Small Business Lending

How might we digitize data collection to expedite the underwriting process to relieve Small Business Lending during a global pandemic?Overview

As a top-10 Small Business Administration lender, KeyBank helped thousands of businesses quickly gain funds through the Paycheck Protection Program (PPP), a federally provided, forgivable loan that covers certain business costs. The impacts of COVID-19 led to a $2.2 trillion coronavirus stimulus bill signed into law in March 2020 and set aside $349 billion for a new small-business loan program.

These funds helped cover certain business costs related to payroll expenses, the continuation of group health care benefits, lease payments, mortgage interest payments, utility payments, and interest on other pre-existing debt obligations.

Goals

Our initial focus was to quickly define some requirements to work as agile as possible with our clients in mind.We prioritized our work in two quadrants, with my focus primarily on the experience trigger and actions needed by underwriters, and eligible clients.

Constraints

While the 1-week turnaround proved to be the greatest constraint, some of the challenges along the way include:

Ideation

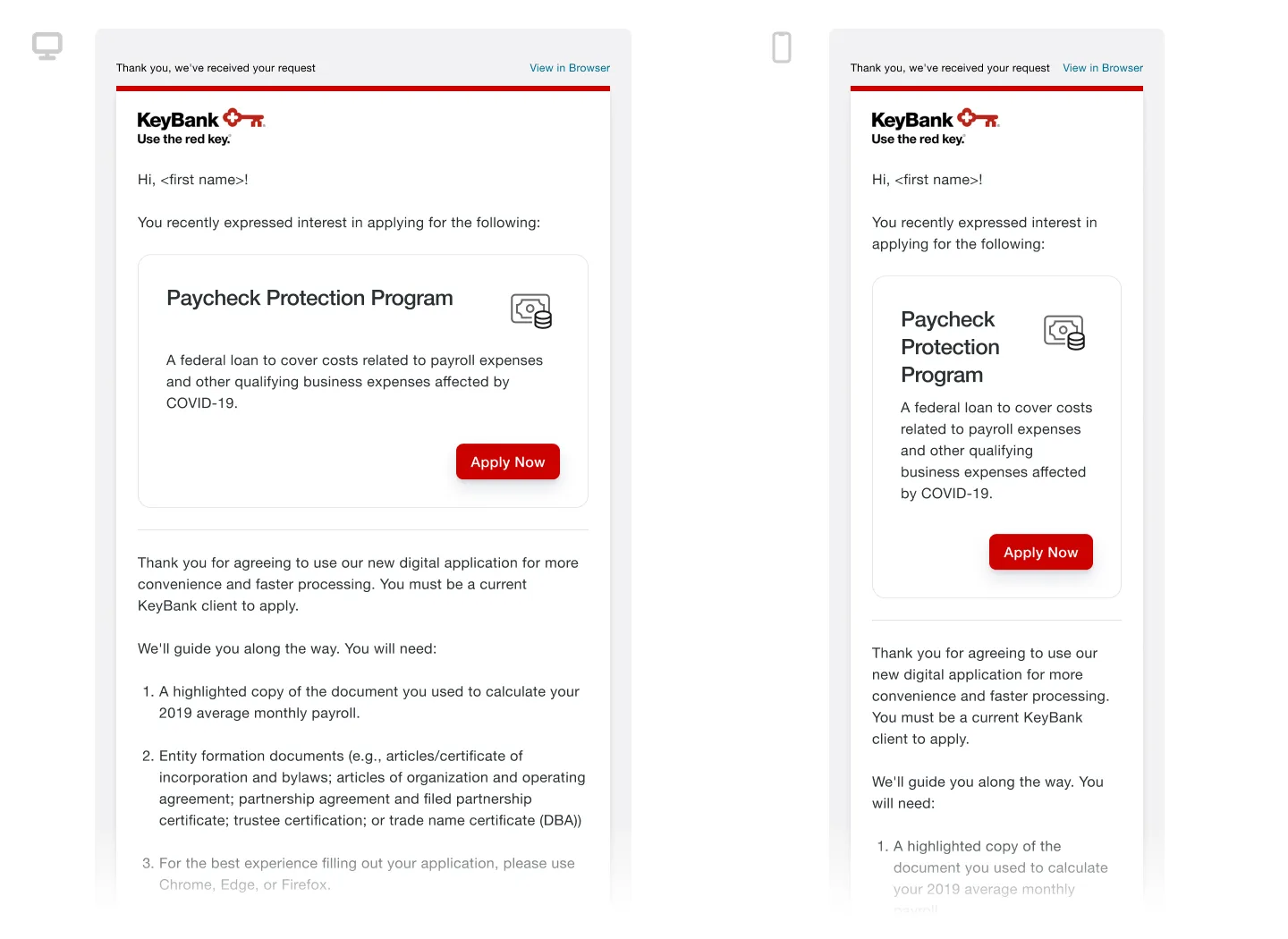

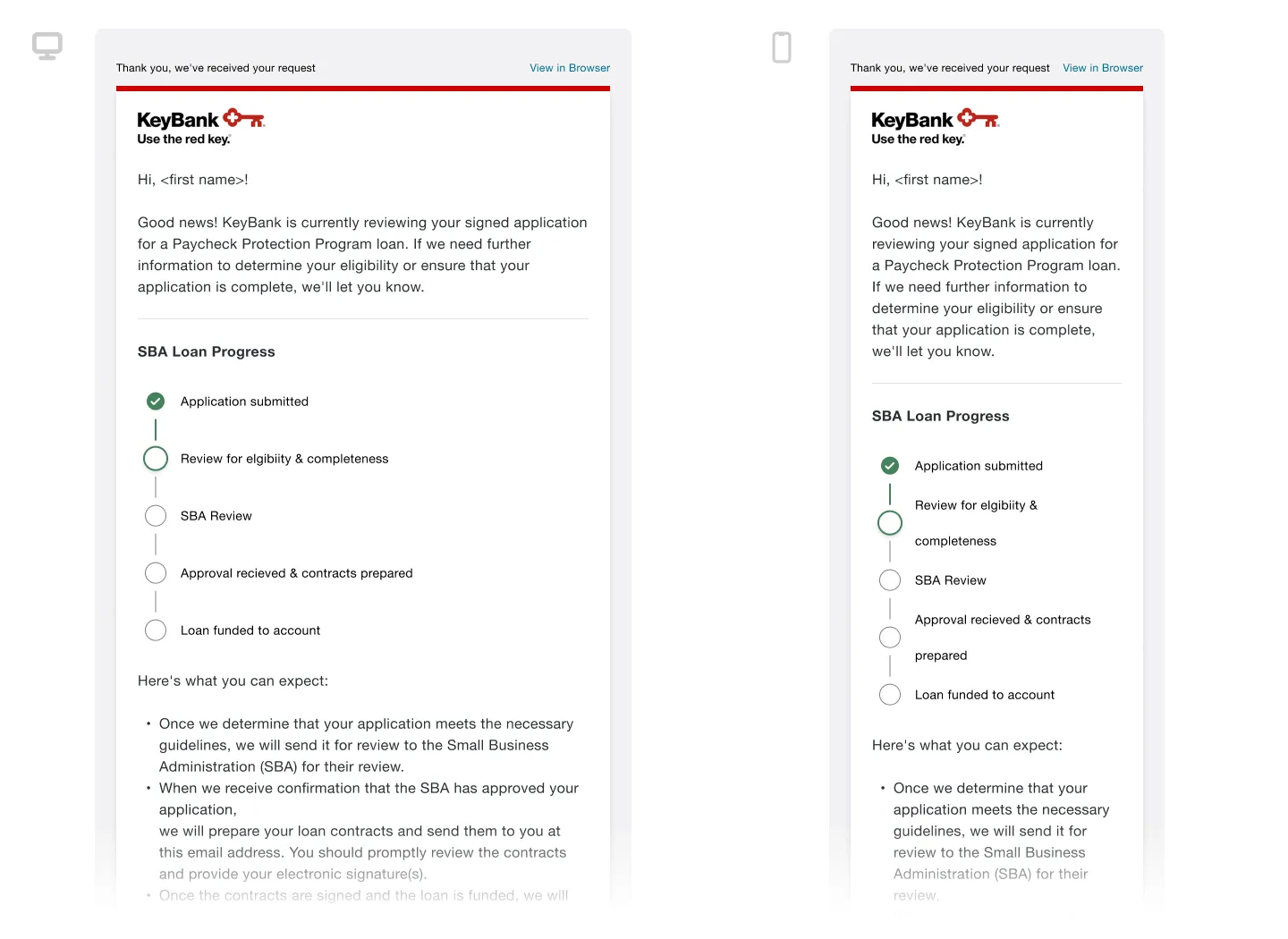

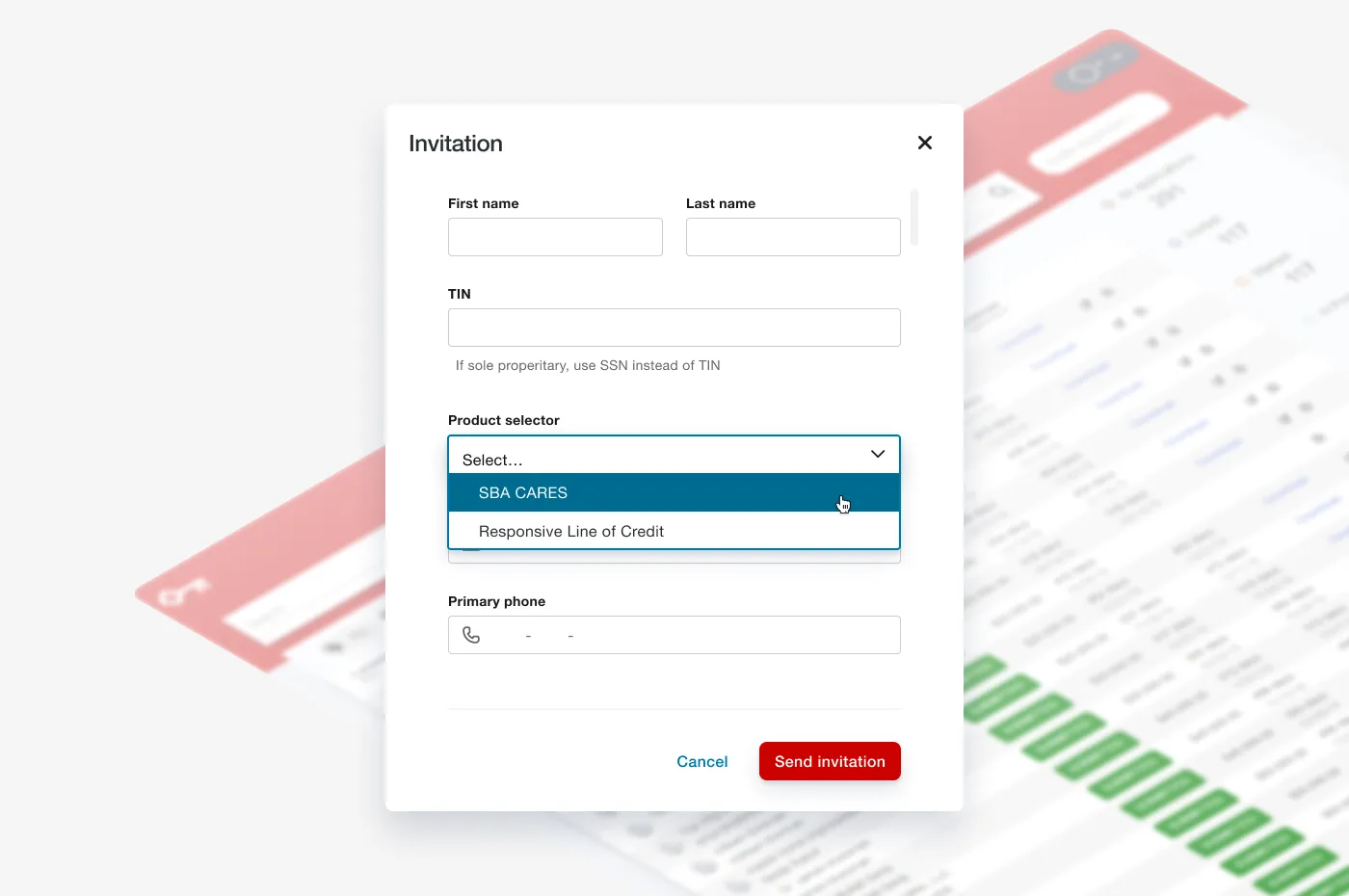

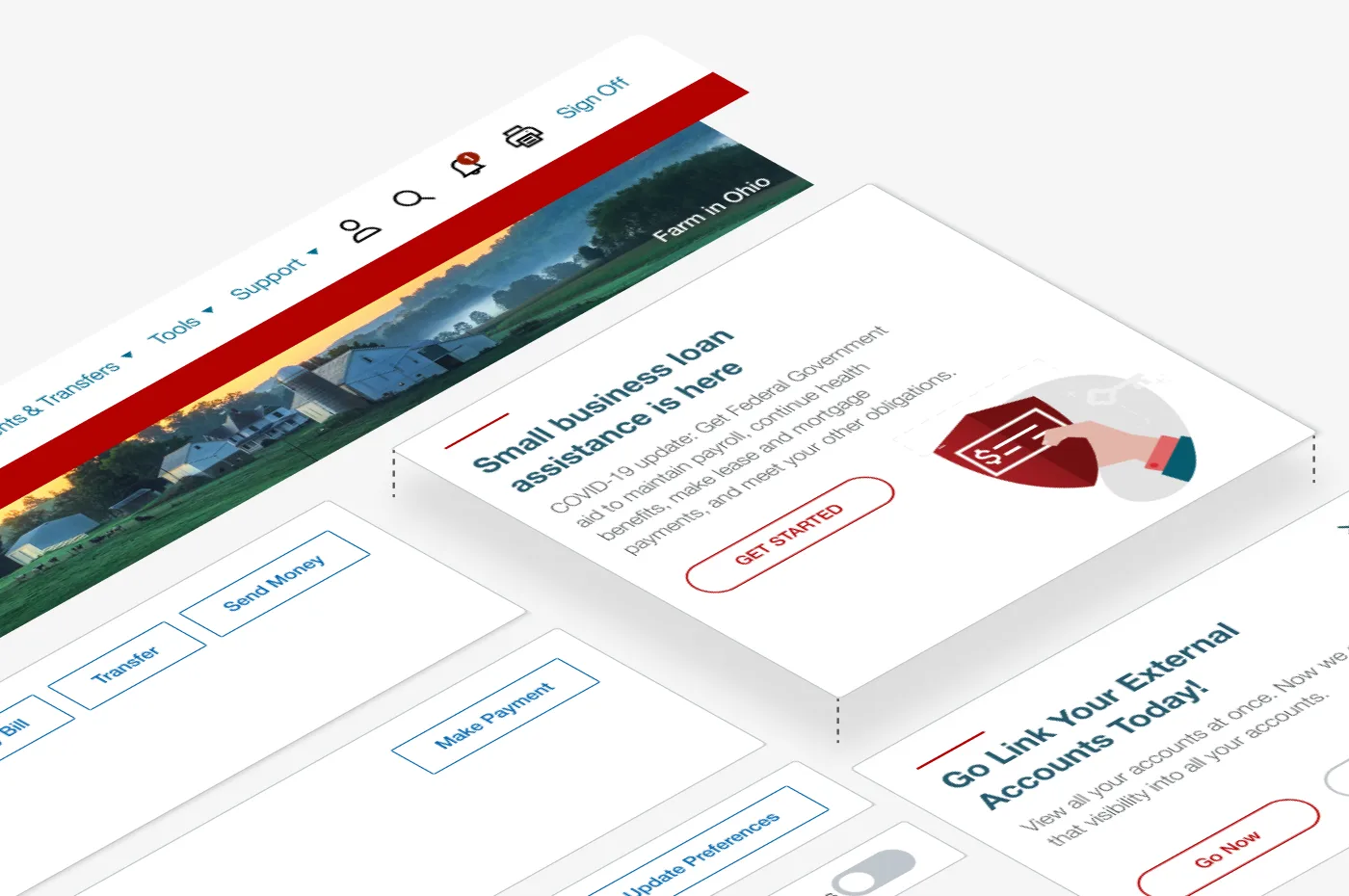

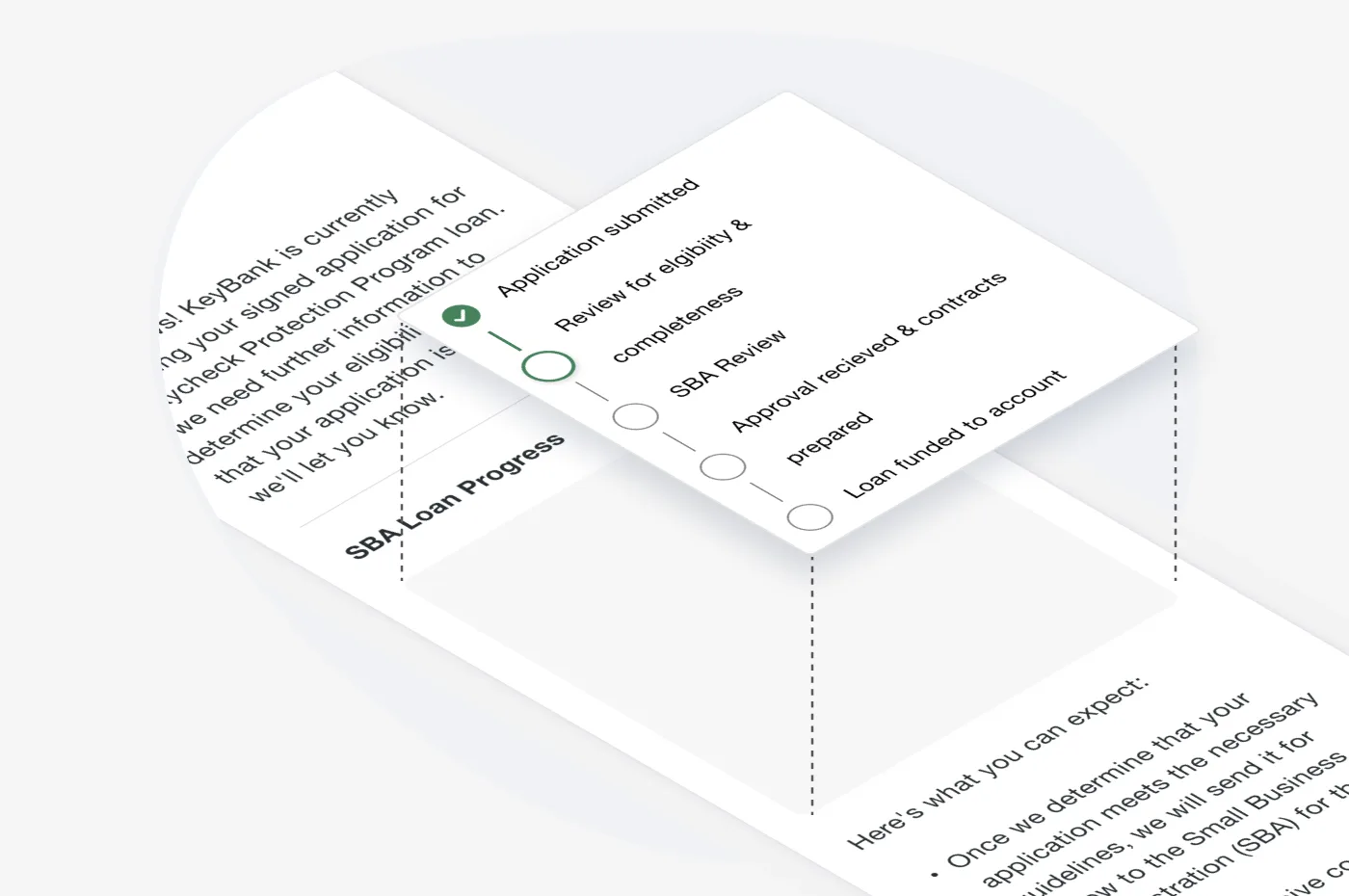

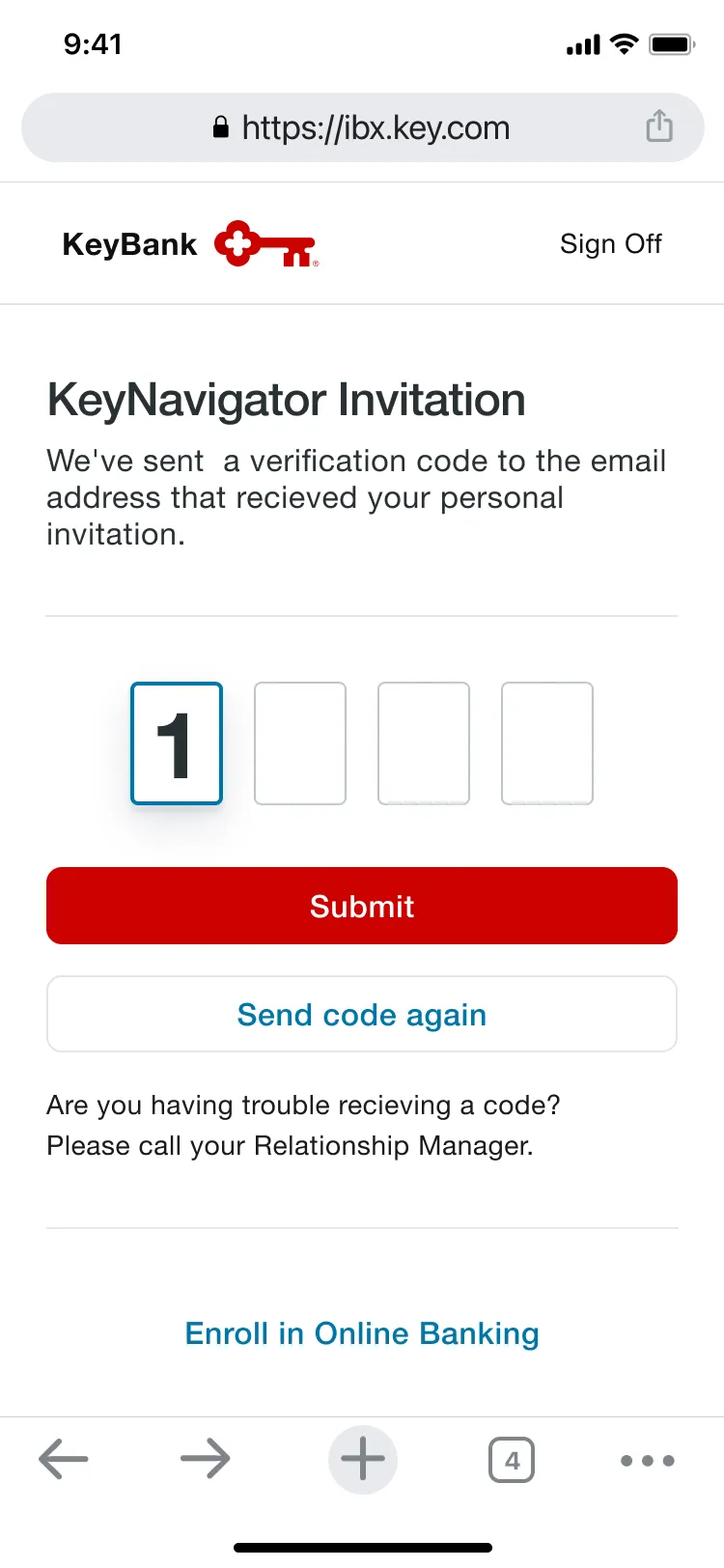

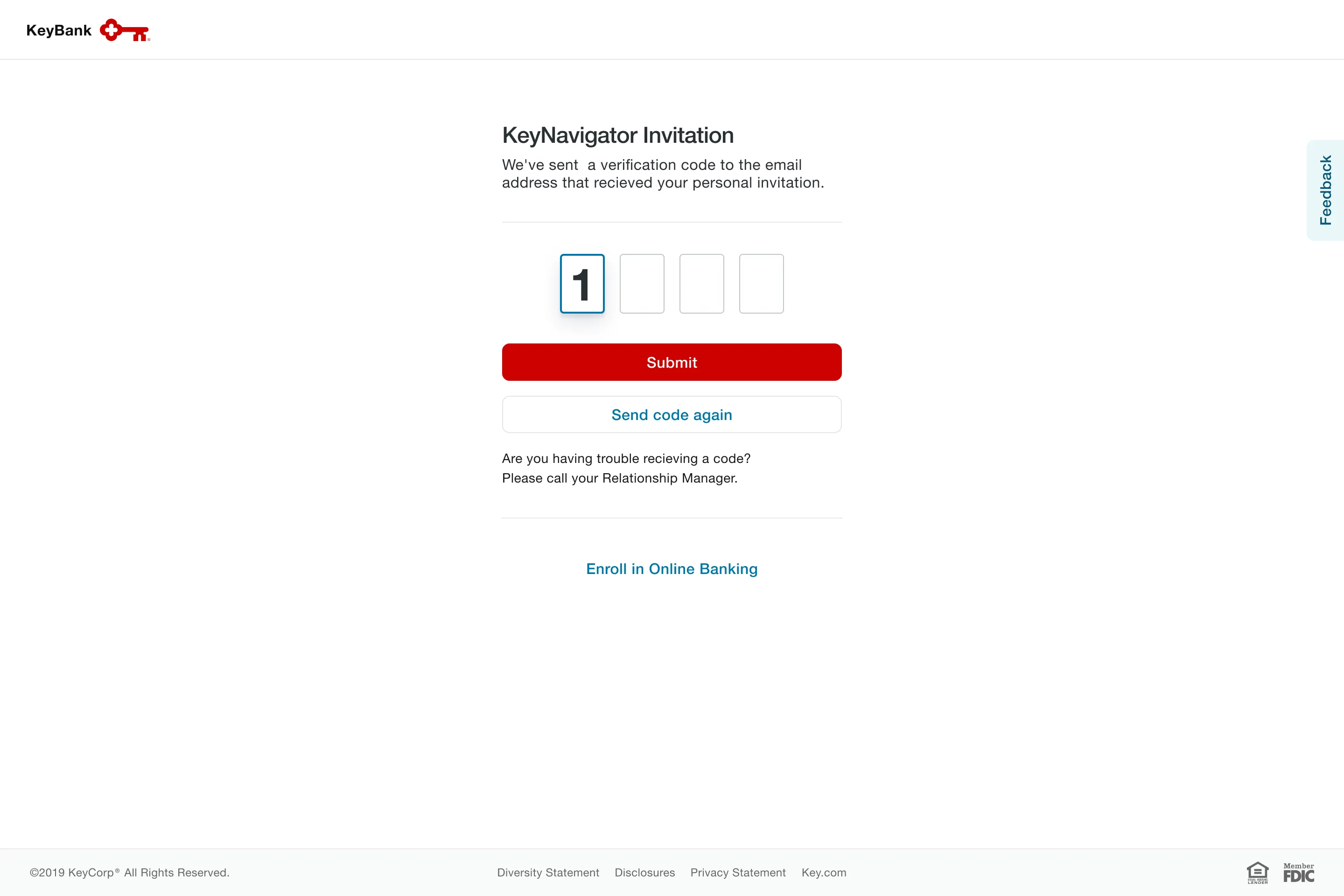

By collaborating with business and developer associates, we were able to envision our initial communications for invitations to apply for the paycheck protection program.

