Real Estate Capital

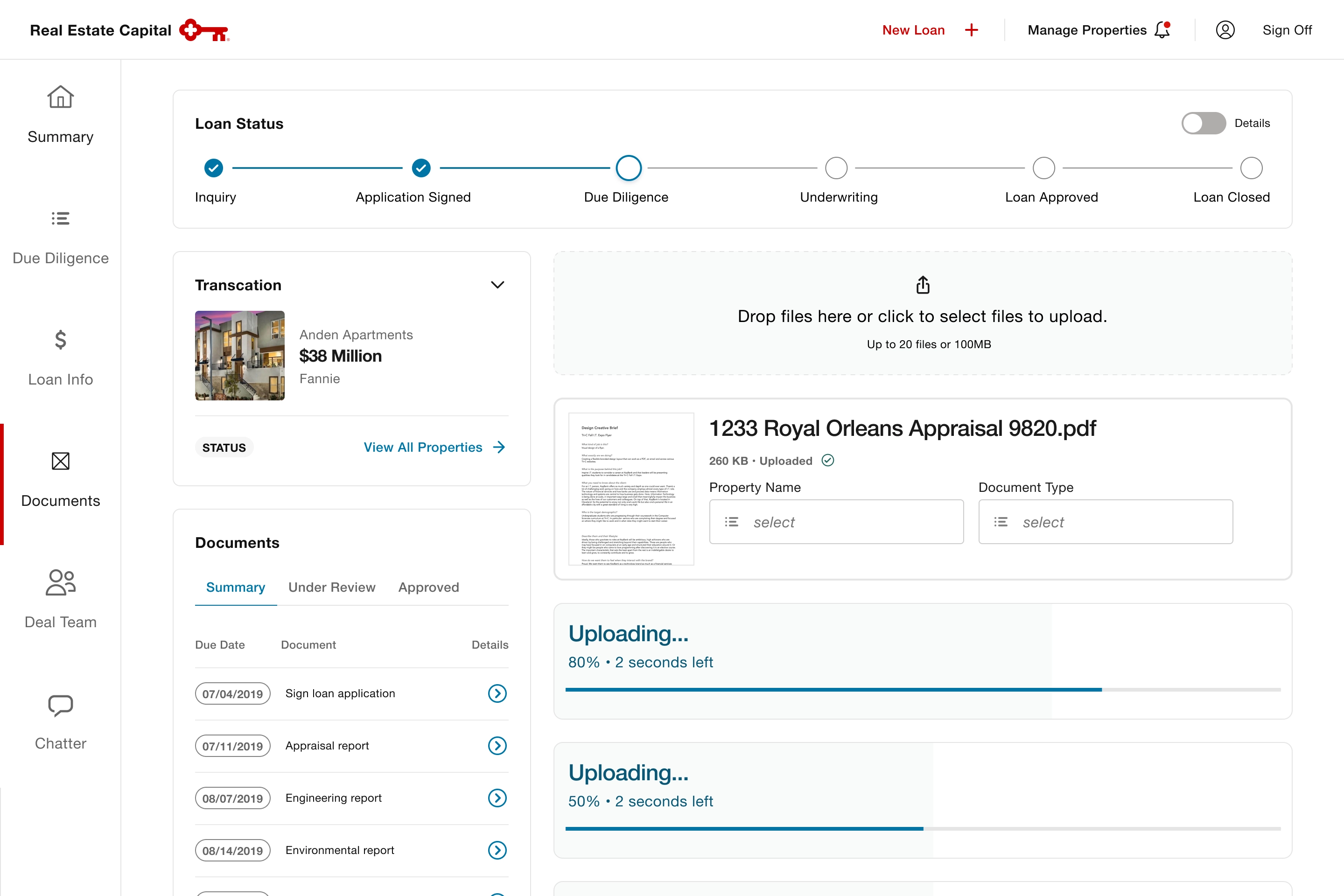

How might we increase efficiency and conversion rates by creating a client self-service platform to track their transaction property loan applications?Overview

As one of the nation’s leading commercial and multi-family real estate finance providers, KeyBank focuses on building relationships with our clients and offering financing options for short and long-term goals.

As a squad, our goal is to address the end-to-end experience by optimizing the process and automating the input, flow, transaction, and information output. Creating a streamlined and automated process will considerably reduce pain points for both clients and employees.

