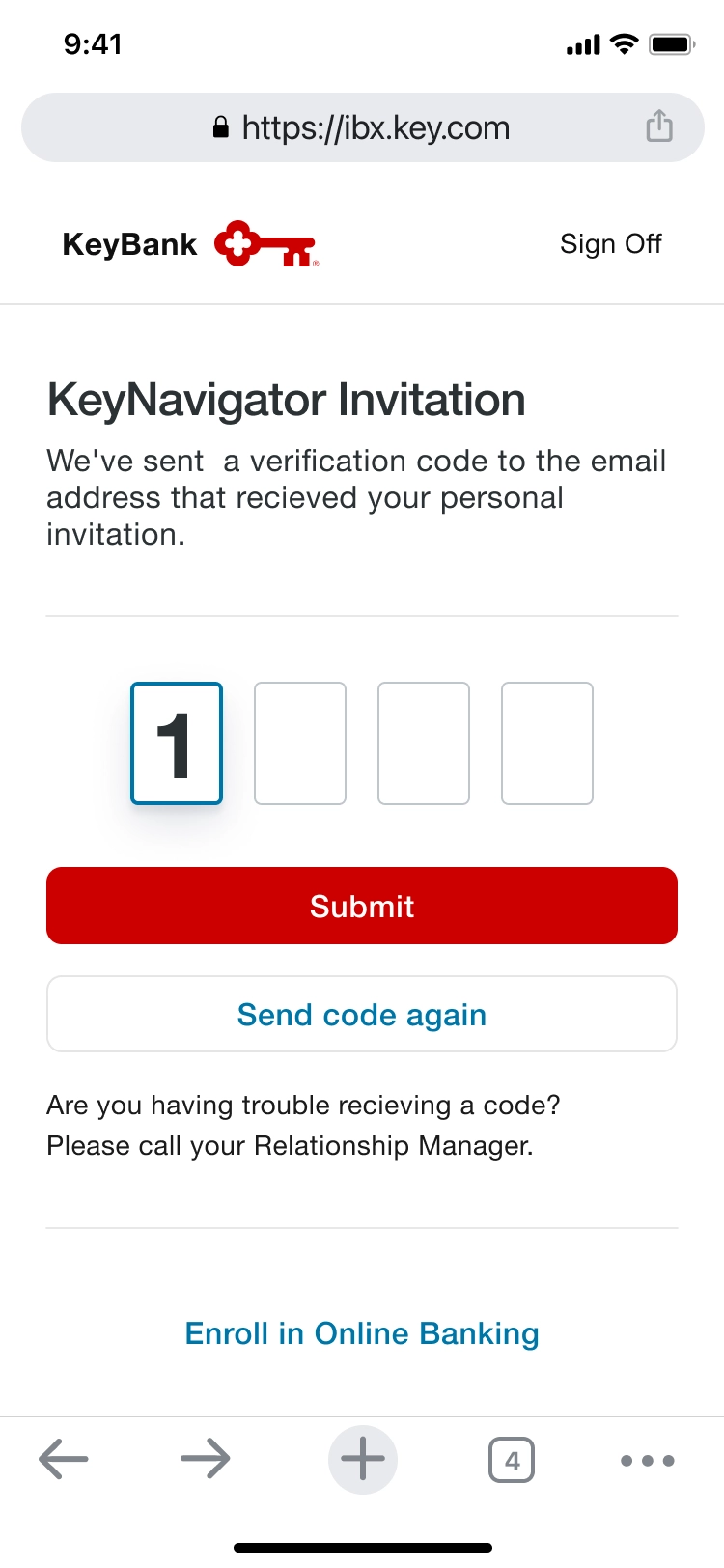

Sign on

Loan offering selection

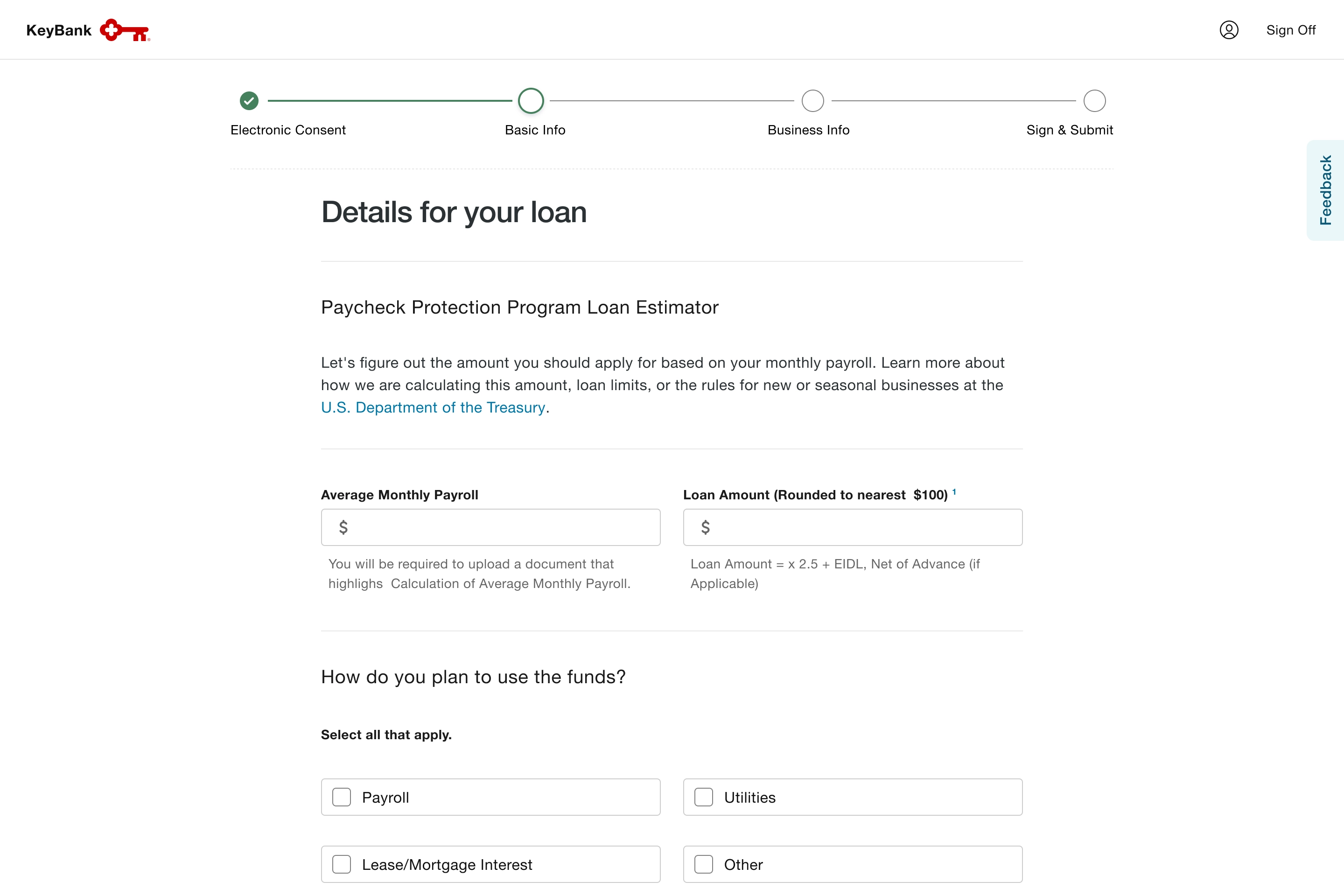

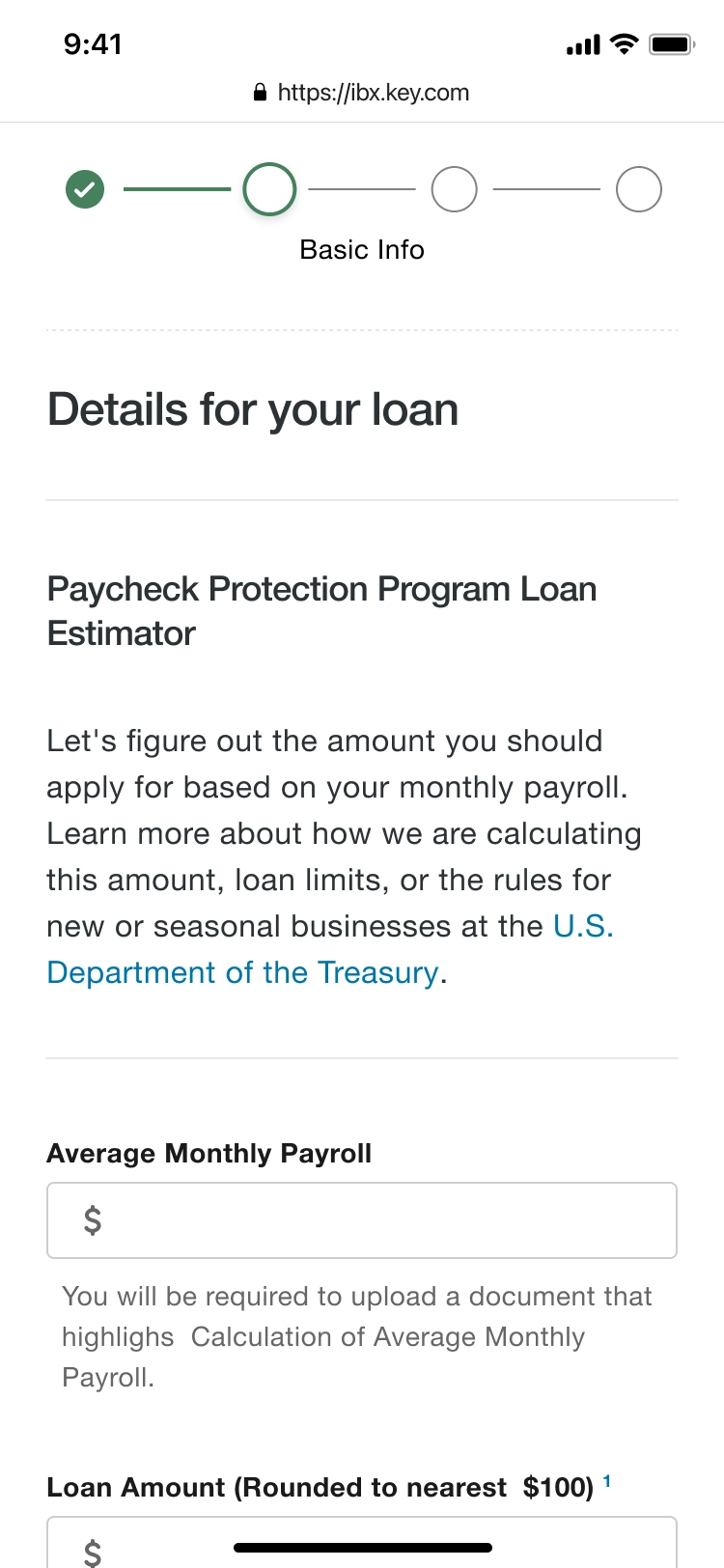

Loan details

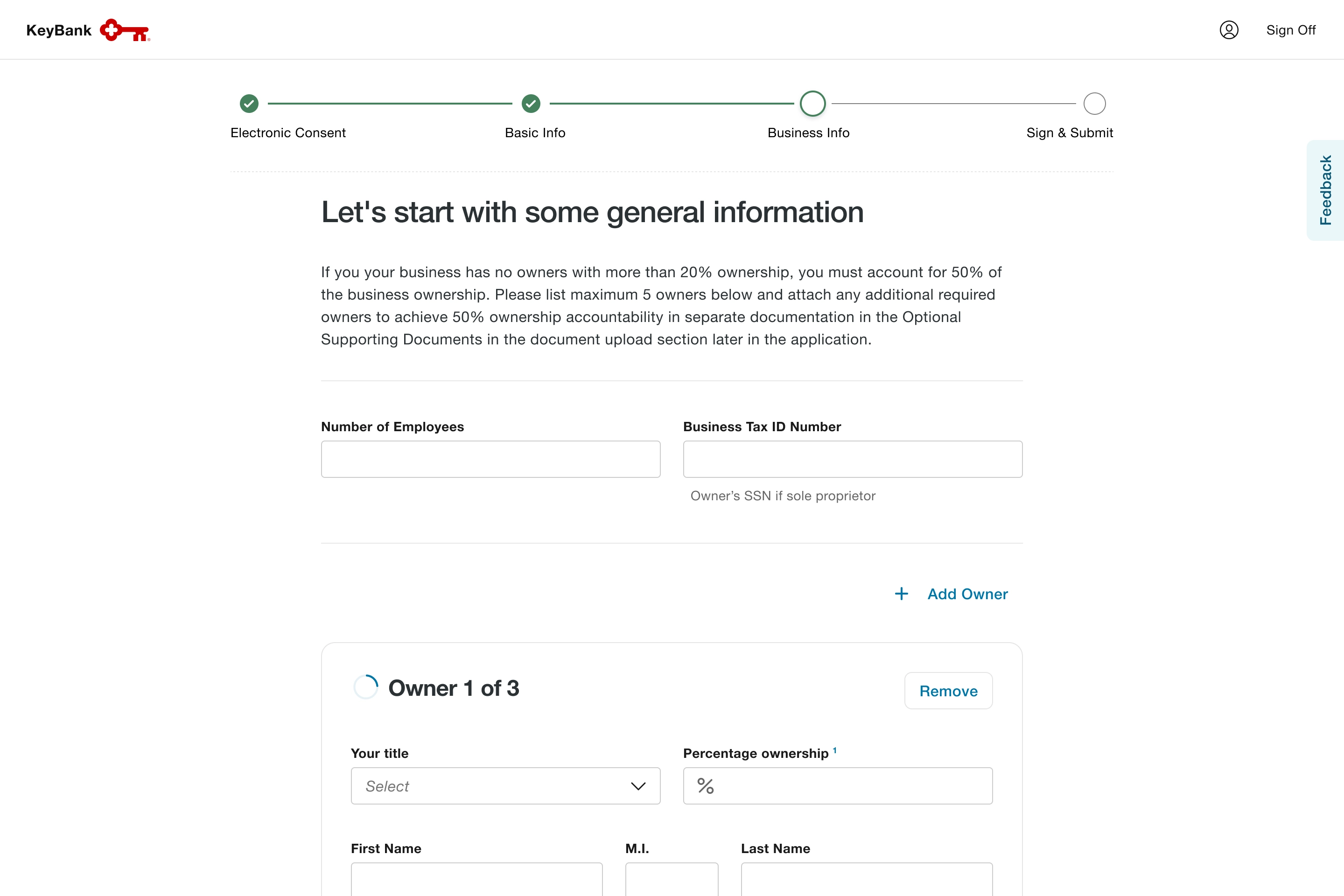