Features

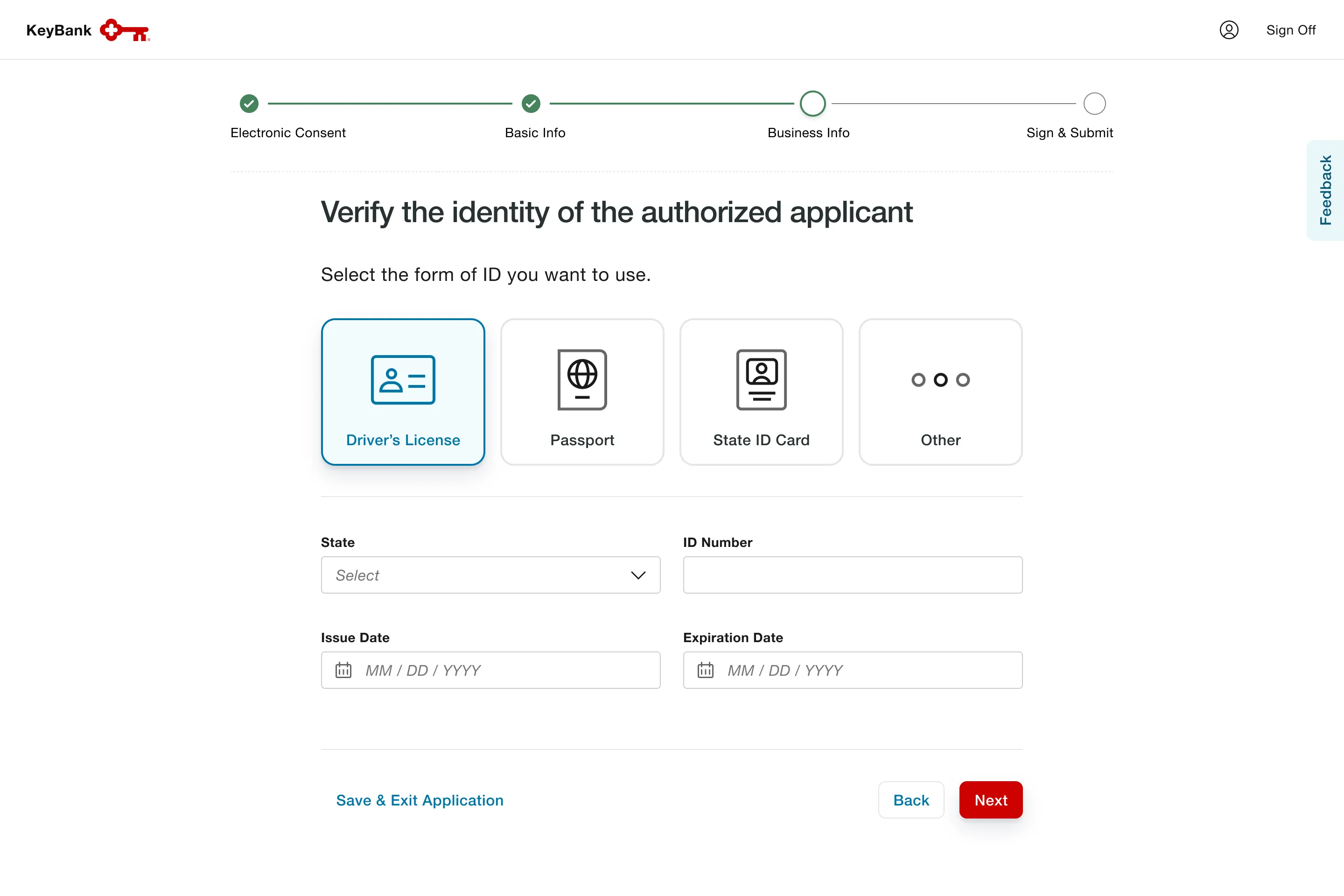

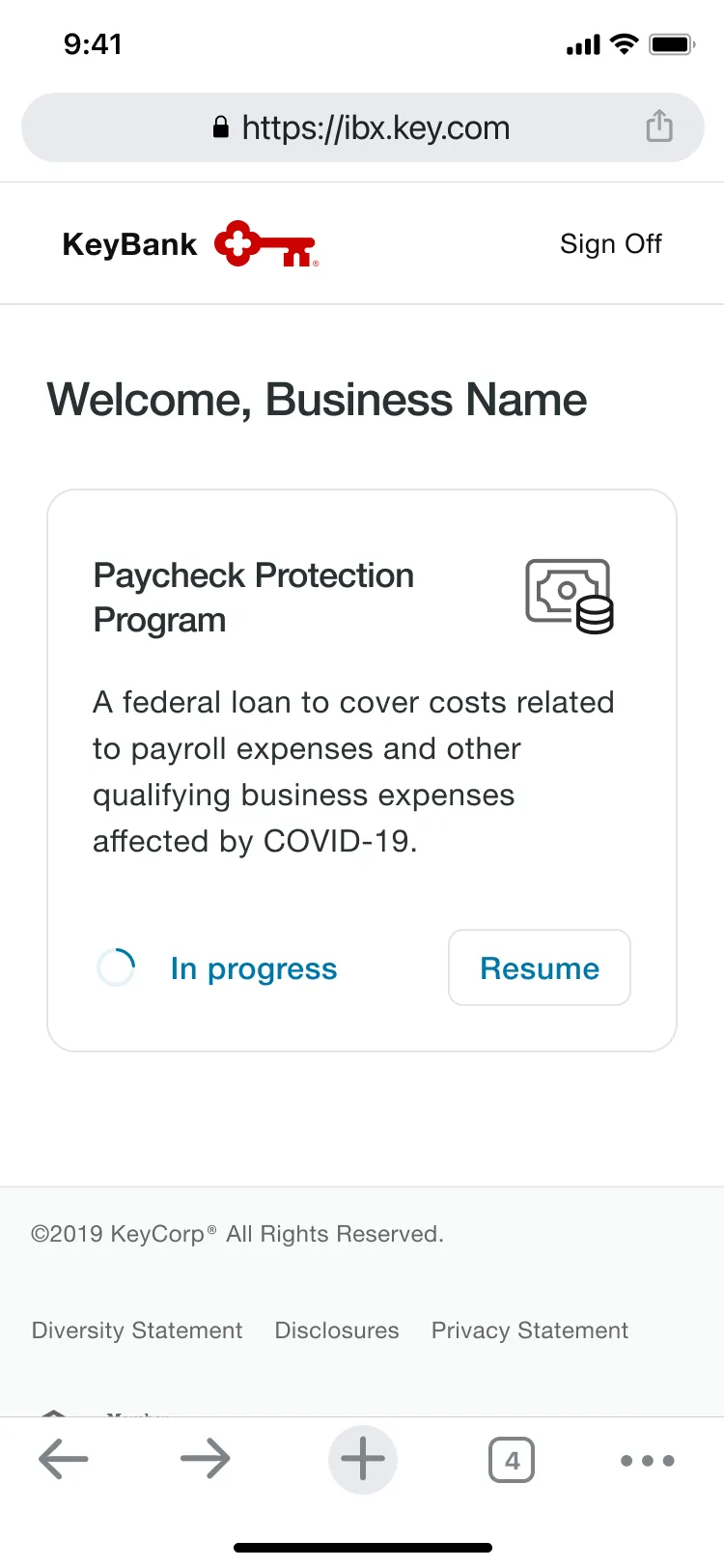

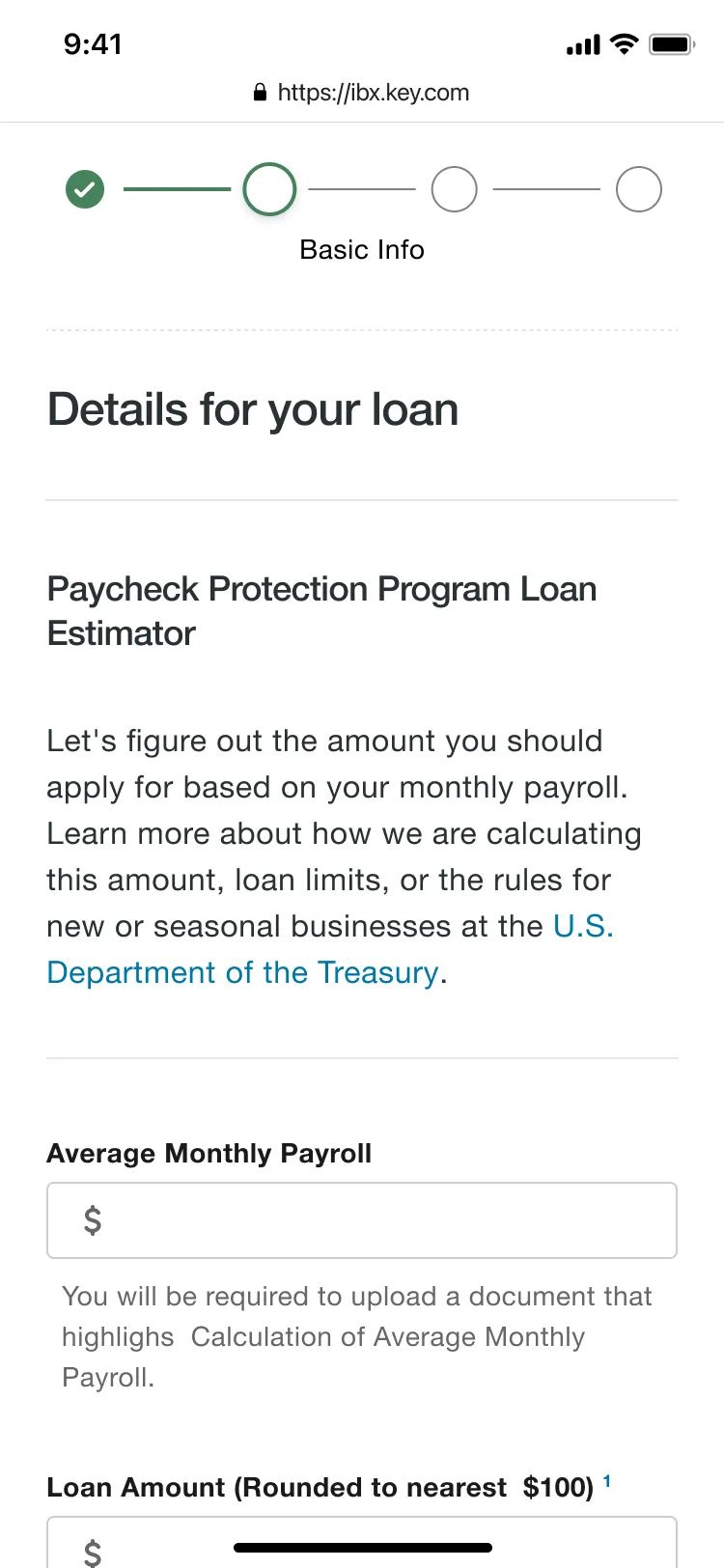

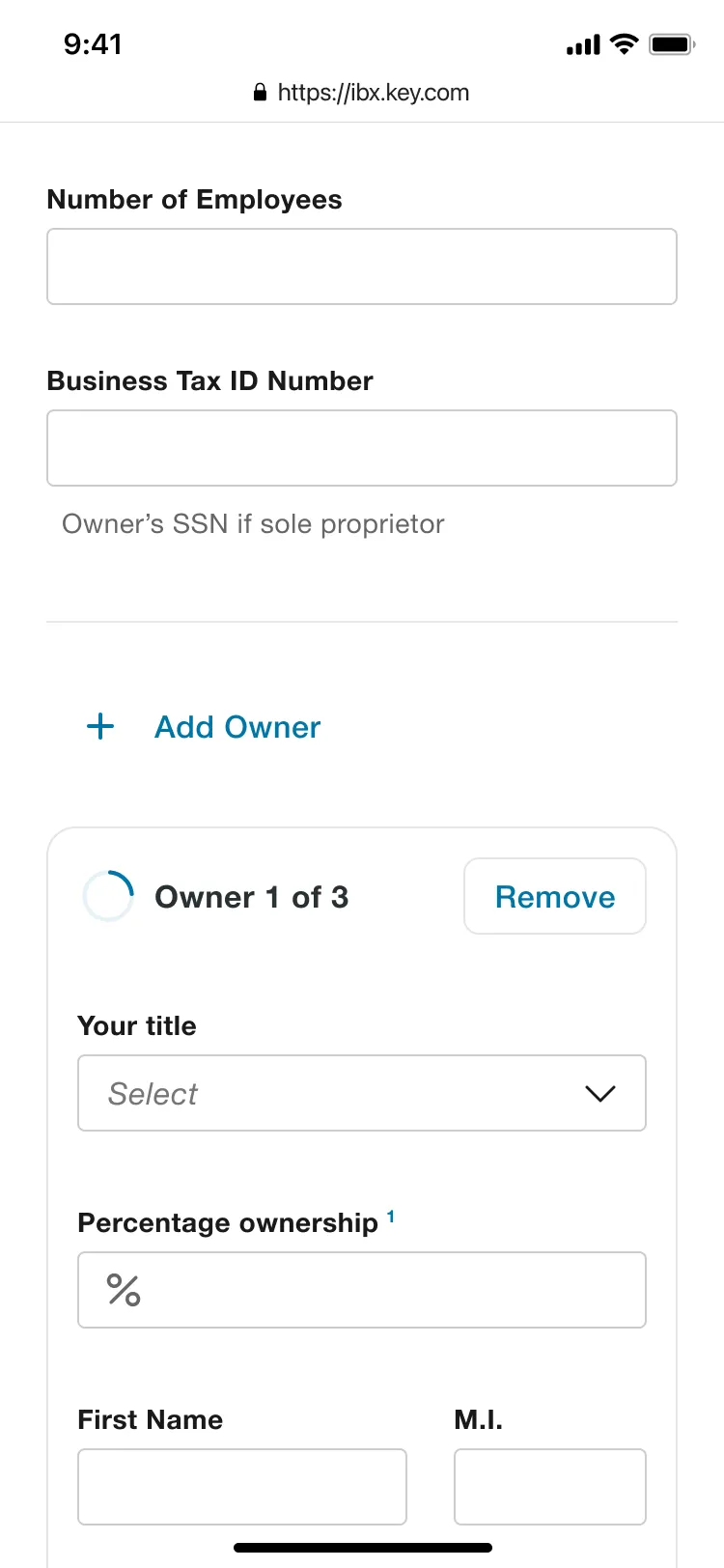

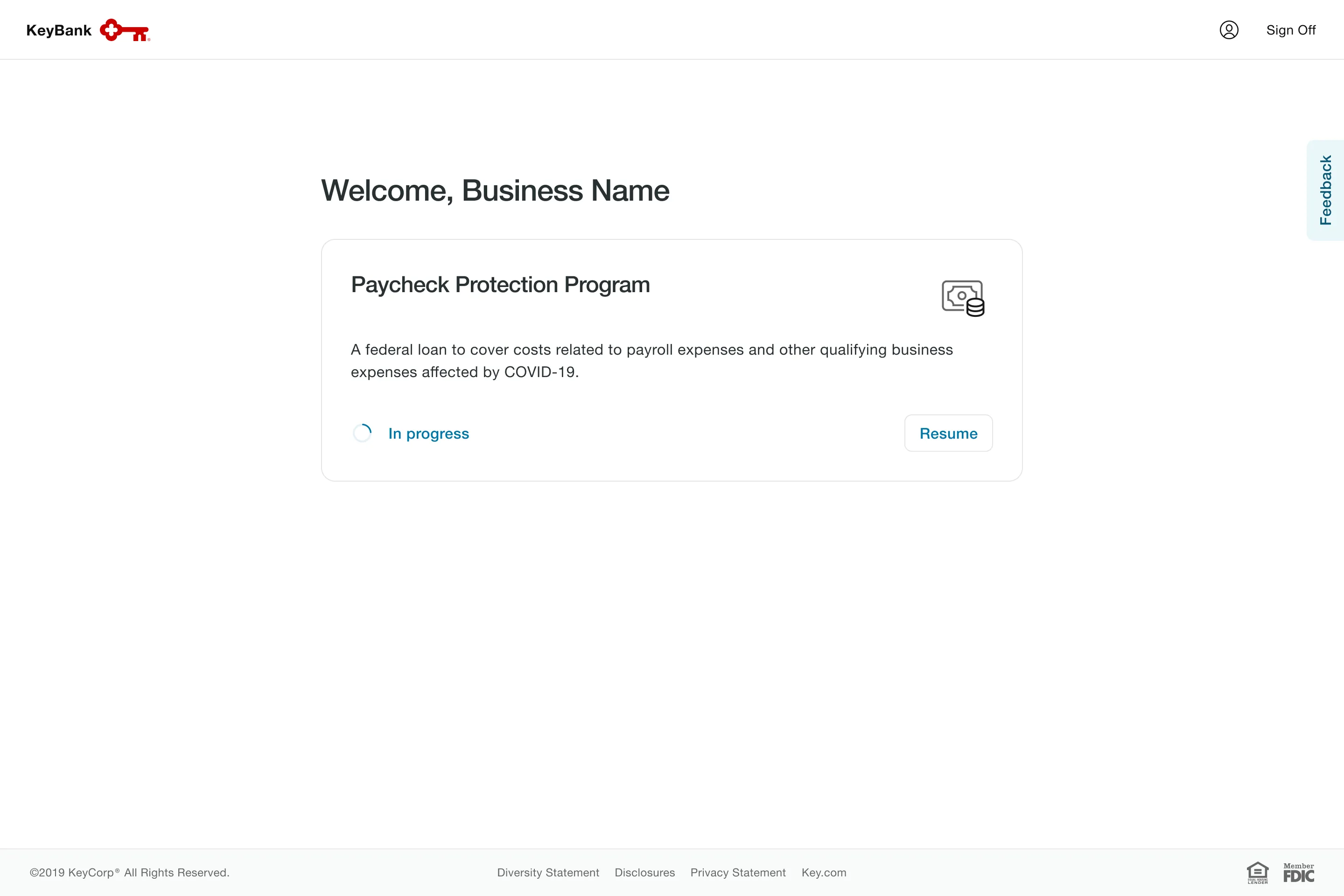

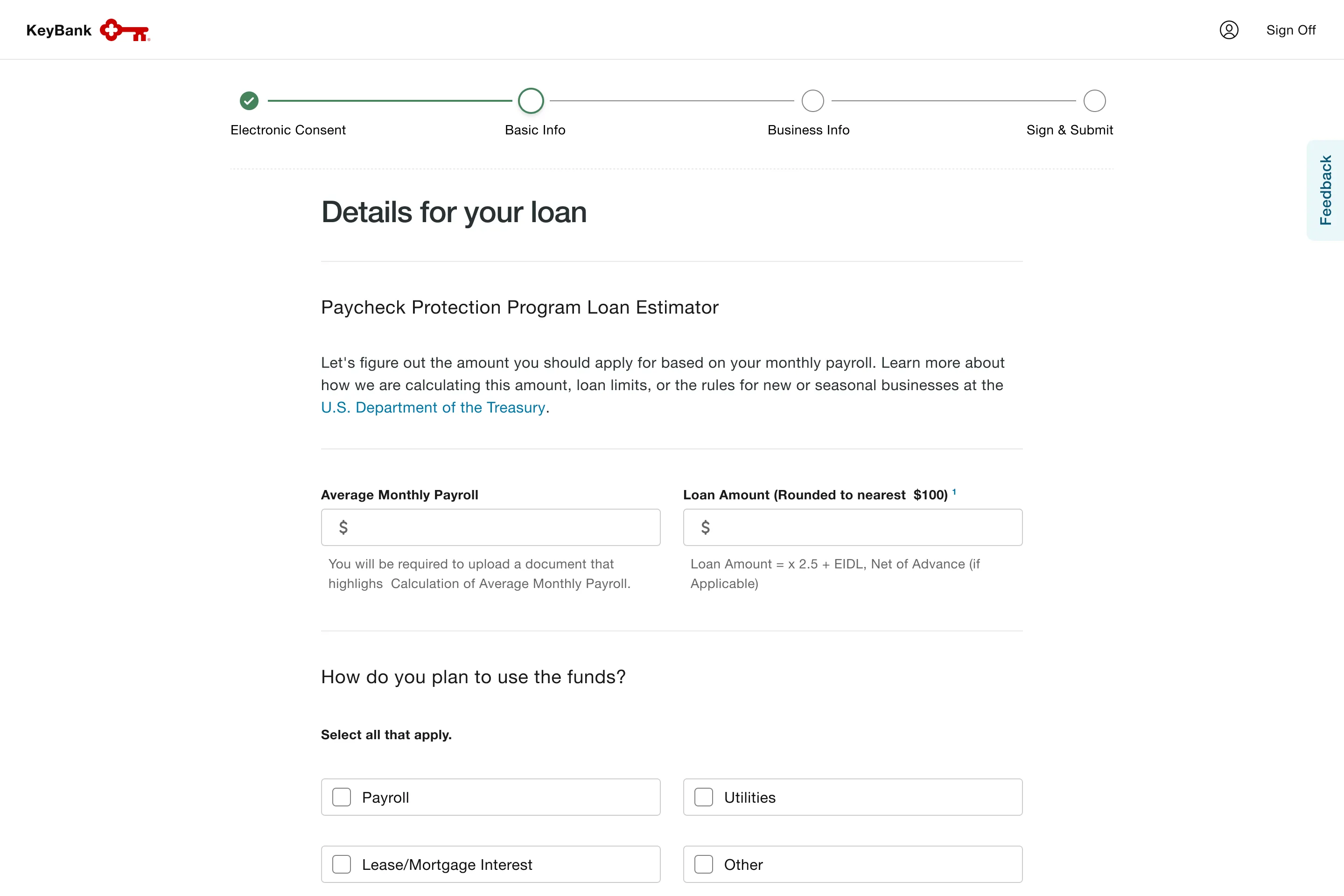

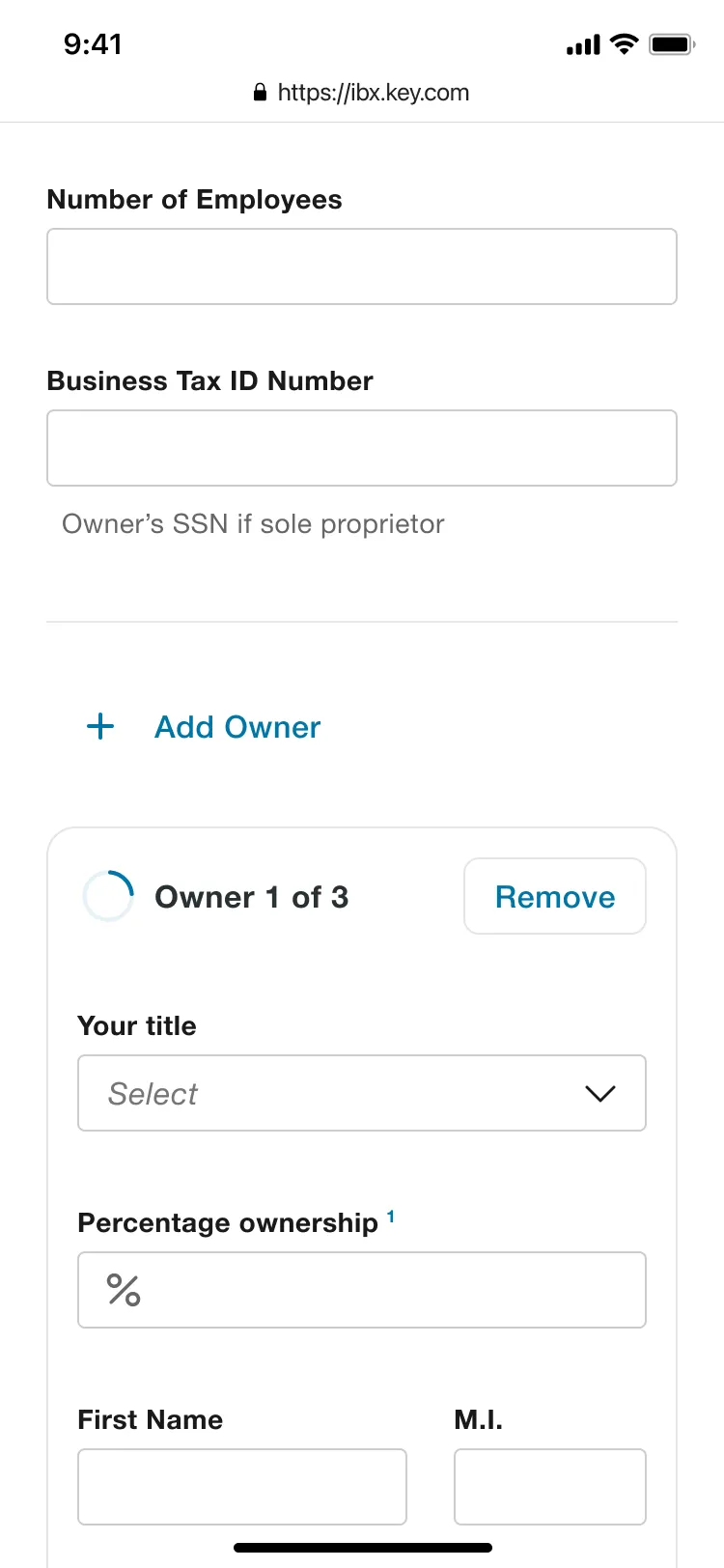