Approach

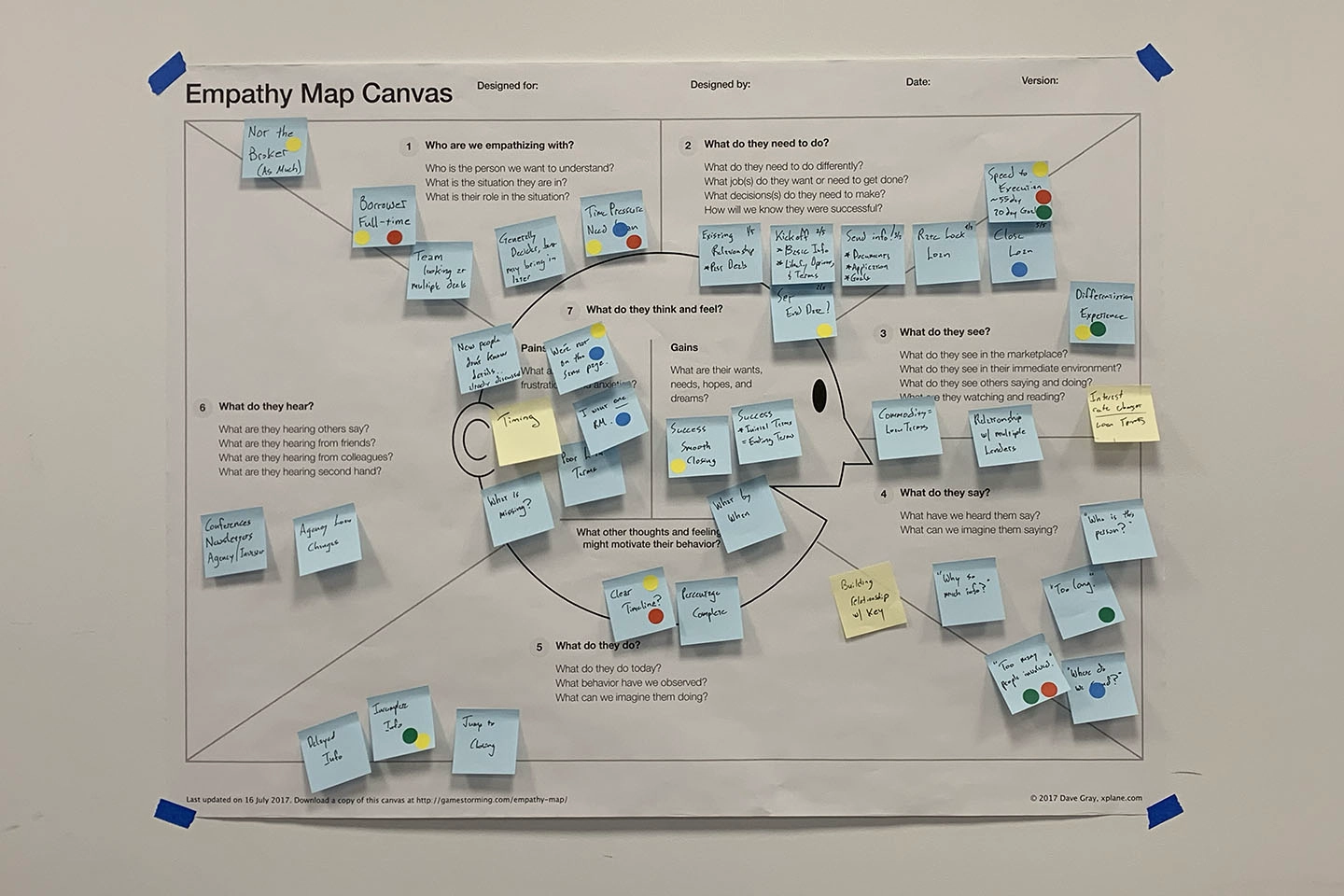

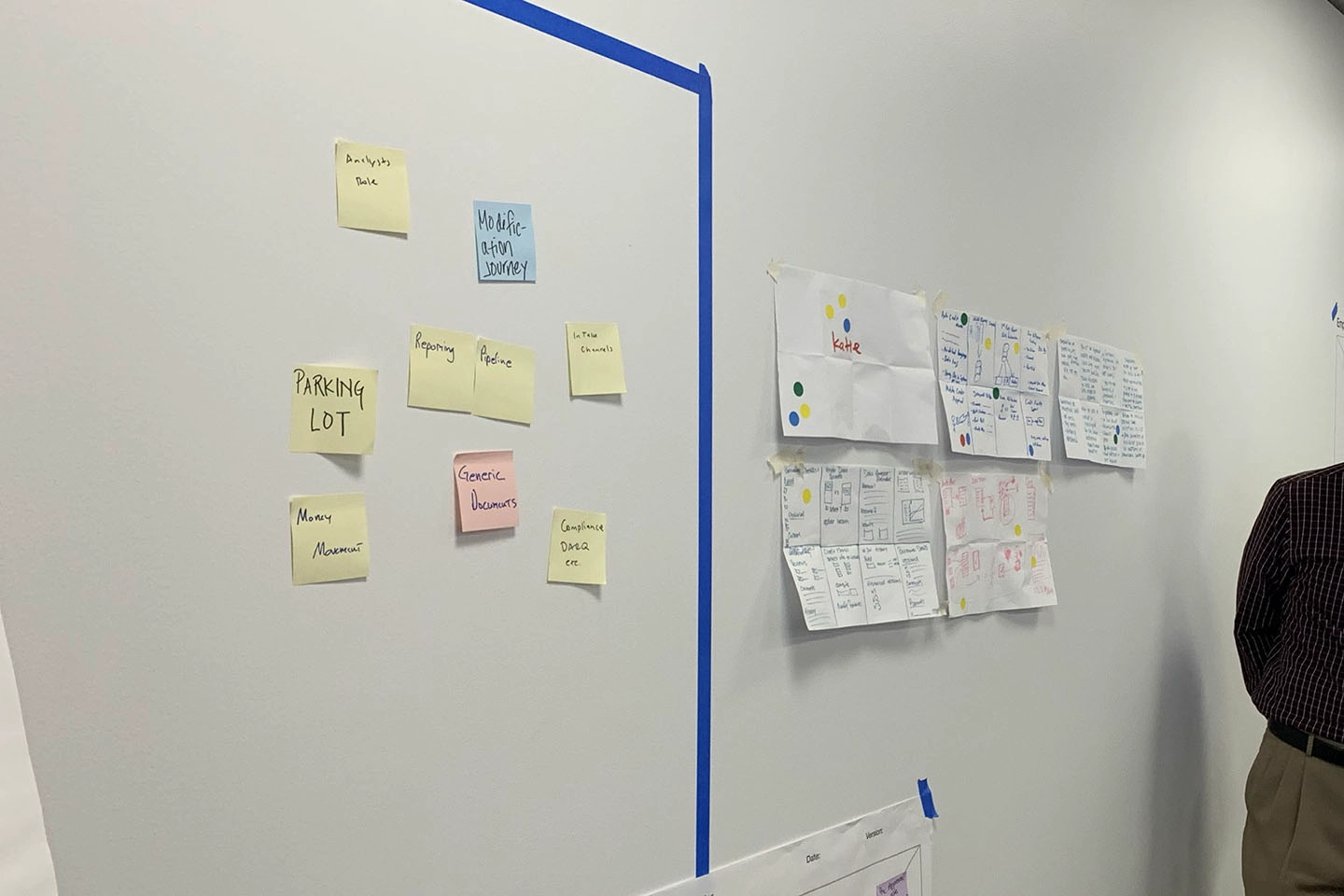

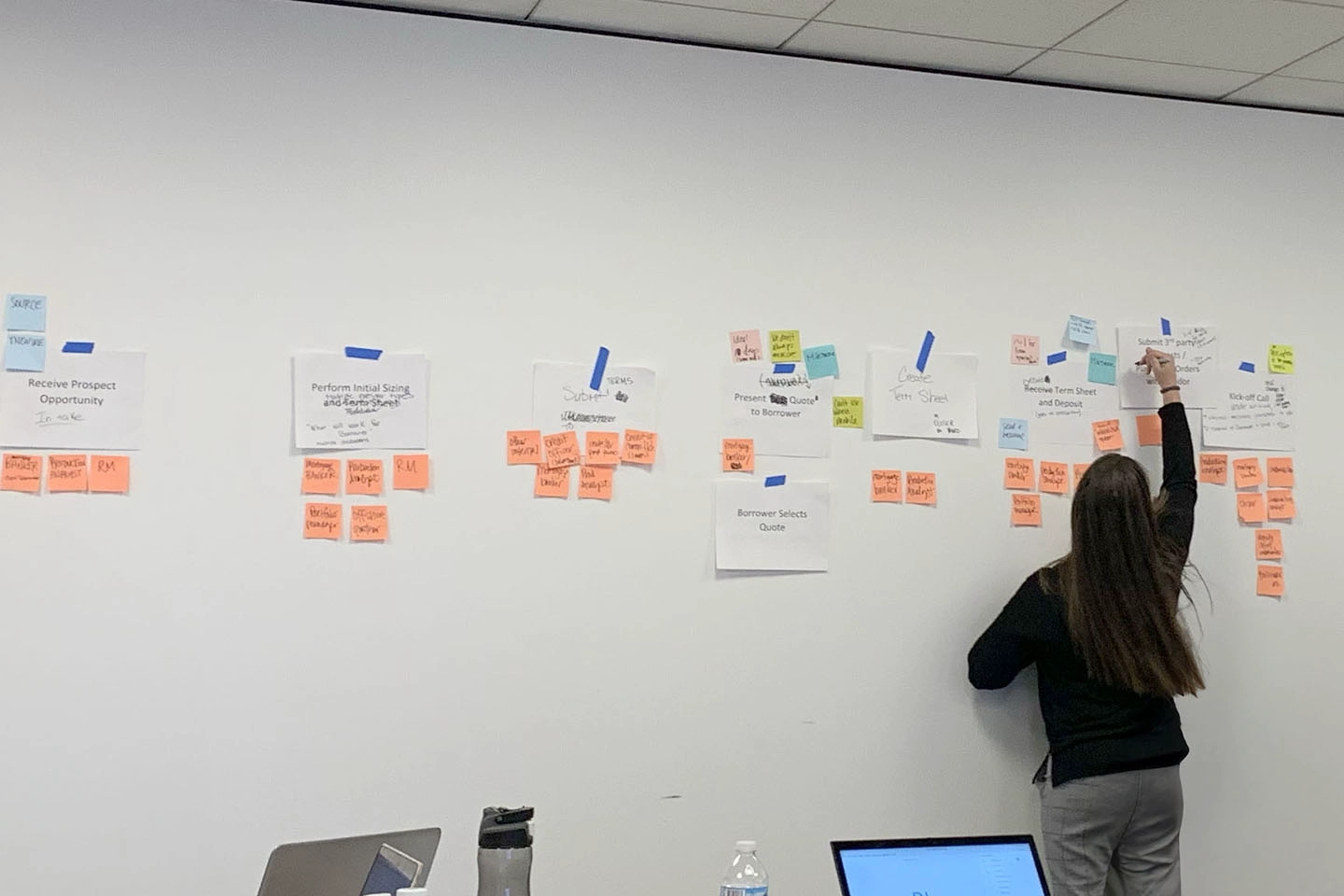

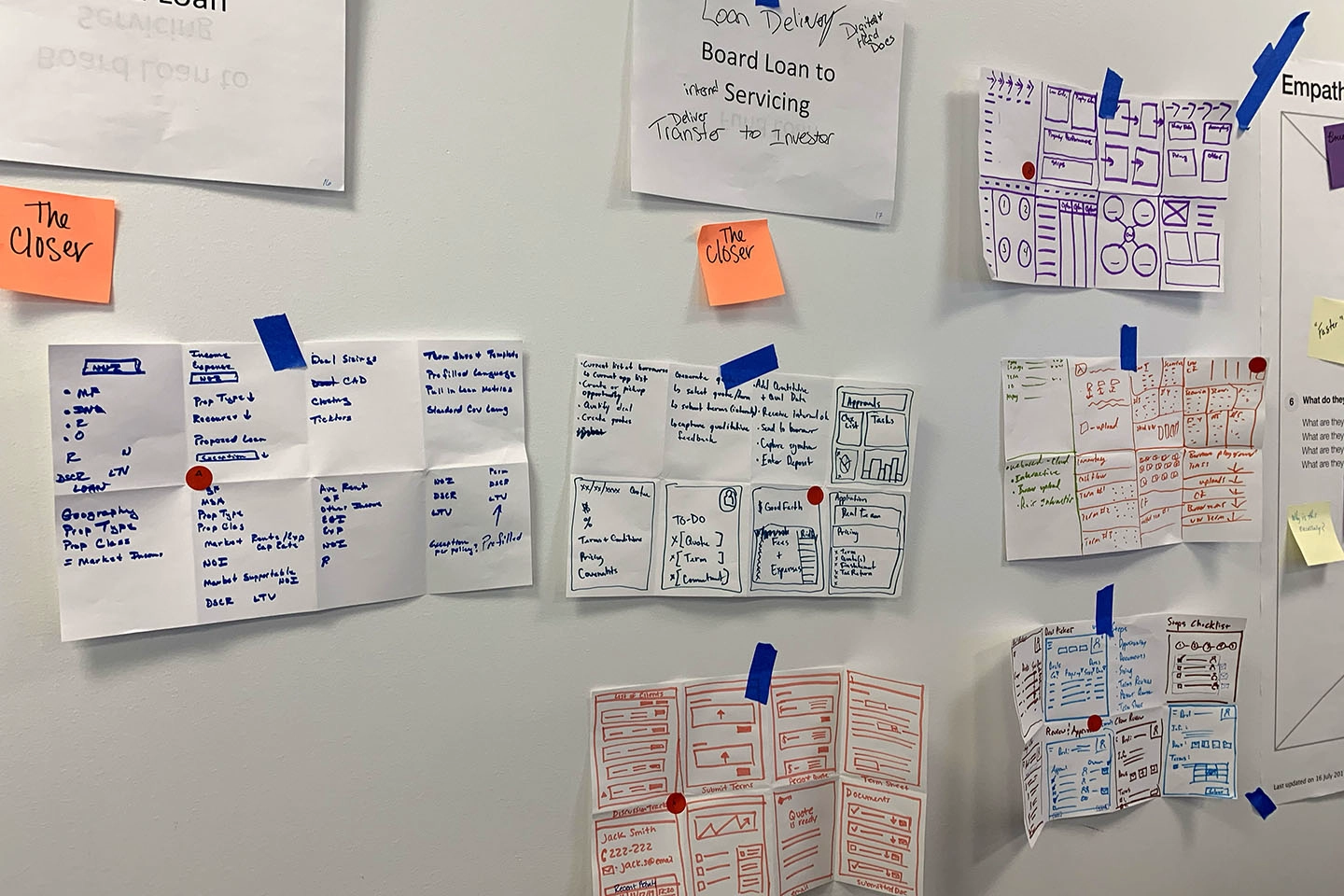

Our project kick-off included breakout sessions, during which we mapped critical milestones in real estate capital, from prospect opportunities to portfolio management.

We identified critical user flows and utilized sticky notes to highlight steps, systems, pain points, and opportunities. This initial phase laid a solid foundation for strategic innovation and user-centric design.