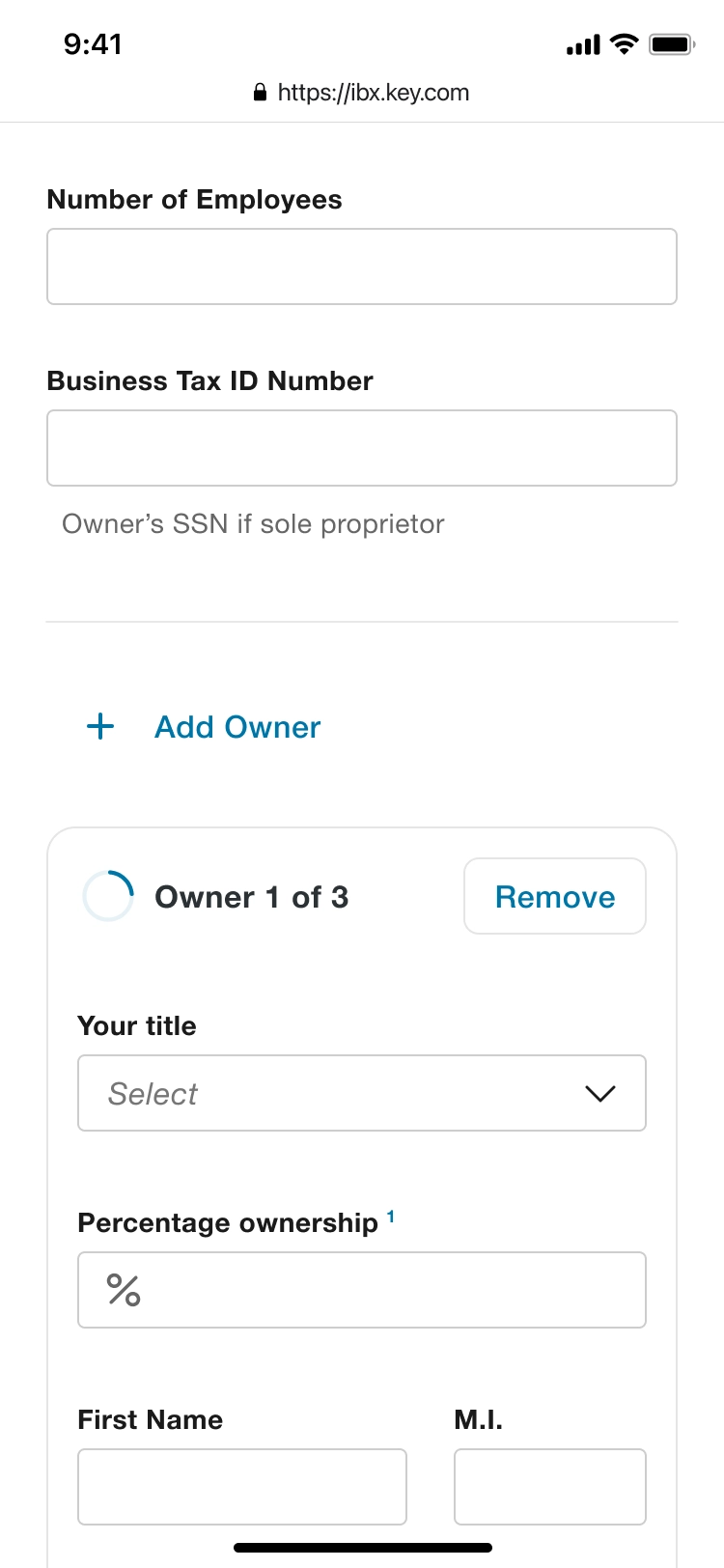

Business information

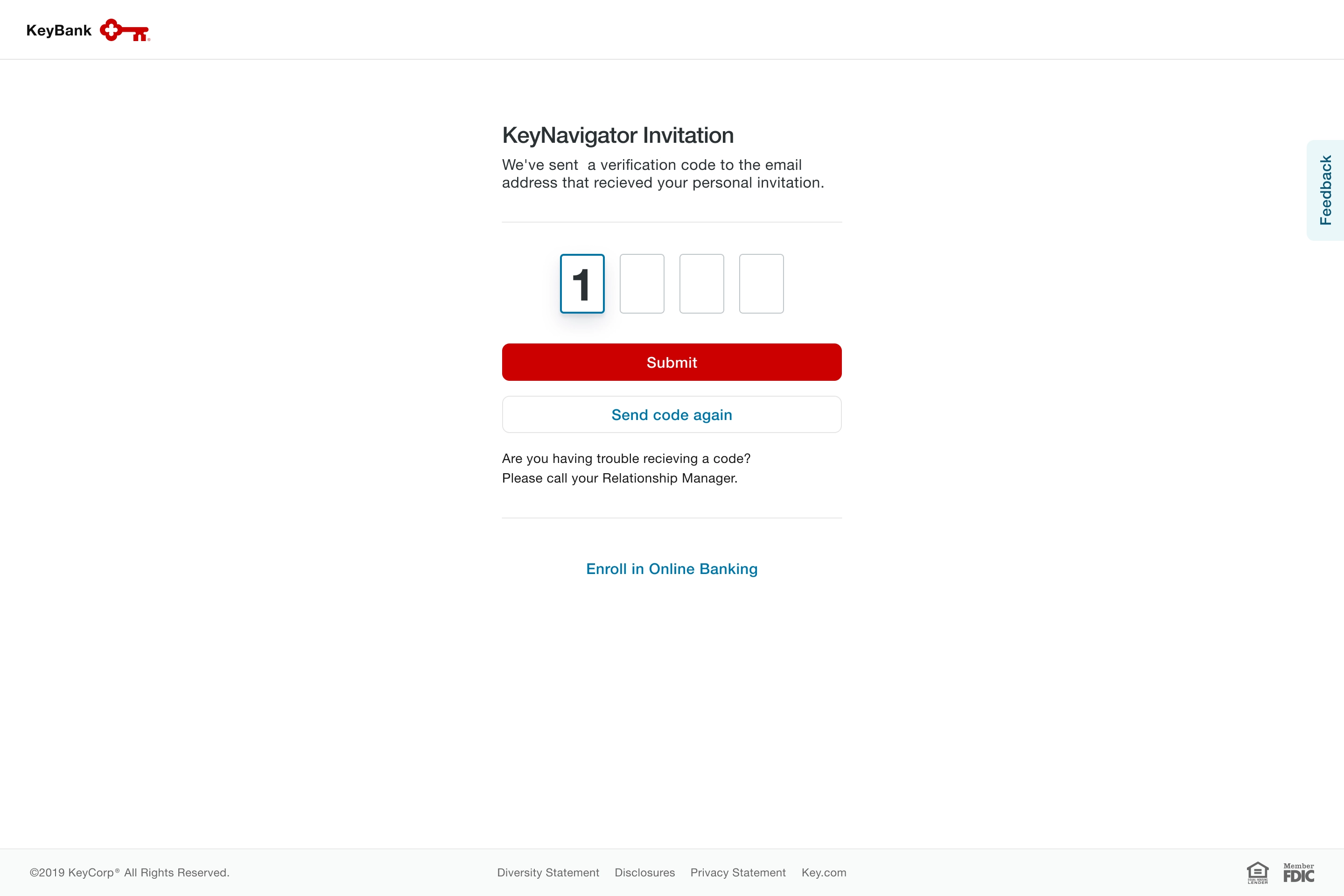

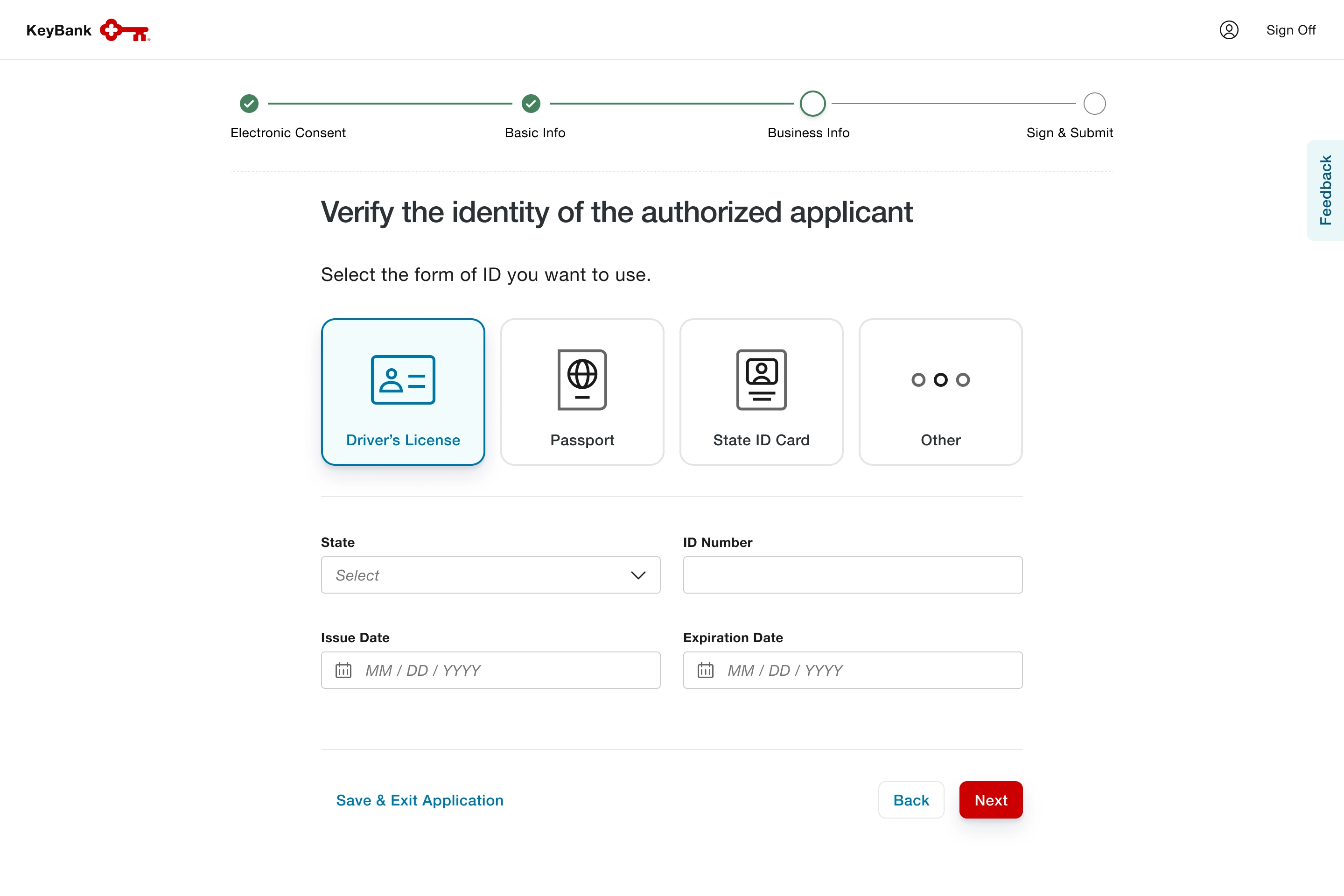

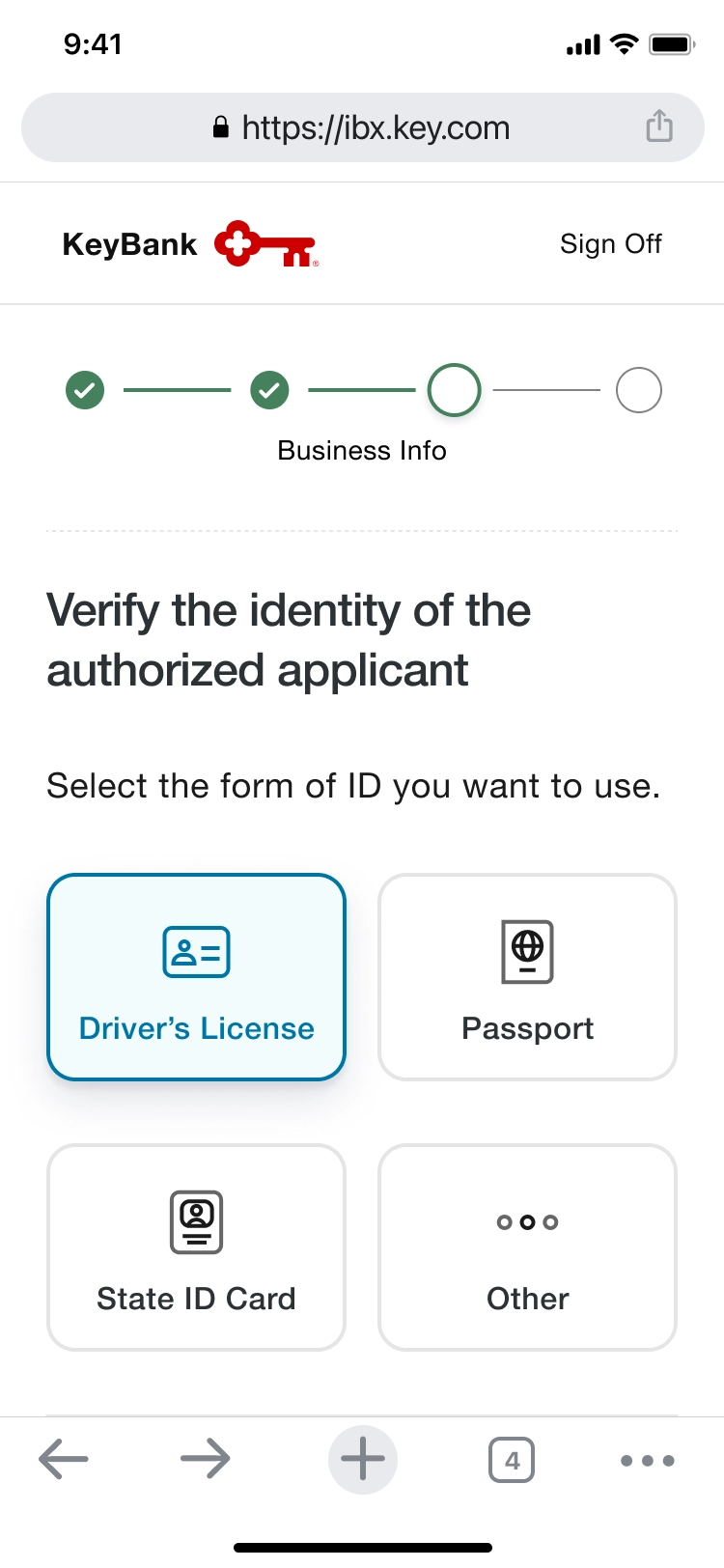

Identity verification

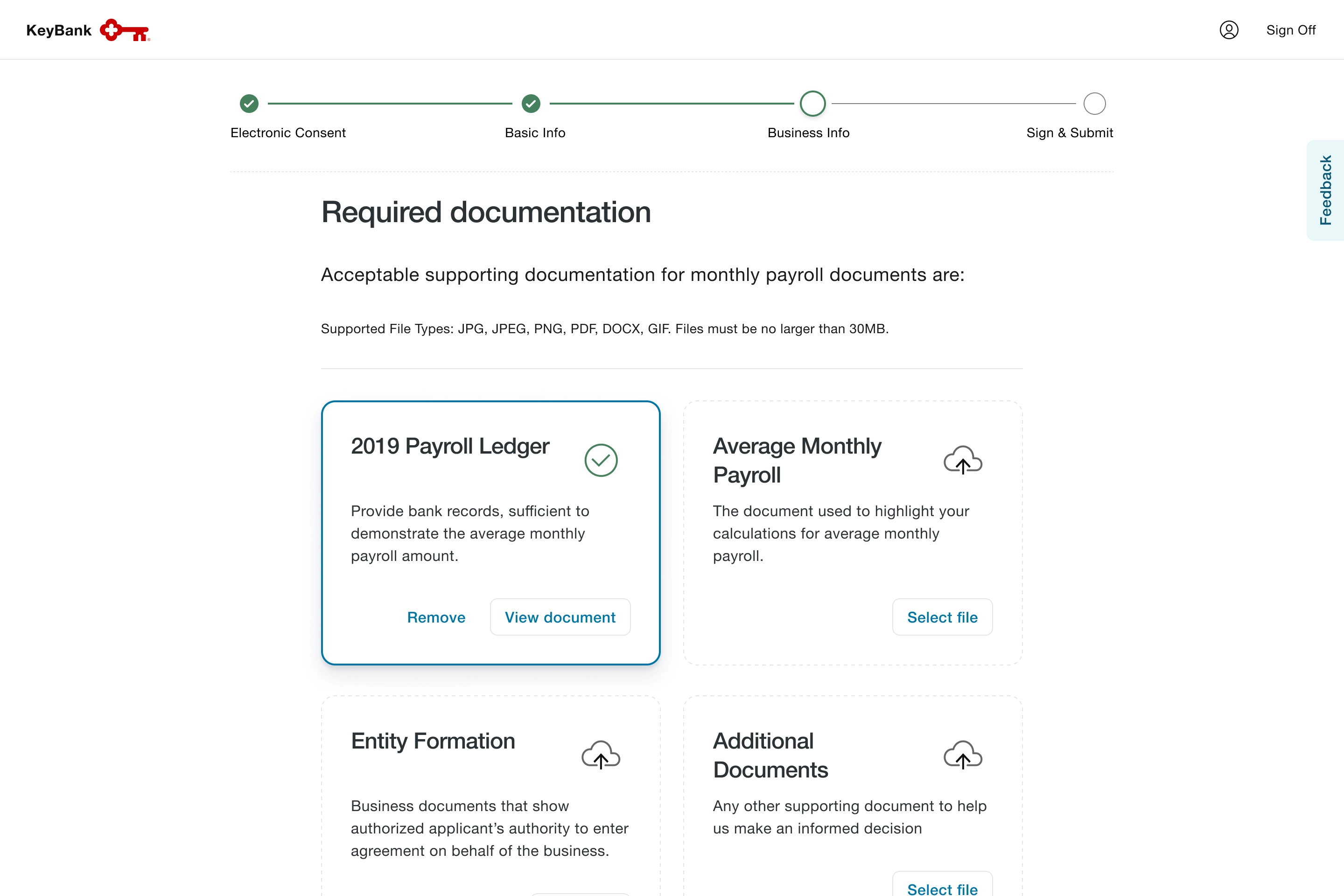