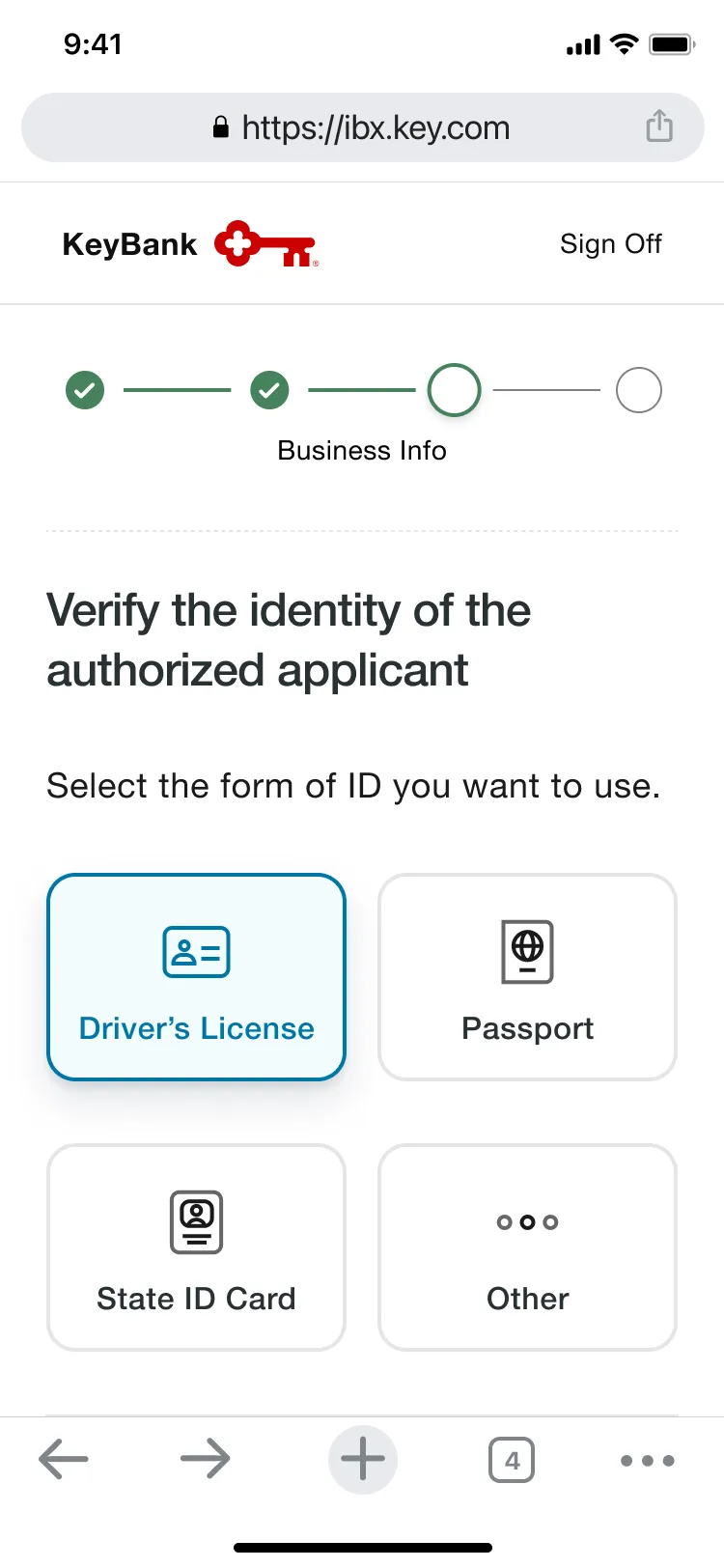

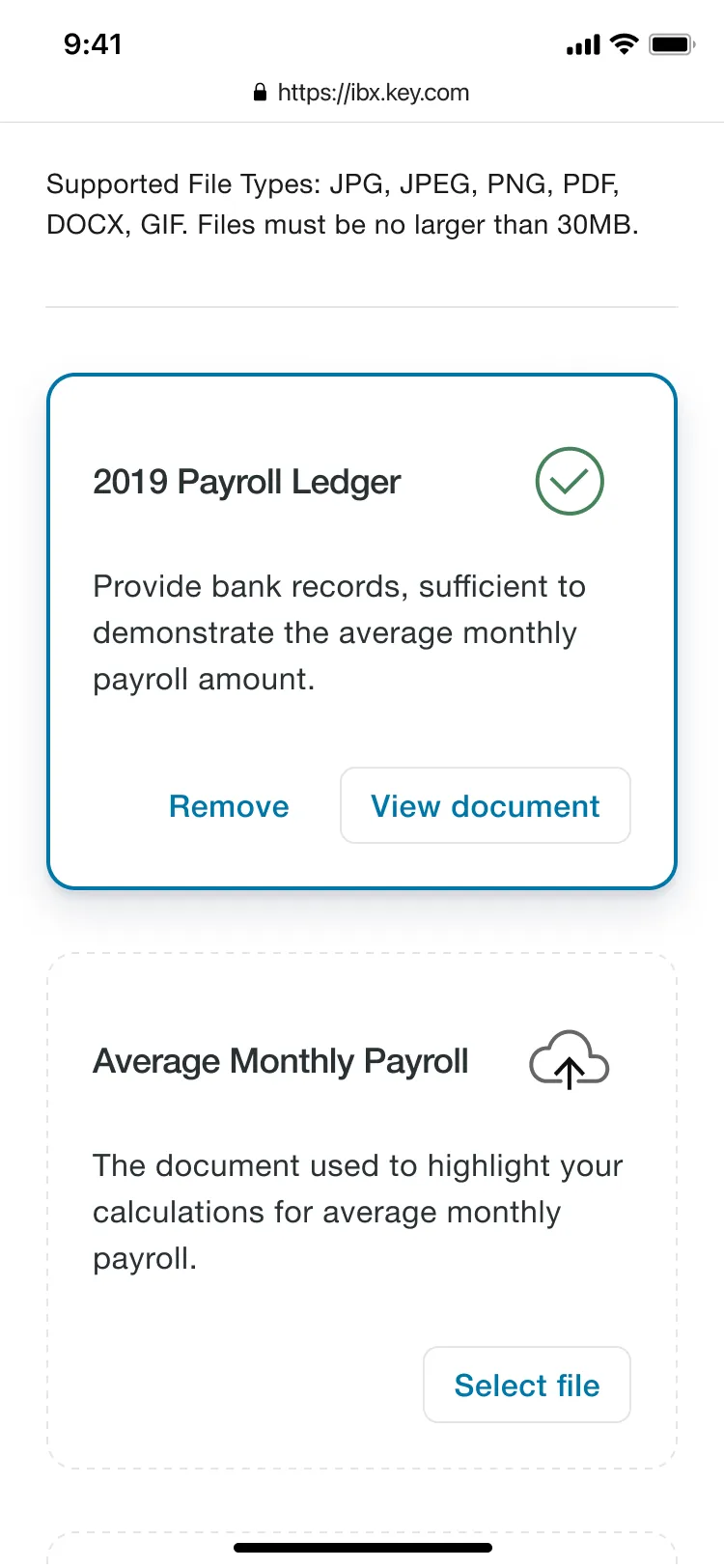

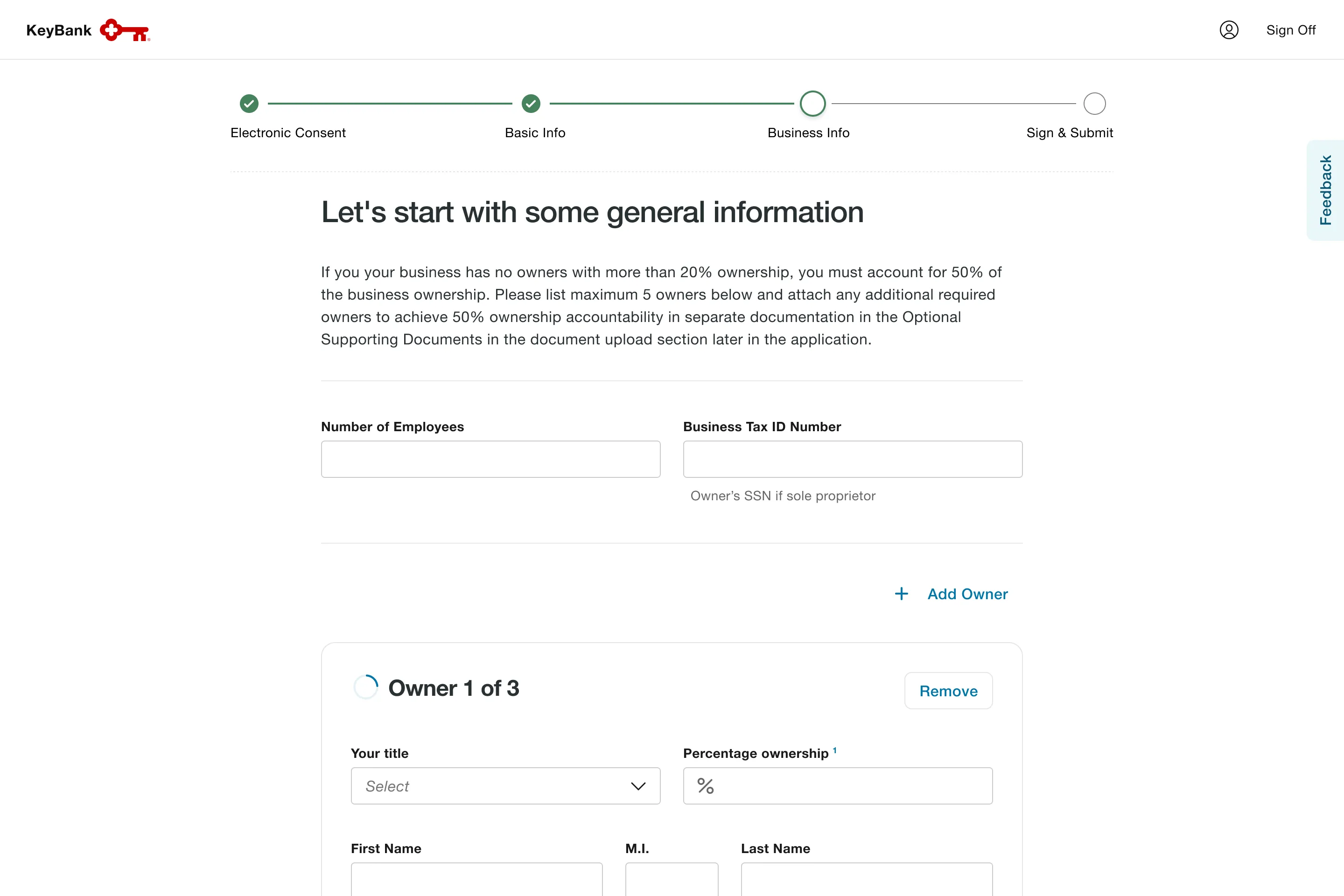

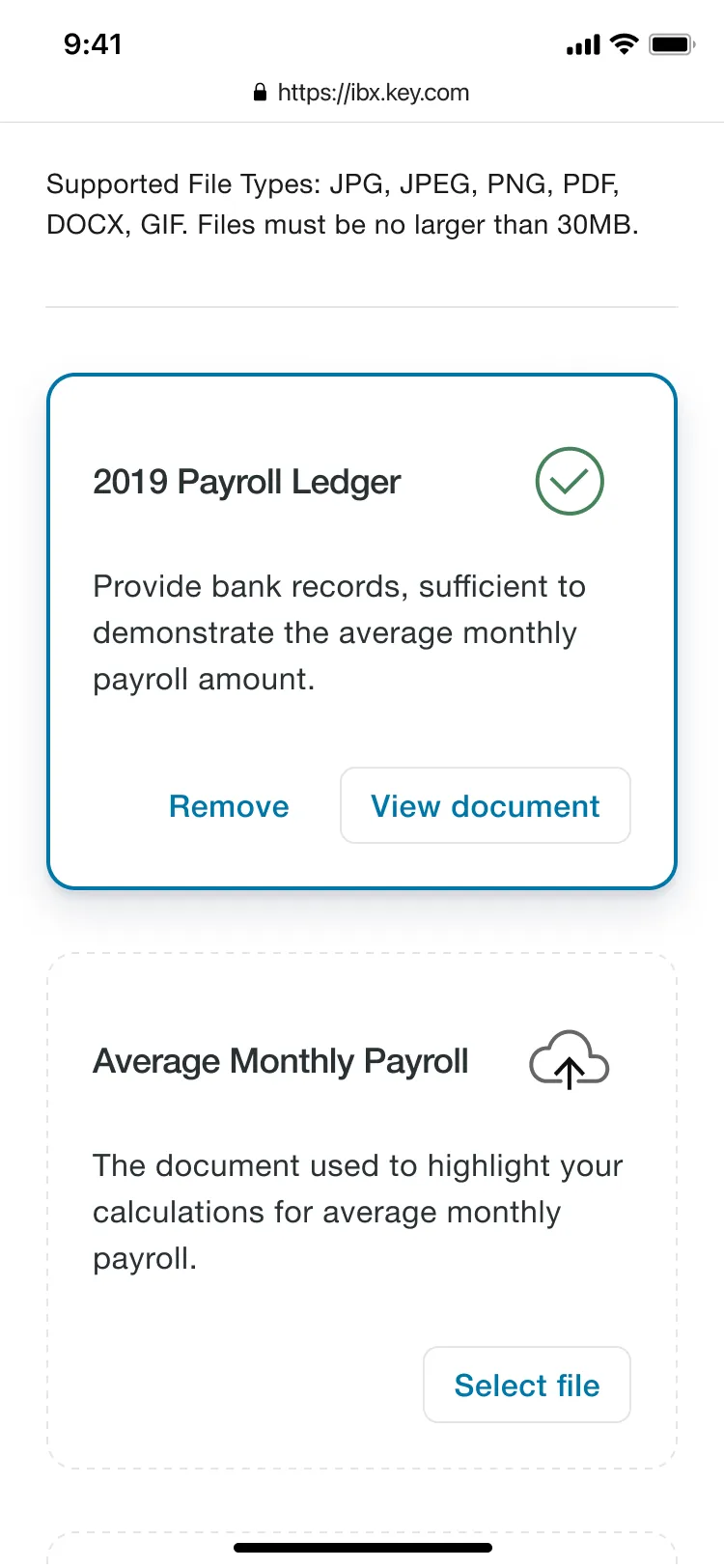

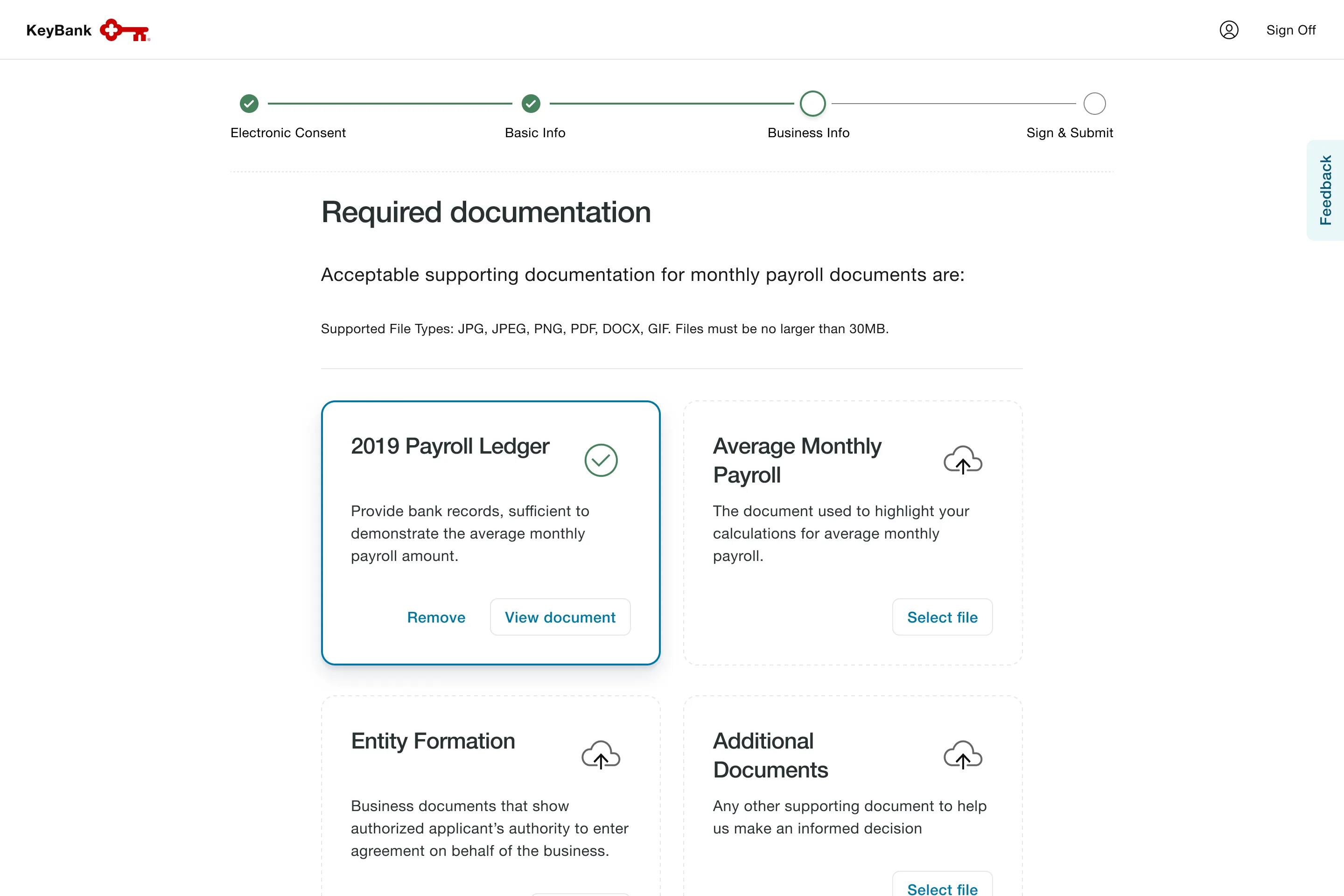

Our biggest feature with this release was retrofitting an existing enrollment experience for commercial clients and modifying the