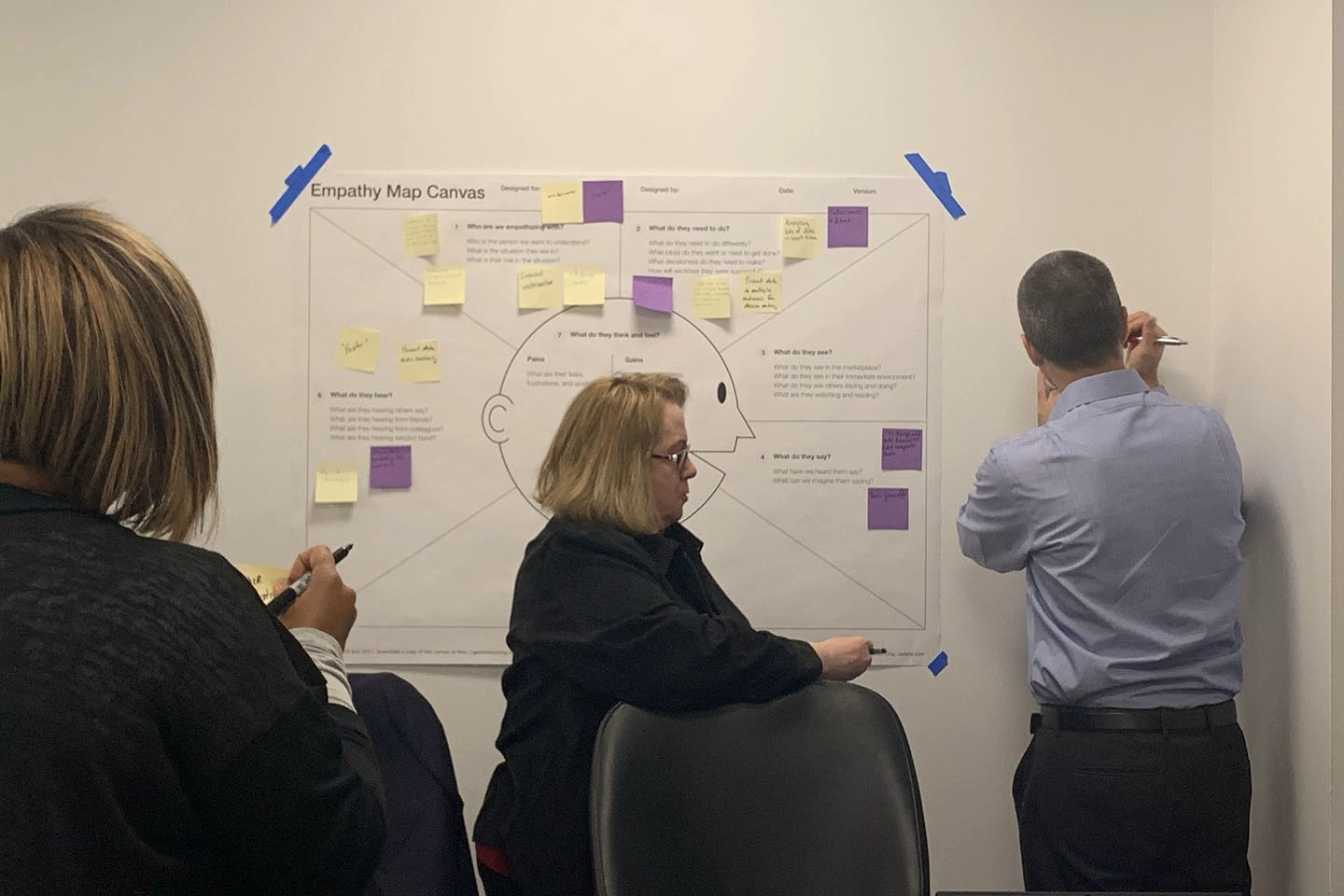

I partnered with a User Researcher to design an onsite workshop methodology to engage 15 participants, including 5 Prospect Loan Borrowers, 5 Relationship Managers, and 5 Underwriters. The workshop focused on journey mapping and low-fidelity prototyping.

-

Key findings

- The communication and document collection process can take up to 32 days.

- A lot of manual input of repeated information across systems creates more opportunities for user error.

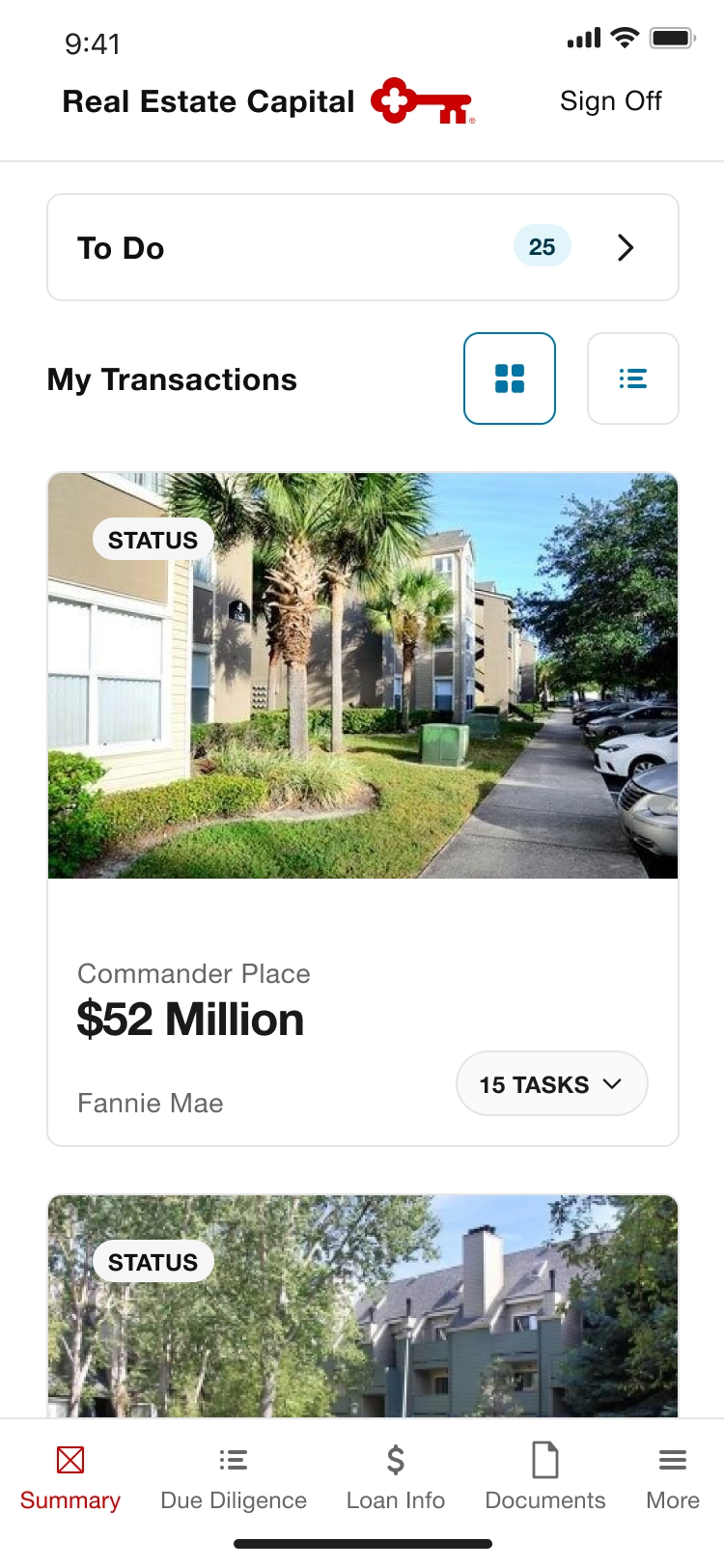

- Loan borrowers lack transparency about where their application is and how long it takes until completion.

- Competitors provide more flexibility to underwriters by traveling onsite to collect information directly from borrowers.

- Competitors are digitizing and reducing print and scanning with modern platforms.

-

Recommendations

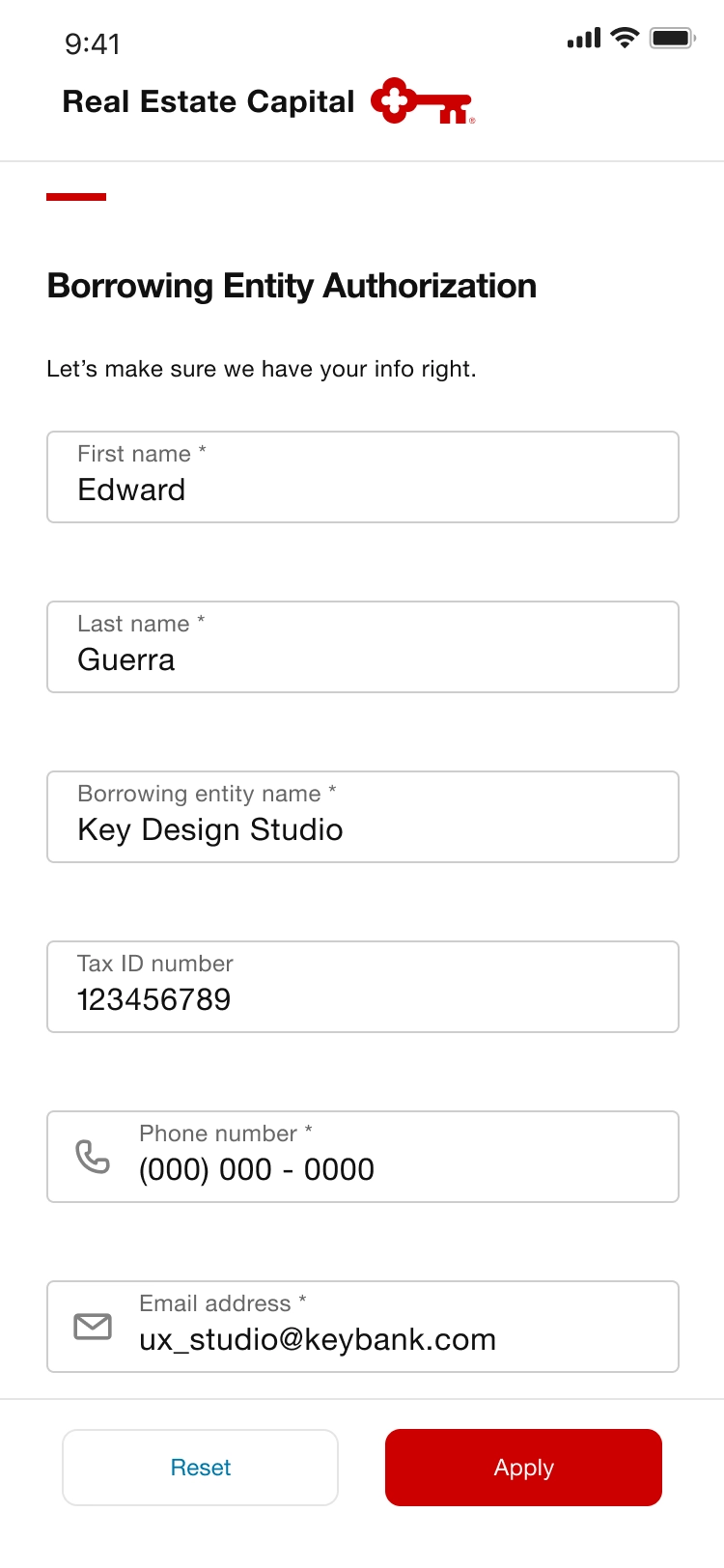

- Reduce the time of application for loan borrowers by improving the process for underwriters and third-party vendors.