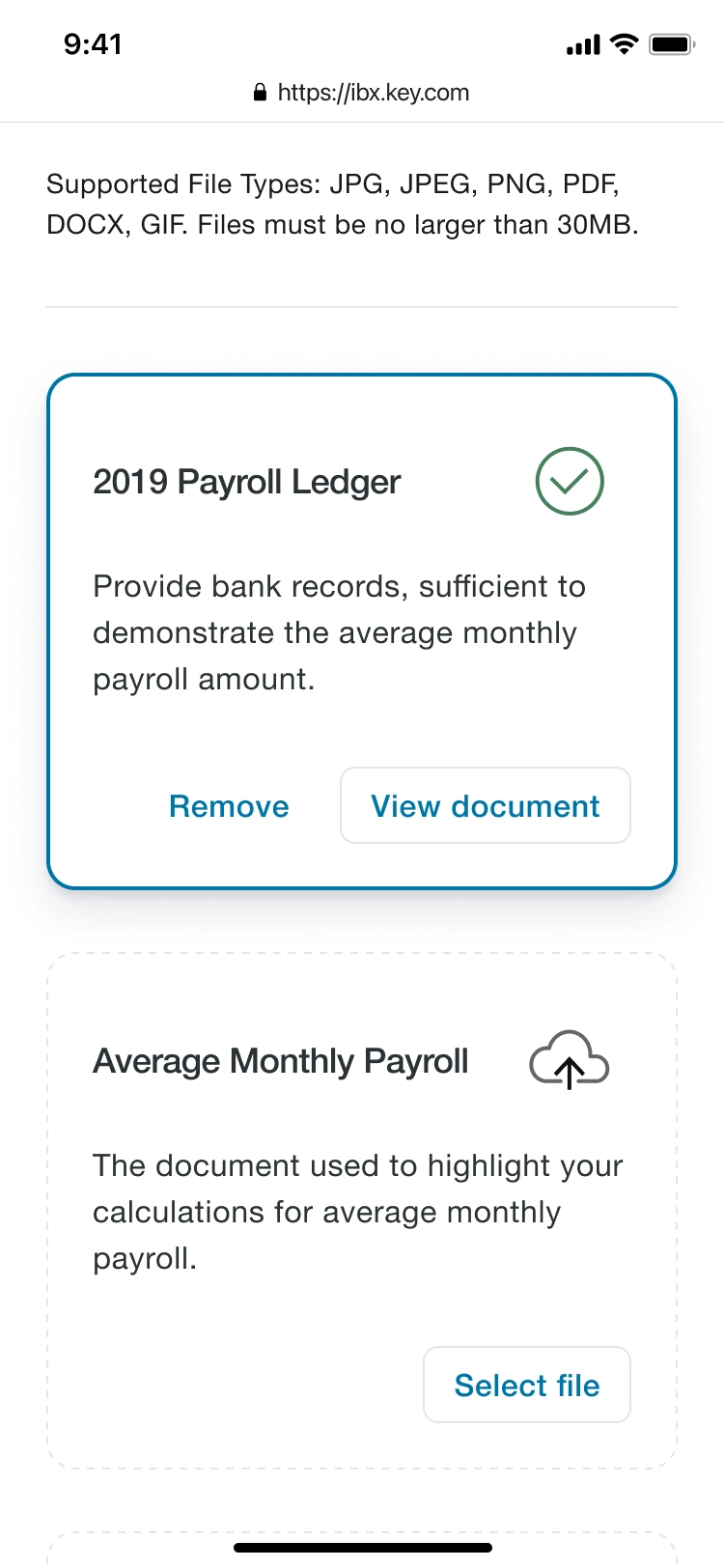

Document upload

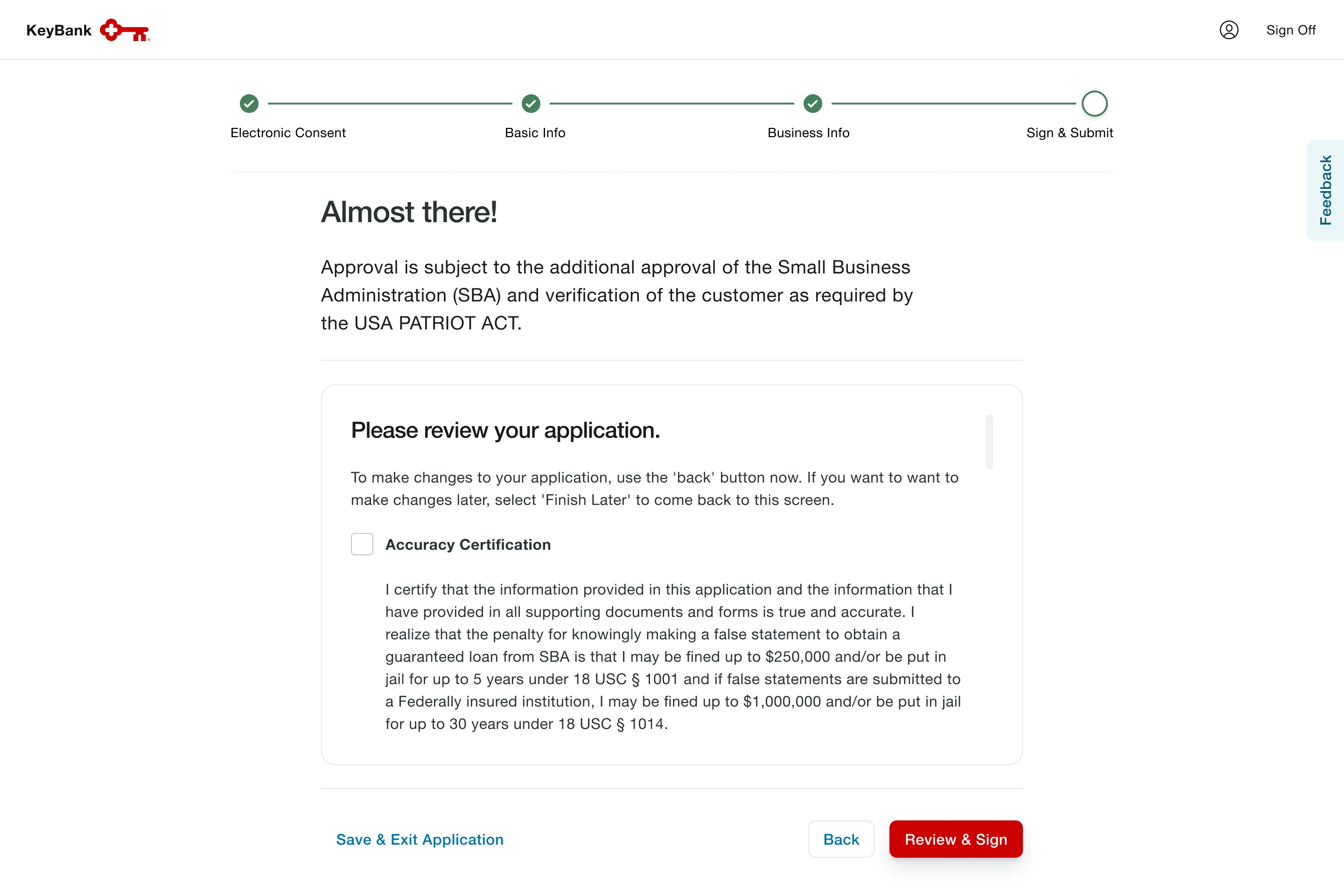

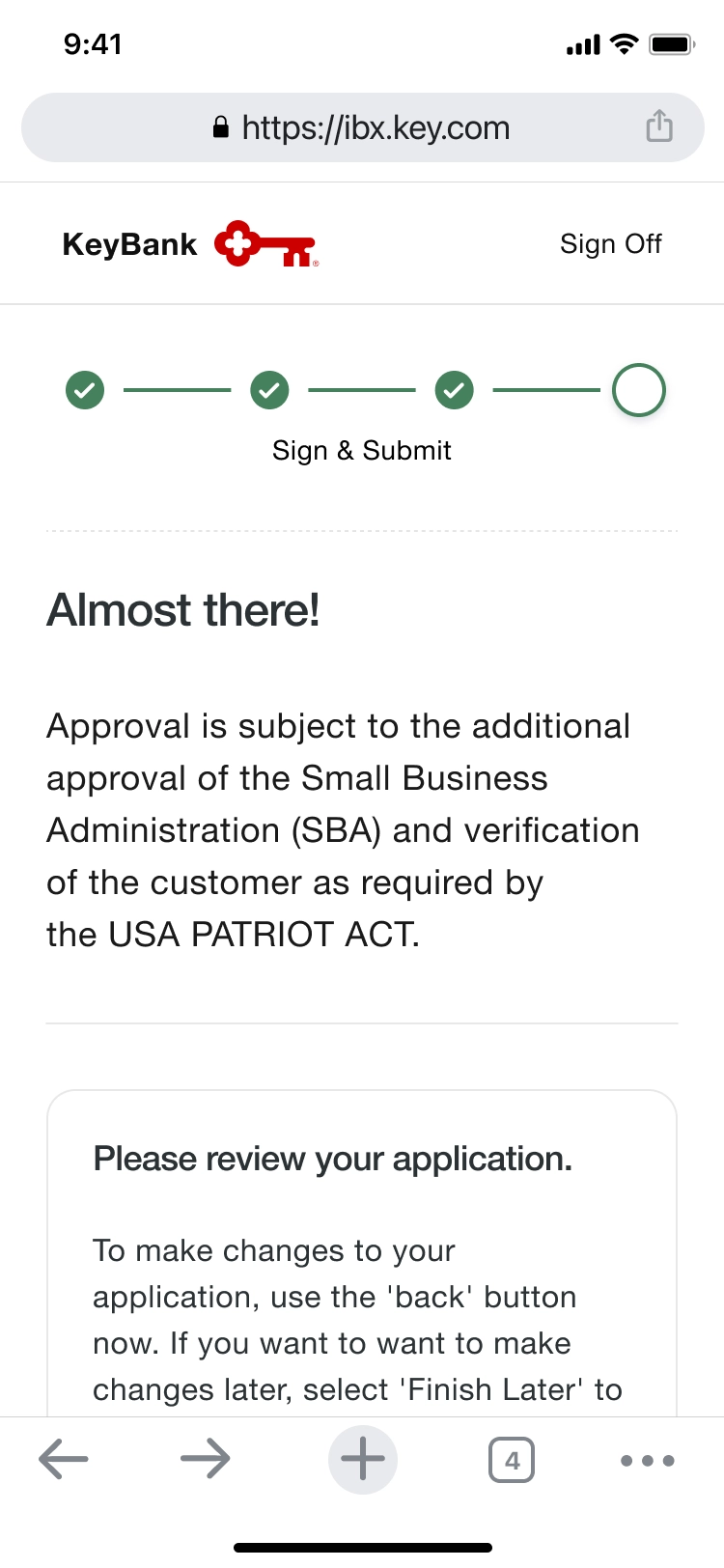

Electronic disclosure

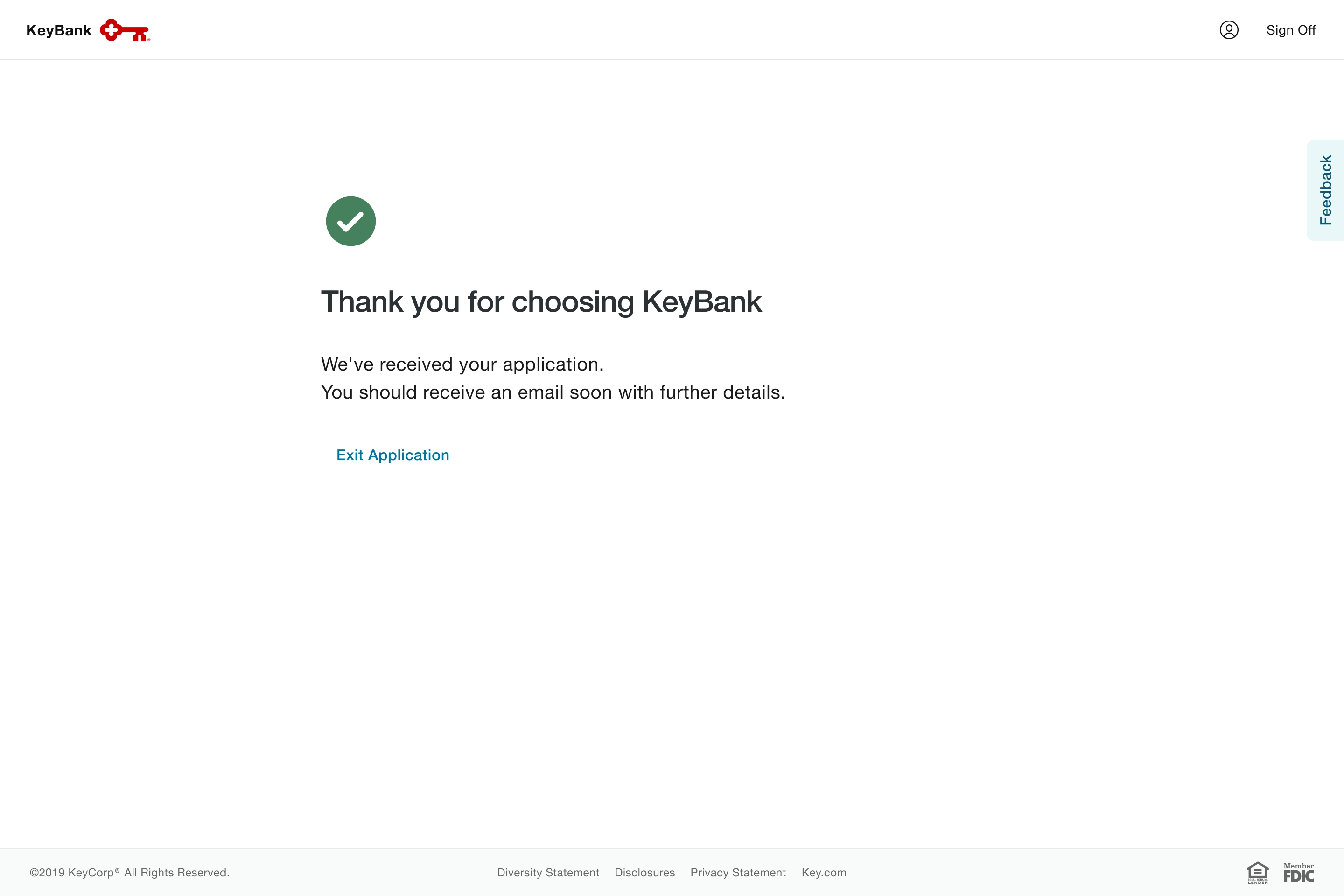