application to be specific to the Paycheck Protection Program.

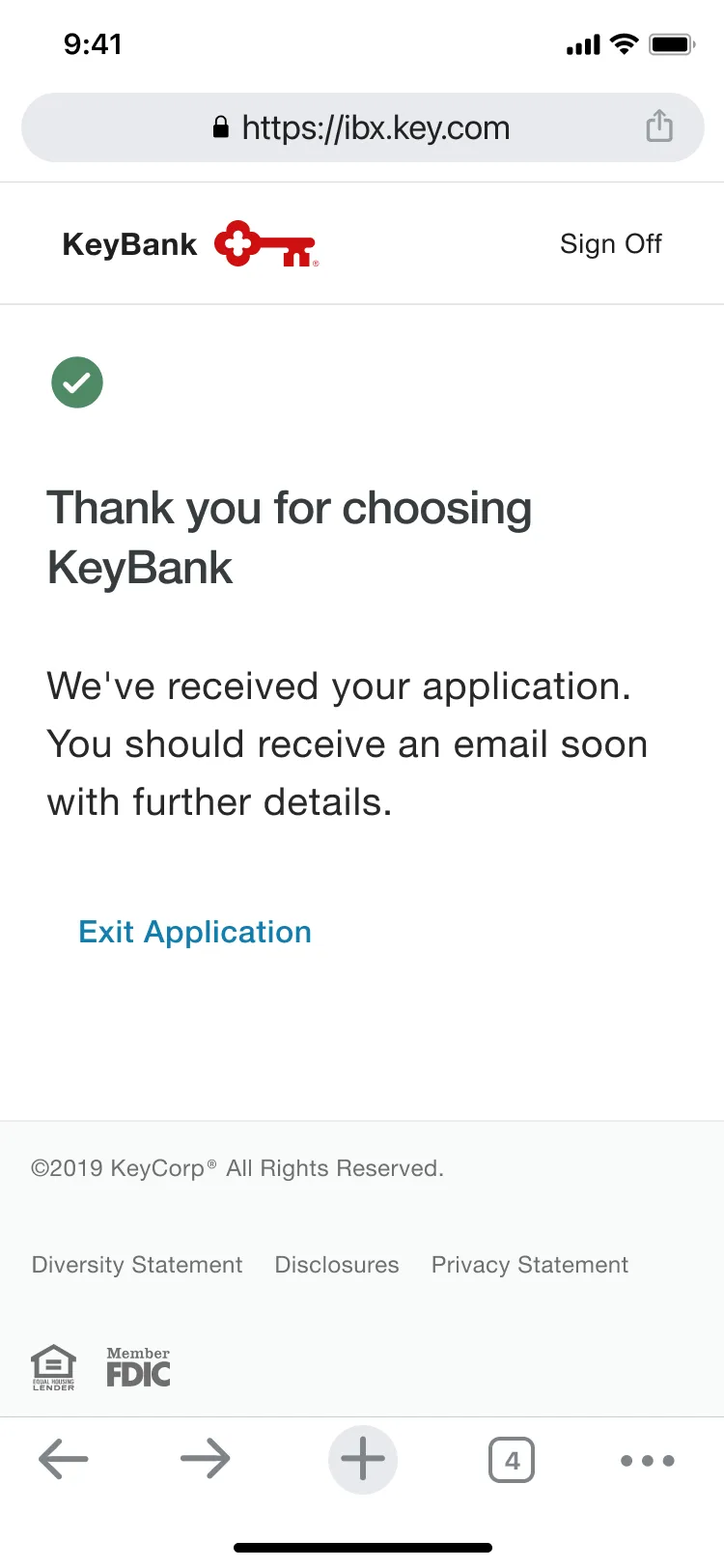

Key screens

Impact

Over 40,000 loans processed.

Takeaway

This experience was truly rewarding in being able to keep work moving around the clock and handing off to offshort to continue at the end of a day, to then catch up on changes made overnight.- Establish clear communication channels especially in short-term engagements. Be intentional on what is chat vs email.

- Prioritize pace over perfection, remain nimble and iterative. Prioritize functionality then visuals.

- Be an advocate for users when presented with technology constraints.

- Deep analysis on 9% drop-off rate to understand if there are underlying opportunities.

- Accessibility testing to ensure microinteractions are compliant, especially patterns like document upload.

- Service blueprint for underwriting process to understand more on what is involved to streamline loan applications.