- Improve the application review process by providing more transparency for loan borrowers on application progress.

- Adapt and become more omnichannel-focused on enabling onsite handheld technology support.

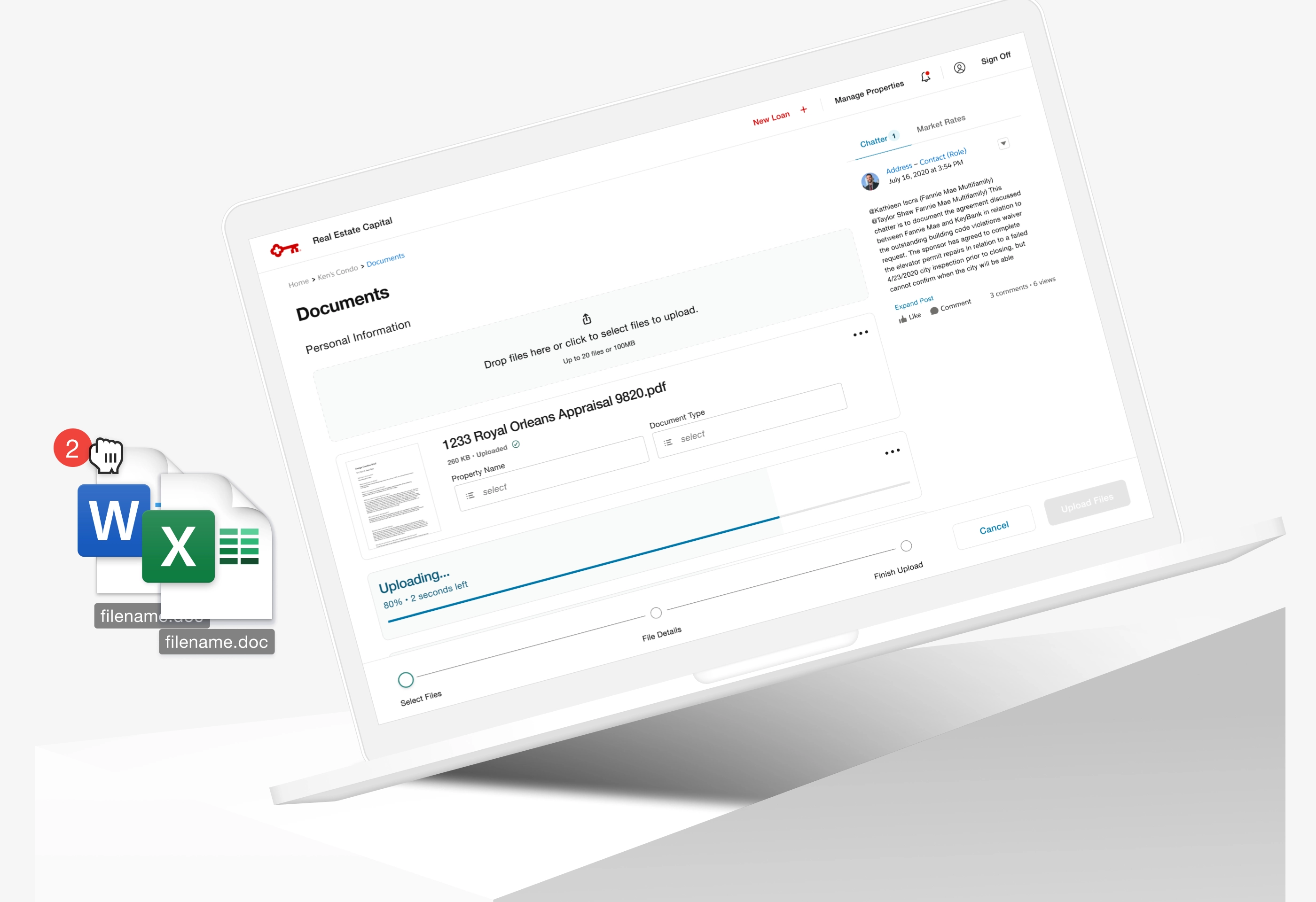

- Reduce paper by digitizing and providing a centralized electronic document repository.

- Integrate with a client relationship manager platform to initiate the next steps for individual parties.

James, Loan Borrower

"Time is money, I don't want to miss on a great rate!"

50 years old

Massachusetts

Employment FPO

Jane, Relationship Manager

"I am on the front lines and need to be in the know with our customers and their loan applications."

36 years old

Ohio

Relationship Manager

Patrick, Underwriter

"I support our relationship manager by being in the know with client information."

26 years old

Texas

Underwriter

Constraints

Our cross-functional team was structured in a 2-week window to plan an engagement lasting 2-months. This timeframe required that we set up our working agreement quickly.

To reduce the back-and-forth of collecting user requirements to ideate solutions:

Gallery

Ideation

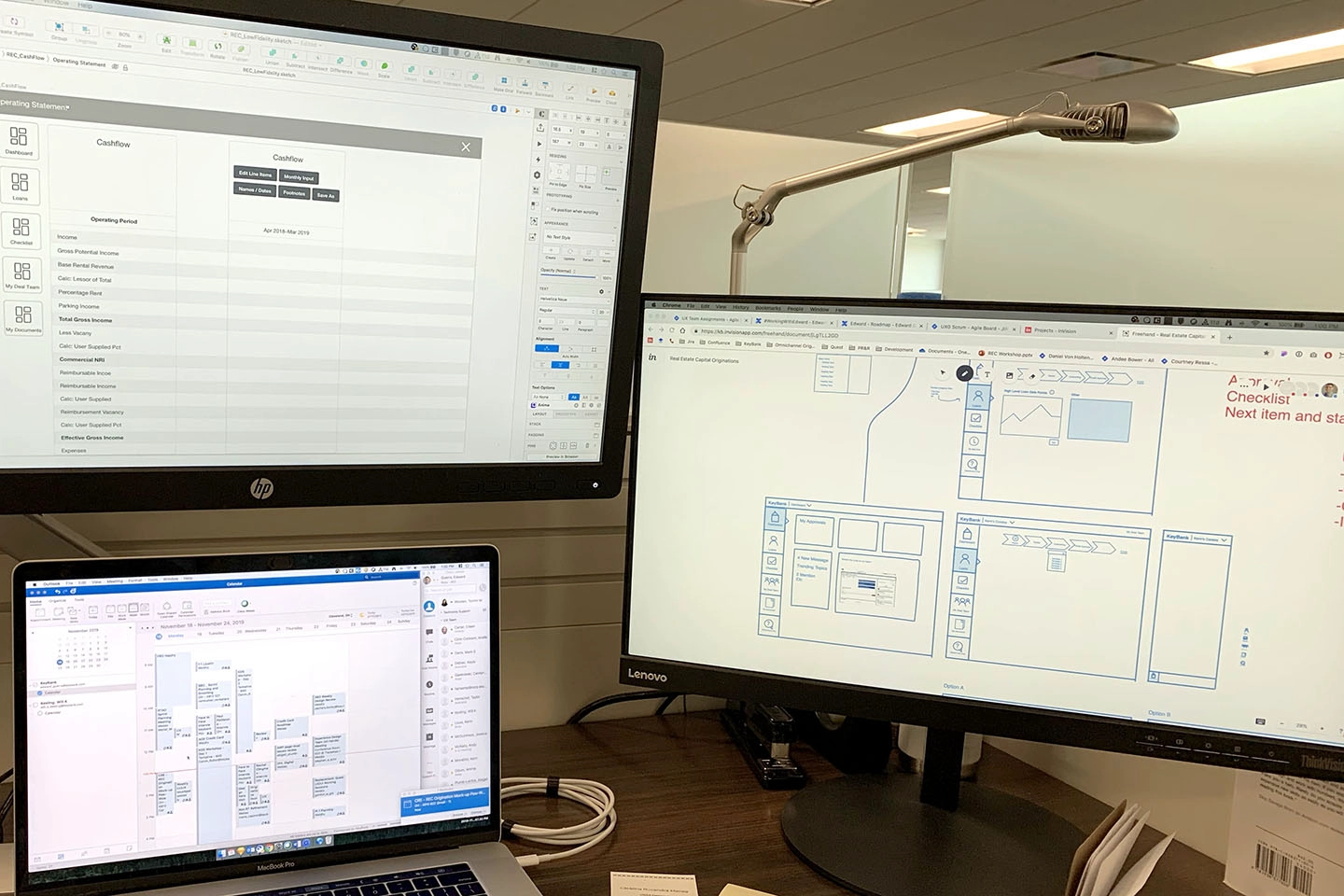

Following our co-creation workshop sessions, two prevailing themes emerged as key focal points for our strategic direction.