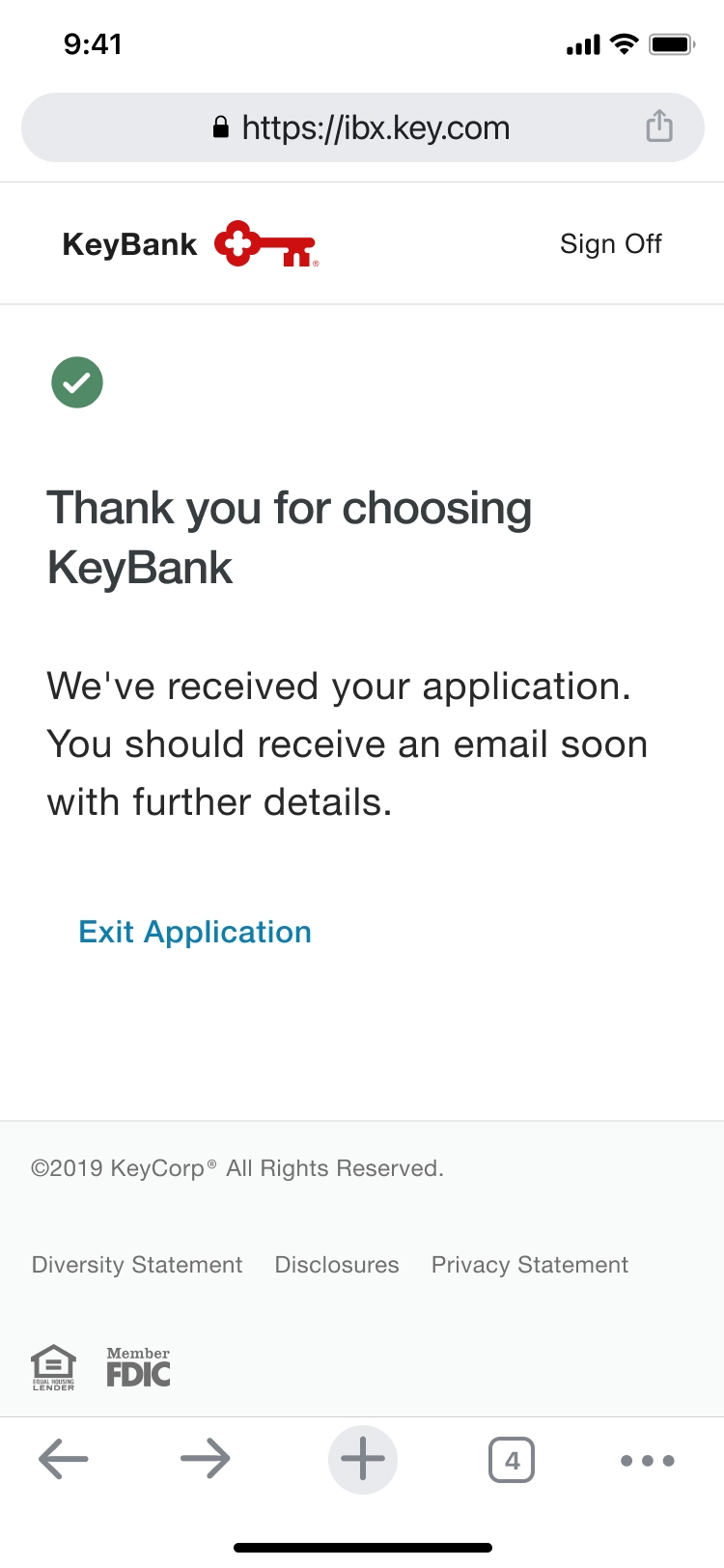

Loan confirmation

Invitation email

PPP Loan Tracker

Outcomes

We ranked #7 in the nation for the Paycheck Protection Program with a historically high 91% click-through rate for our portal.

28,000+ clients applied

Small business, commercial and institutional clients

$8 billion in funding

Over 40,000 loans processed

Reflection

Next steps

- Continue to review usage data and conduct user research sessions to discover potential pain points and opportunities

- Revisit UX patterns for multi-owner enrollment to be able to support gathering information for up five owners in one application

Takeaways

Invest in understanding how your team operates, especially for a short-term engagement. If guidance is required to be effective and efficient, plan to level set how the team can work quickly to onboard and establish a working agreement, especially with design handoff with offshore teams.

Find ways to maintain morale, even when powering through 2-3 am deadlines for 10 am user acceptance testing. Remain empathetic and remember the client and employee users this digital experience will impact during a global pandemic.