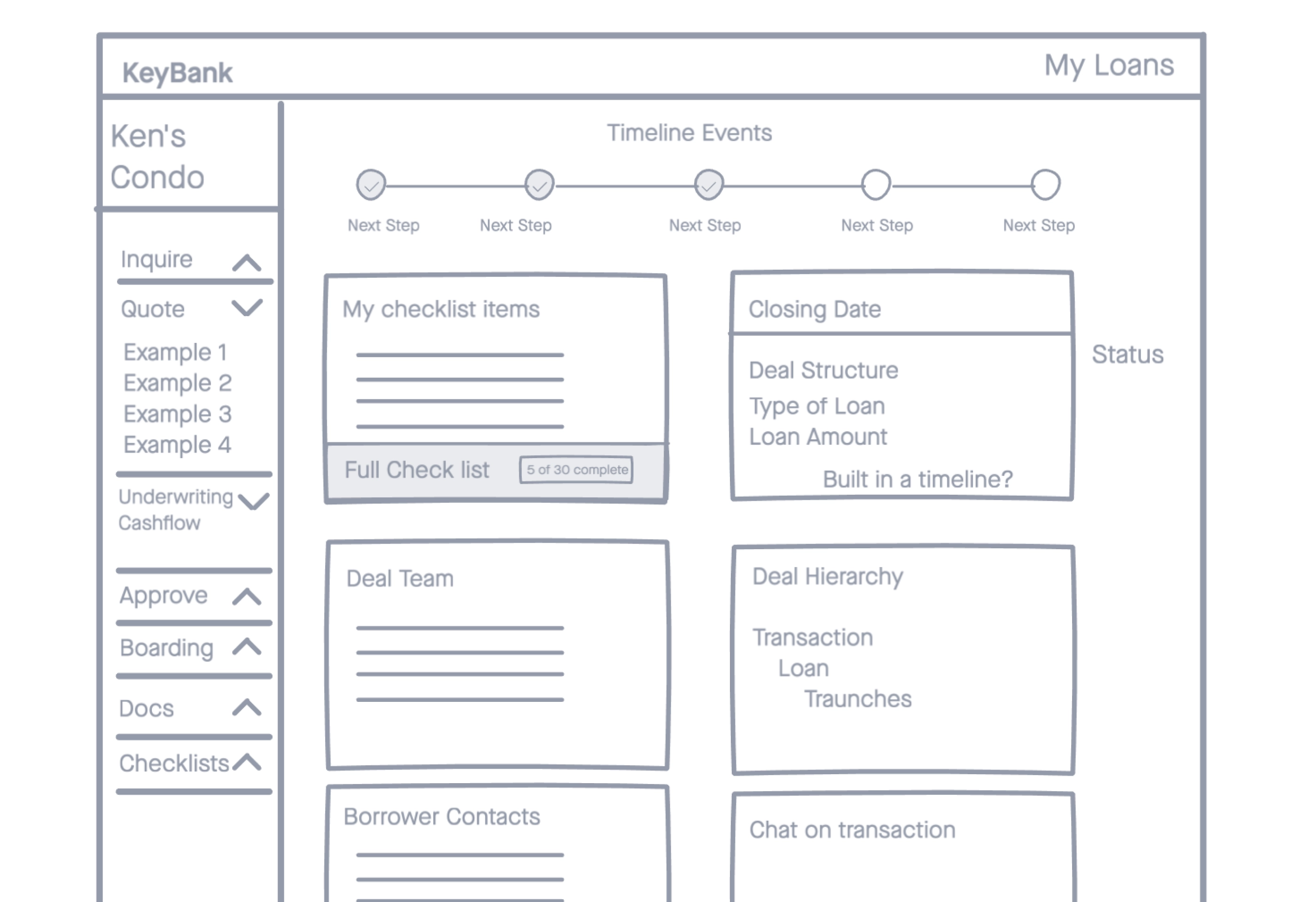

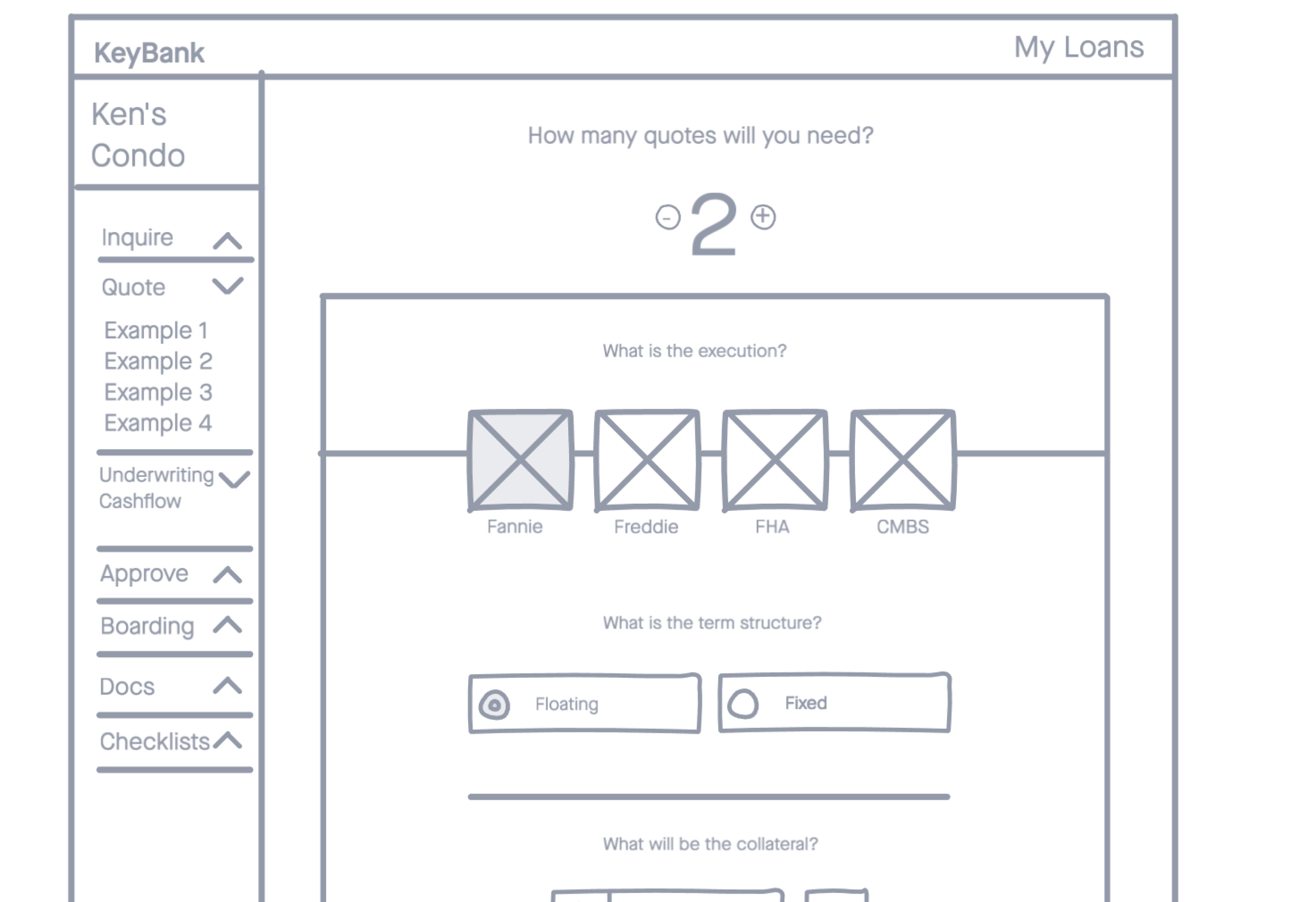

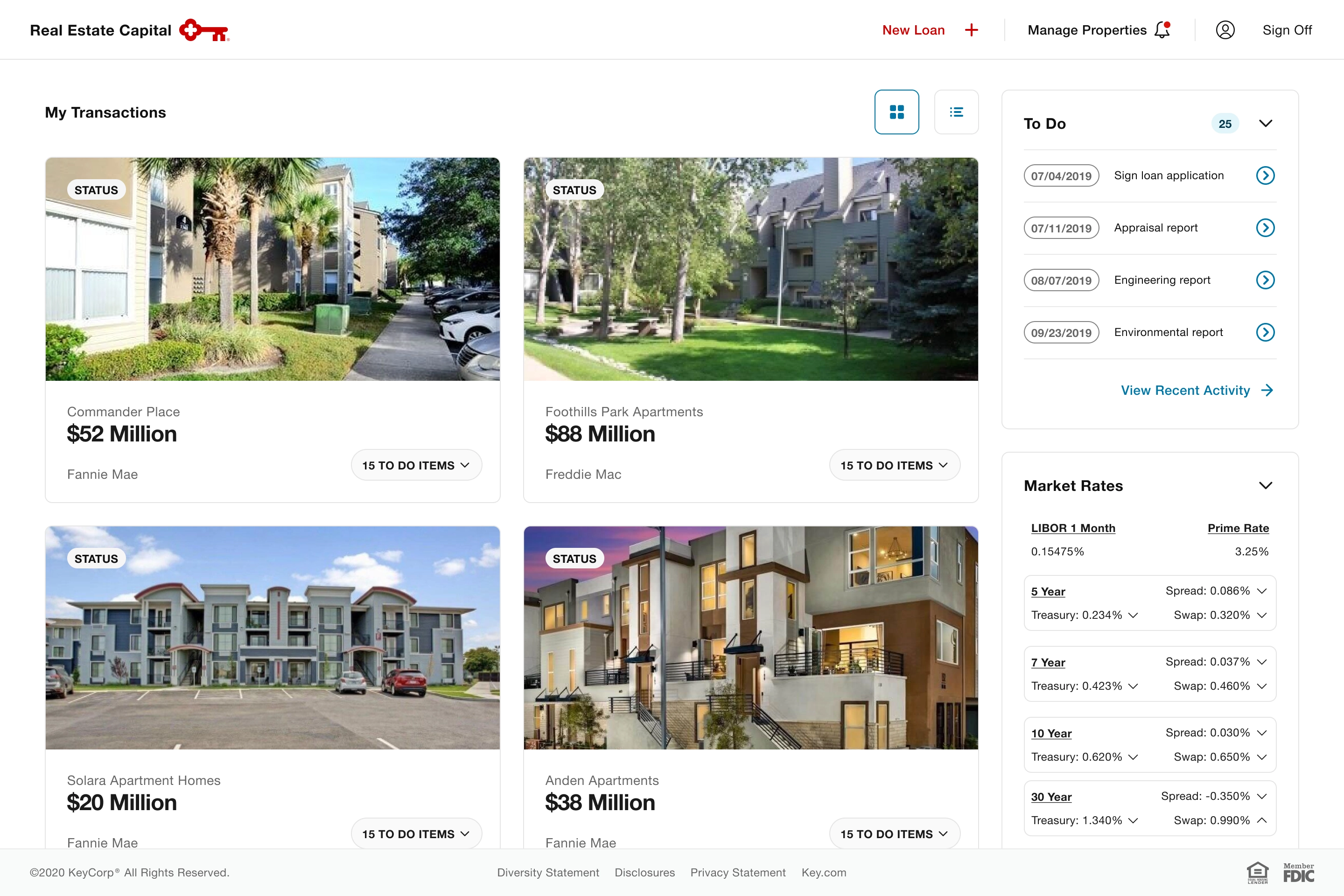

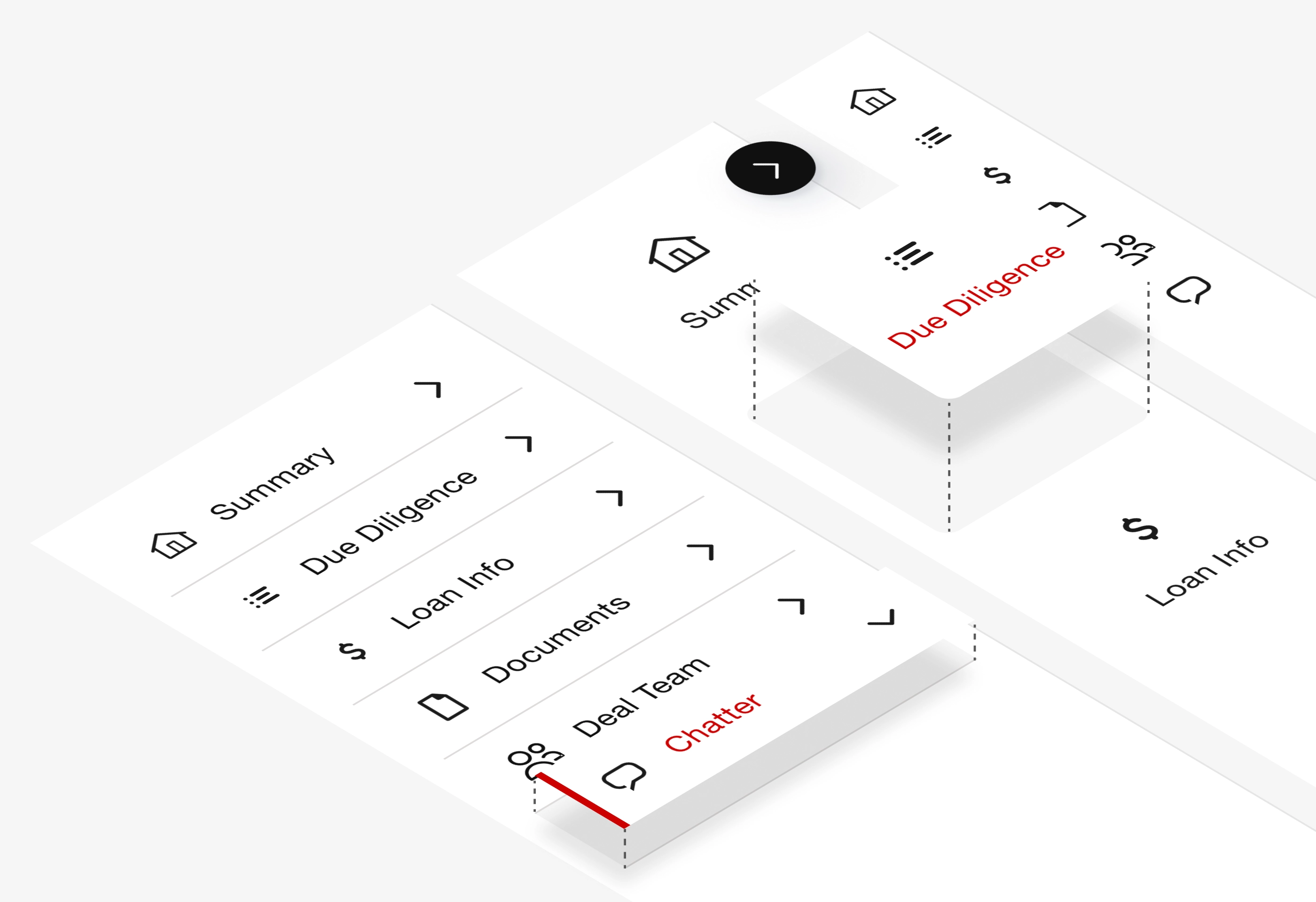

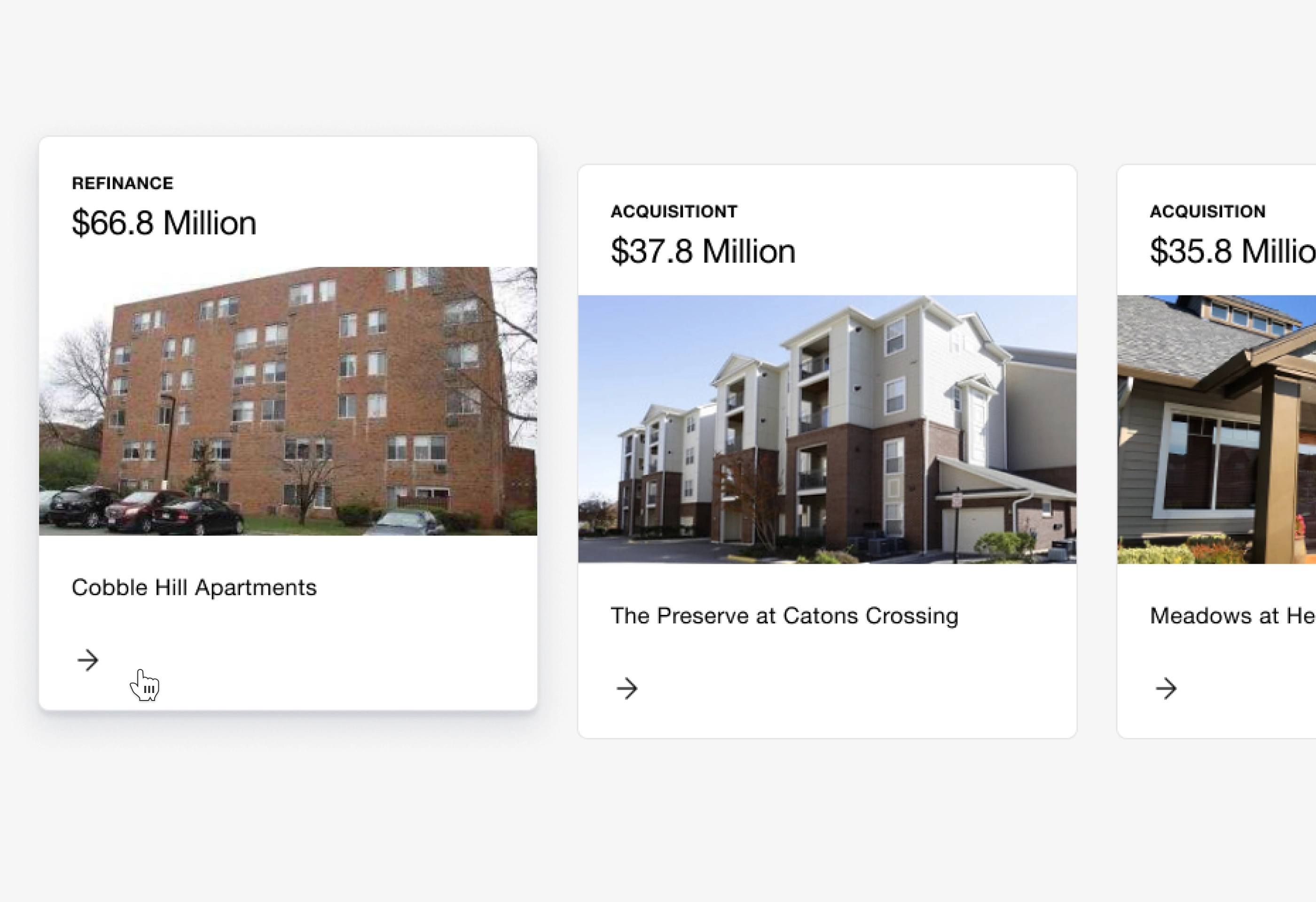

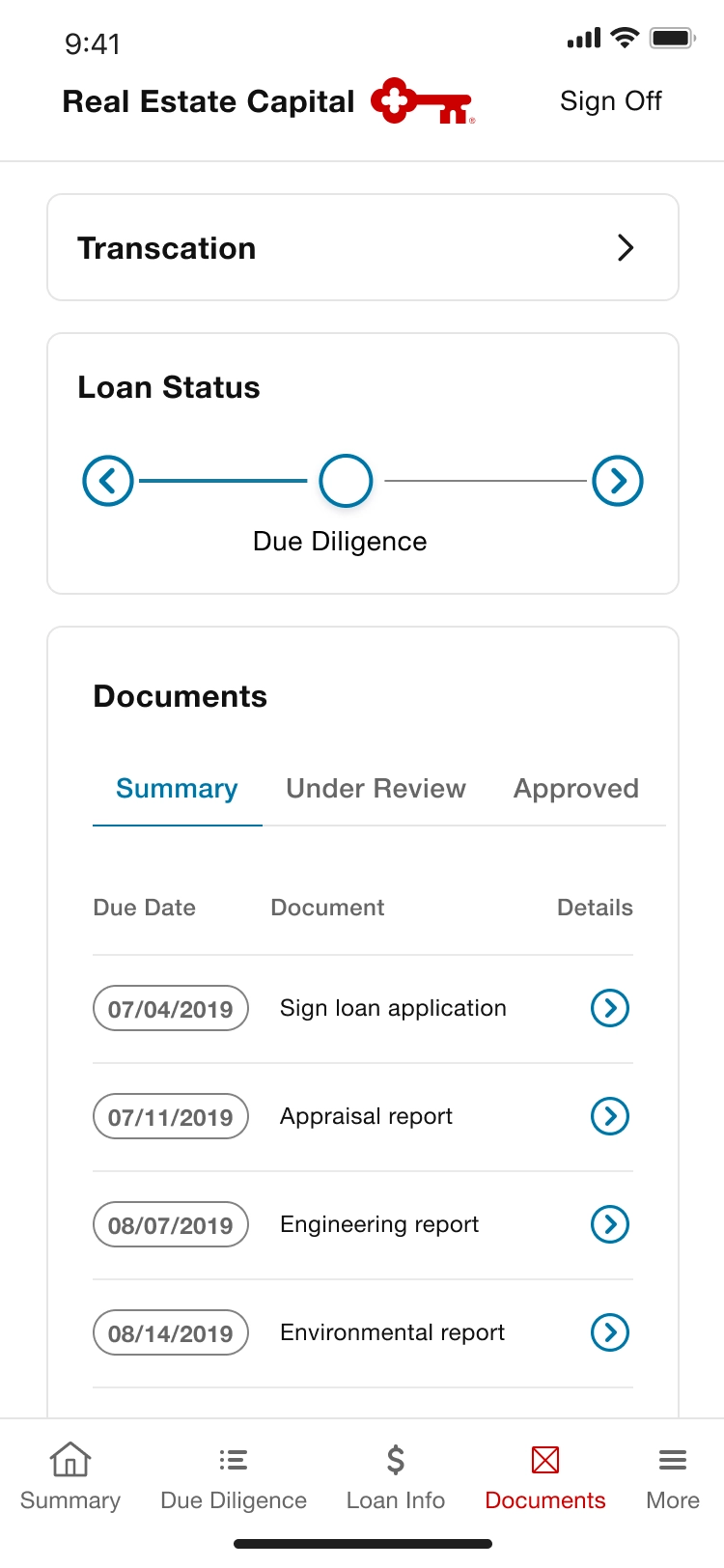

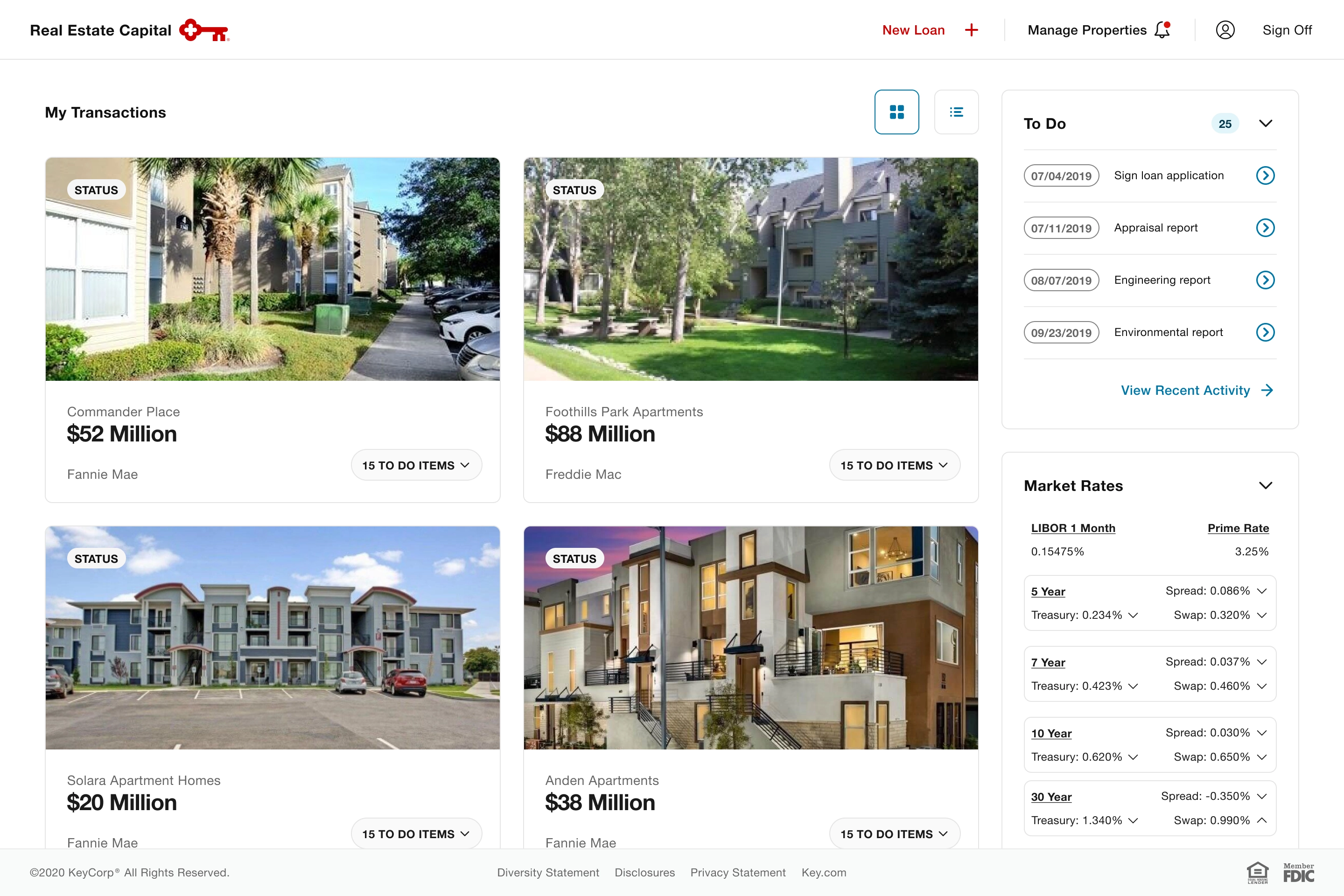

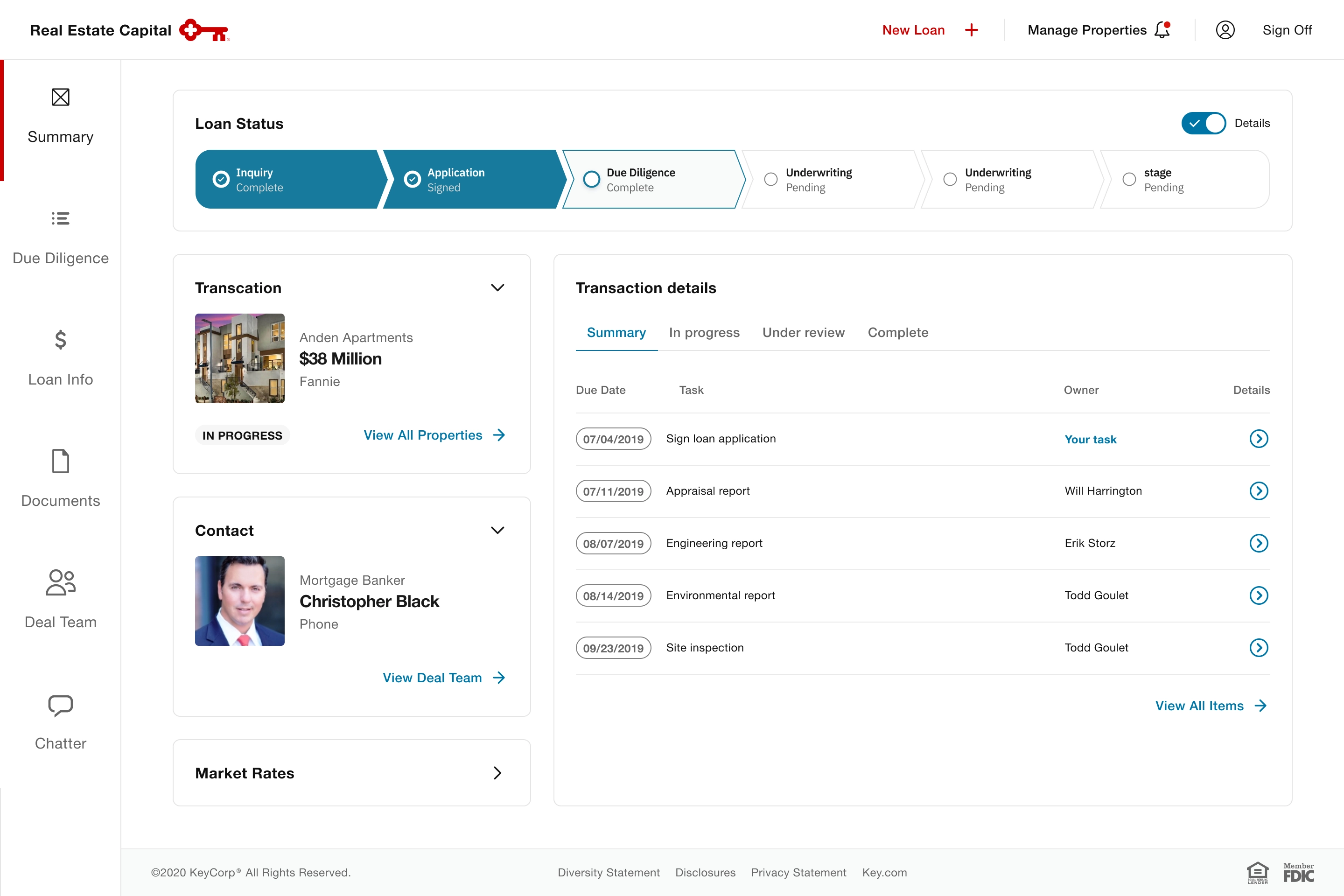

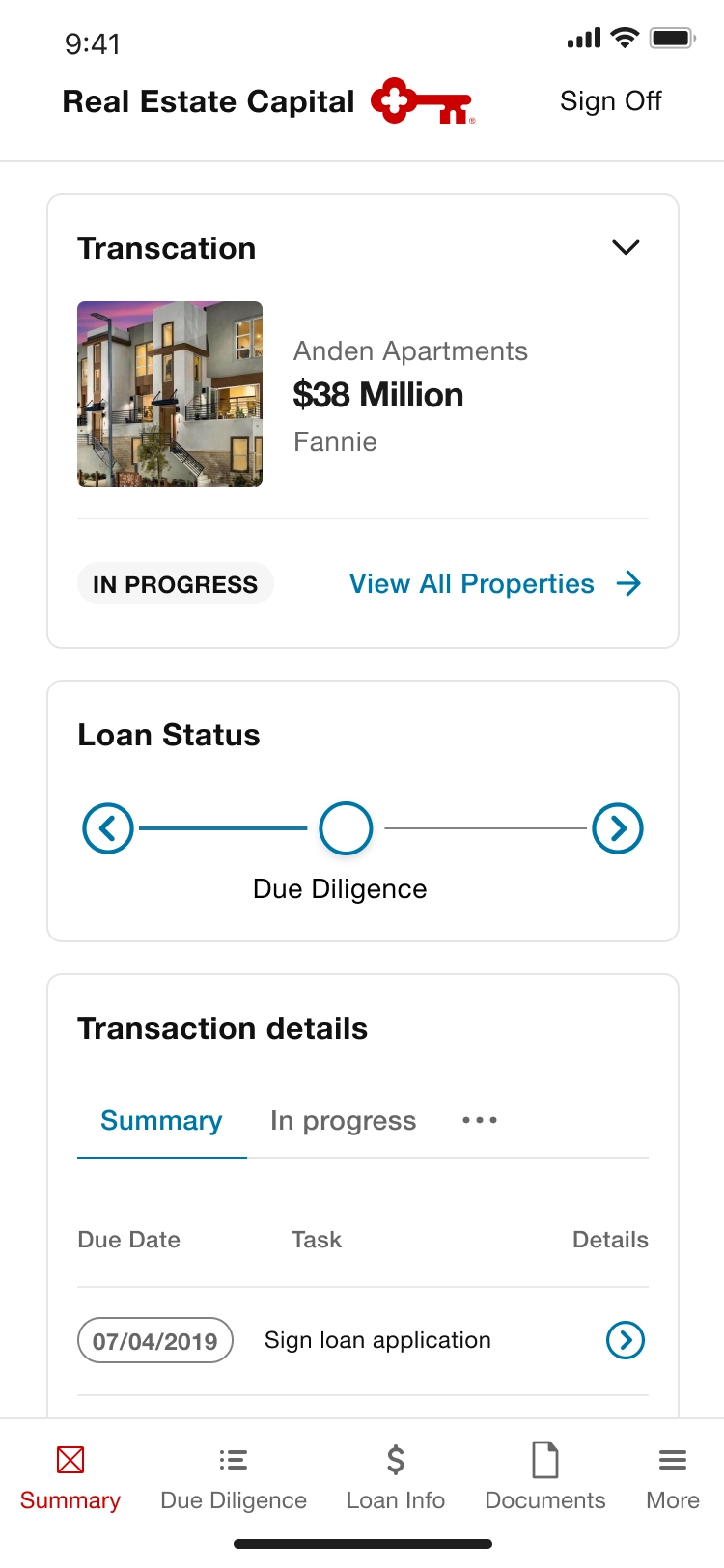

Features

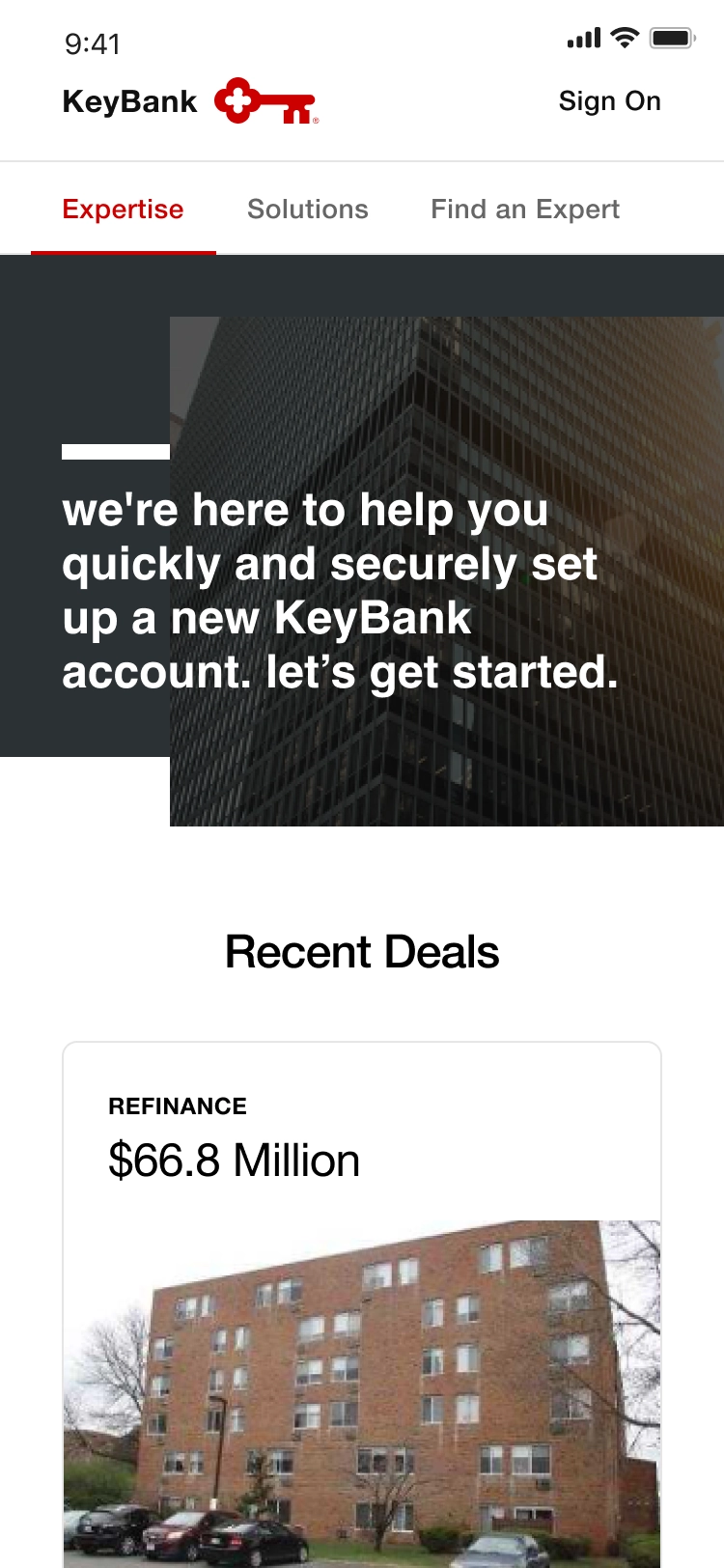

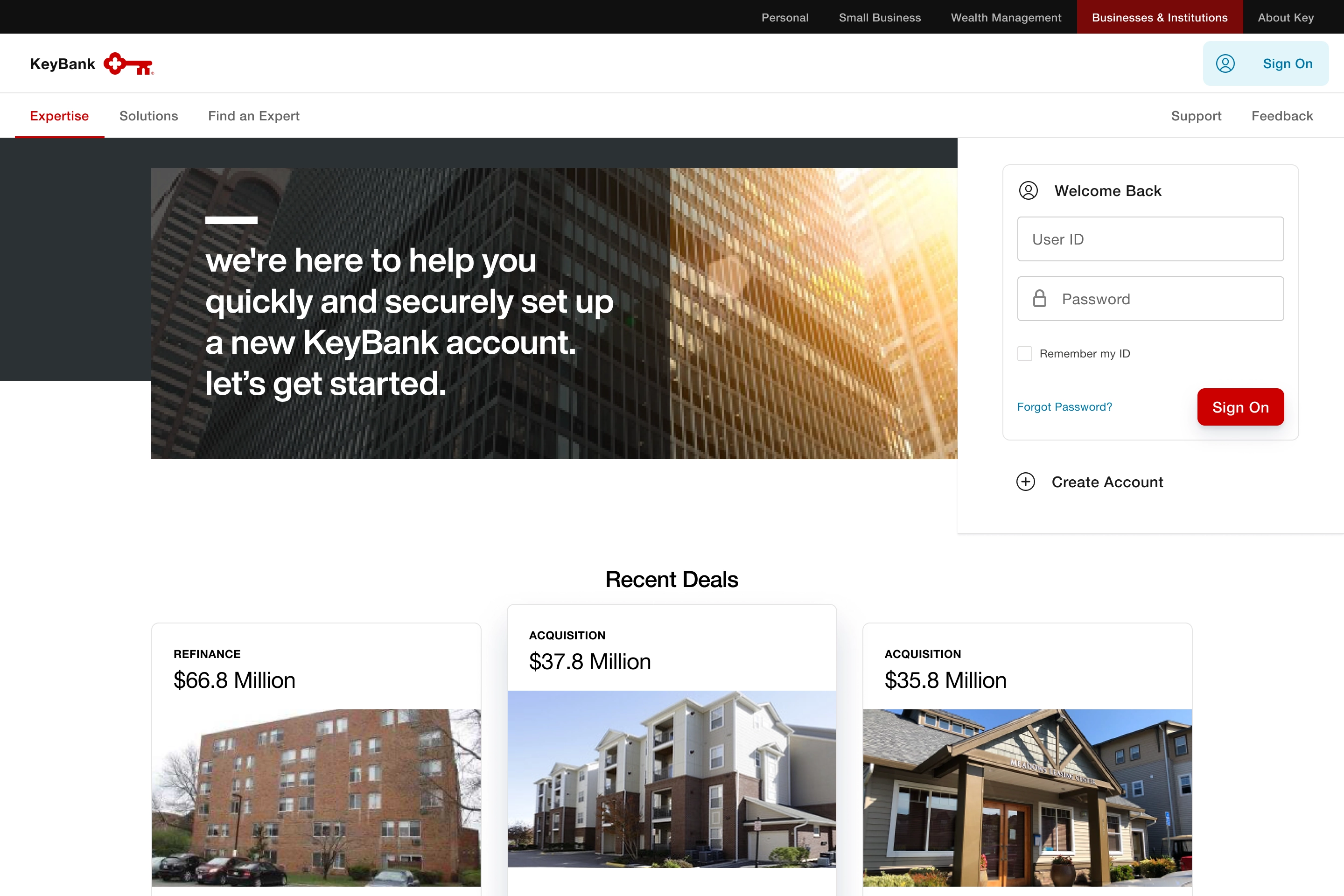

As a blue sky concept, there were no bounds to how we could ideate agnostic to component or UX pattern availability. Our approach became a hybrid, combining features from multiple platforms in a single experience.

Key screens

Impact

While this short-term engagement primarily focused on developing a proof of concept exploration of what this experience can look like, we ultimately informed a new product area for expanding commercial business.

Takeaway

As a sole designer, sometimes designing in real-time with multiple stakeholders weighing in on opinions, I learned to prioritize adopting a human-first approach rather than technology.- Invest time in building and establishing a working relationship with cross-functional team members.

- Leverage existing UX sources to help educate and influence stakeholders, especially on accessibility.

- Familiarize yourself with the terminology used for product engagement conversations.

- User testing to measure effectiveness, efficiency, and satisfaction.

- Modify design based on user testing insights.

- Partner with technology to launch first MVP release.